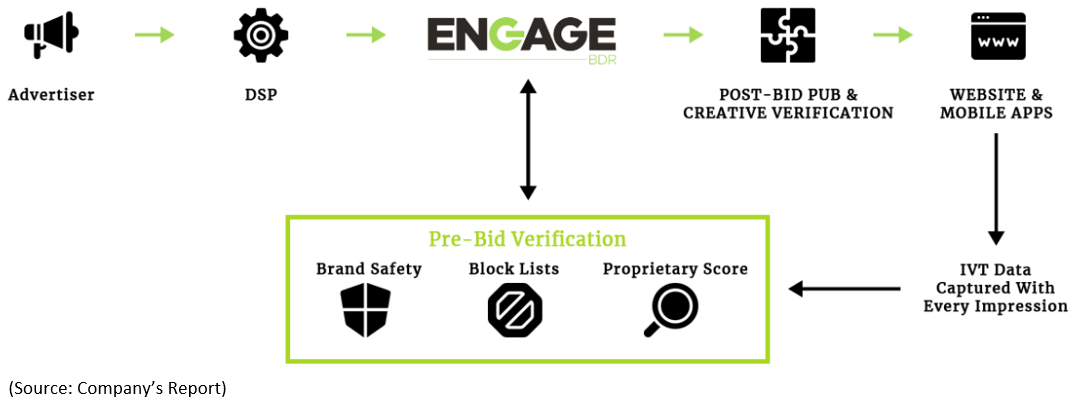

Yesterday, on 20th May 2019, engage:BDR Limited (ASX:EN1) announced its 13 new signed programmatic integration contracts along with a mid-month trading update. This contract brings engageâs total programmatic integrations to 191, just three integrations short of annual milestone set by EN1. Till now, 88% of annual goal and 216% of quarter two goal have been achieved. This has helped EN1 to create new partnerships with Advenue, AMLI Media, Clean Media, Inmobi, Mediaforce, SomeSpider, Vidstream, Admixer, Axonix, Criteo, LoopMe, Mintegral, and Velis Media. As per the financial update, the companyâs mid-month revenue has increased to about $48,000 per day with an expectation of about $65,000 per day by the end of quarter two of 2019. Its gross margin remained consistent in April at 40%, whereas its operating expenses reduced in April 2019. It is expected that EN1 will reach run-rate profitability in quarter two. As per the release, one publisher from the group 2 activations is live and exceeding the companyâs initial expectations of approximately $4.3K per day. Several other publishers planned to go live in this week and will beat group 2's initial per day target of $10.7K.

The companyâs AdCel daily revenue has doubled and is at about 230% since April 2019. This can be attributed to new partnerships with important players. EN1 is concentrating to again double the AdCel revenue by June 2019, as the increase in revenue is on the back of test tariff at 10% scale of each publisher. Additionally, EN1 is undergoing assessment of term sheets for debt facilities, which will allow EN1 to instantly pay to the publishers on the receipt of their invoices. It is expected to expand cash flow for the publishers and nudge them to migrate from their current platforms, which will help EN1 to get incremental revenue volumes. This opportunity will help EN1 to increase its market share compared to peers. Improved market share in this hyper-growth stage will boost publishers and buyers to generate revenue (Compound) and drive profitability for the company. The company plans to use its own programmatic and social media platforms to broadcast aggressive payment terms to the industry.

As per the release, US addressable market size is estimated to be around US$70 billion and US$98 billion globally by 2020, wherein most of the spending is expected to be done on programmatic advertising across desktop, mobile and TV screens, where EN1 is operational. Globally by 2020, around US$10 billion is the potential market size for influencer marketing.

On the stock information front, the shares of EN1 were trading at $0.033 on ASX (as at AEST: 1:11 PM, 21 May 2019) down by 2.941% as compared to its previous dayâs closing price, with a market capitalisation of $17.65 million. Today, it touched dayâs high at $0.034 and dayâs low at $0.032, with a daily volume of 4,661,280. Its 52 weeks high price stands at $0.160 and 52 weeks low price at $0.012, with an average volume of 26,043,810 (yearly). Its absolute returns for the past one year, six months and three months are -78.06%, -26.09%, and 61.90%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.