Summary

- June retail sales growth was lower compared to a significant rise in the previous month, but the sales turnover was up over 8% compared to the same period last year.

- There have been two consecutive month sales growth in categories like footwear, personal accessories and clothing. However, retail sales in these categories remain well below the levels last year.

- Household goods retailing softened over the previous month but remains elevated compared to the same period a year ago. Supermarkets continue to experience higher consumption of food items by households.

The Australian Bureau of Statistics (ABS) has released June retail sales preliminary data. On a seasonally adjusted basis, retail turnover grew 2.4% in June 2020 after rising 16.9% in the previous month. Retail turnover went up by 8.2% in June 2020 compared to the same month last year.

Retail turnover has been volatile this year, owing to COVID 19, and some categories are well-below their levels compared to the previous year. In March, panic buying among households helped to post a significant rise in retail turnover.

In April, retail sales fell severely after rising in the previous month, as households embraced lockdowns and social distancing measures. In May, there was a sharp rise of 16.9% in retail sales after stemming from a low base in the previous month and easing of social distancing measures.

Momentum in some discretionary retail segments

ABS reported that clothing, personal accessories, footwear, food services, cafes and restaurants experienced a large increase during the month. Retail sales increased in these categories for the second consecutive month by over 18% but remained well below the same month in the previous year.

Despite some trade restrictions, these retailers operated for the full month in June compared to the previous month with no trading in the first week. Presently, there is no clarity how much impact would be felt by these retailers in the wake of second lockdown in Melbourne.

Household goods retailing softened

Household goods retailing has been on a strong run as household demand remains resilient for furniture, fixtures, DIY, consumer electronics, building supplies, electrical, hardware, etc. There could be several factors impacting the trend, including work from home and bushfires that damaged homes.

In June, retail sales in the segment fell compared to the previous month but remained 23% higher compared to the same month a year ago. The housing market revival last year is likely having its lag impact on household goods retail.

Supermarkets and departmental stores

Food retailing fell compared to the rise in the previous month but remained above over the year. Supermarkets are experiencing strong sales growth compared to the same period last year, with perishable goods up by 14.4%, non-perishable goods increased by 12.4%, and all other product sales grew by 7.8% during the month.

ABS noted that growth also indicates that household food consumption has increased compared to June 2019 due to COVID 19 restrictions. Retail sales in departmental stores fell in June after rising in the previous month. There were signs of panic buying, mostly evident in Victoria, at the end of month.

Let’s look at some retail businesses listed on ASX.

Accent Group Limited (ASX:AX1)

Footwear retailer, Accent Group is expected to disclose full-year results for the period ended 28 June 2020 on 26 August 2020. In the latest trading update, the company stated that it expects ~ 10% growth in EBITDA for FY2020 compared to FY2019.

In the 51 weeks to 21 June period, AX1 recorded sales of $923 million with a strong increase in digital sales. Online sales have continued to increase with record sales in May, clocking more than $2 million, a new daily record during Click Frenzy.

Its investments in digital infrastructure over the past three years have generated results during these times and ensured that record growth in sales could be managed with customer satisfaction. Accent’s digital platform has additional capacity and scalability.

All stores of the company were operating. Wage subsidies by the Governments have allowed the business to bring team members back despite lower foot traffic and sales. The company stated that NZ, WA, QLD, SA and regional areas had bounced back strongly than Sydney and Melbourne. Accent expects to incur a non-cash impairment of $3-4 million on some stores and assets due to revenue impact by the current environment.

On 22 July 2020, AX1 settled the day’s trade at $1.275, down by 1.544% from the previous close.

Adairs Limited (ASX:ADH)

Furniture and homeware retailer, Adairs re-opened all its stores in May. Since the opening of stores, online sales and store sales have increased, according to a company update during mid-June 2020. Sales growth in Mocka was noted at high levels. The company remains disciplined in inventory and margin management.

Adairs’ omnichannel strategy has yielded decent returns in the wake of COVID-19 crisis. In the FY20 period to 14 June, its LFL sales growth in stores was 3.5%, online LFL sales growth was 64%, and total LFL sales growth was 15.7%. In the 2H20 period to 14 June, Mocka sales were up by 52.1%.

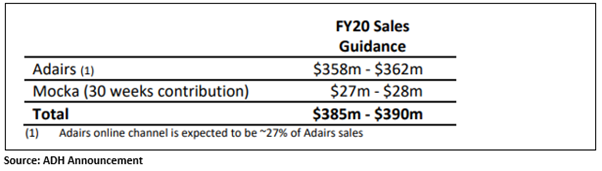

The company expects to deliver total revenue between $385 million and $390 million with online sales anticipated to account for approximately 27% of the total sales. Management, which foresees uncertainty over the medium term, is focused on ensuring that the business is well positioned towards risk mitigation and opportunities.

On 22 July 2020, ADH last traded at $2.380, down by 0.833% from the previous close.

Supply Network Limited (ASX:SNL)

In May, after-market parts retailer, Supply Network reported that Australian business performed better than expected during the peak COVID 19 restrictions. NZ business was impacted due to the level 4 lockdown restrictions but returned to normal trading conditions as lockdown eased in the country.

Management has a revenue forecast of ~$135 million for FY2020 with profit after tax of approximately $8.5 million, which would be $9.2 million, excluding the impact of AASB 16. The company is cognizant of economic risks and the pandemic but believes that the current environment would marginally impact the business and growth plans for the next financial year.

For long term, business and growth plans remain unchanged. In March, the company deferred the interim dividend payment. However, SNL paid an interim dividend on 24 June 2020 after the uncertainty on future cash flows was clear.

SNL last traded at $4.170 on 20 July 2020.

(Note: All currency in AUD unless specified otherwise)