Highlights

- The United States economy could be in for a massive jolt as experts predict a recession in the country.

- The equity markets across Australia and other nations have been the first to react to the news.

- Australian experts have been hopeful that the country would manage the tough circumstances

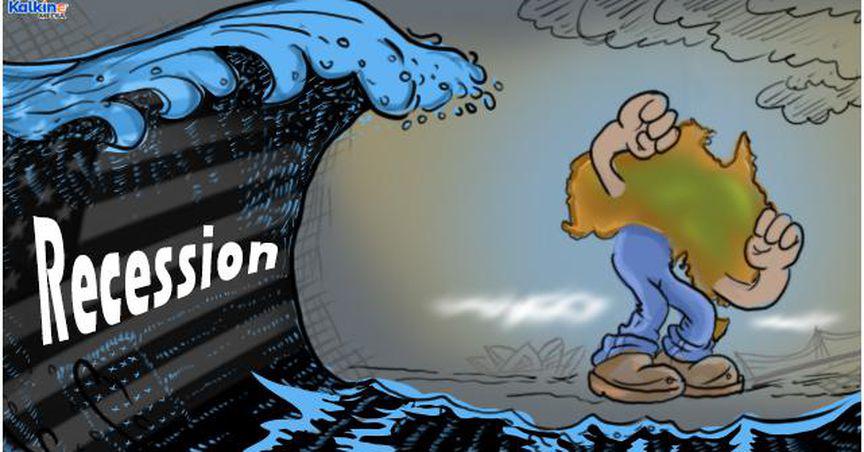

Australia’s top economists and experts have been especially vocal about their concerns over a recession in the US. Just talks of a potential recession hitting the US have triggered massive volatility in the Australian share market in the recent past. Undoubtedly, an economic slowdown in the world’s largest economy is bound to affect the movements in all other economies, including Australia.

ALSO READ: Recession fears stalk US markets: How worried should Australia be?

The large dependency of nations on the US economy and the greenback has cemented the US’ hold on the global economy. Any potential changes to the US economy quickly send shockwaves across the globe. The first and foremost response is received from the equity markets, as visible in Australia.

Which Growth stocks you should be looking at if recession strikes?

Despite these fears, Australian authorities are hopeful that the country will be able to manage the current crisis. Australia has developed the image of being one of the few nations that narrowly escapes global economic slowdowns. Though some part of the slowdown could inevitably seep into the Australian economy, the overall effect is expected to be much less than that seen by other nations.

Based on this trend, Australian experts are hopeful that US recession fears may not dent the economy by a high degree. However, it is best to move with caution in the present uncertain climate.

ALSO READ: How can house price fall impact new property investors?

Why are recession talks emerging in the US?

The annual inflation rate in the US rose to an alarming level of 8.6% in May 2022. On the contrary, the annual inflation rate in Australia surged to 5.1% in the March 2022 quarter. The high inflation rate across the US suggests that the problem is much more severe across the Western nation.

The US inflation rate has been so alarming that the Federal Reserve had to increase interest rates by 75 basis points, the biggest rate hike since 1994. This large uptick in the interest rate suggests that the inflation problem across the US has been keeping policymakers concerned.

The worrying mix of rising prices and shooting interest rates has fuelled fears of a recession hitting the country. In technical terms, a recession occurs when a country’s GDP declines over two consecutive quarters.

Big banks across Australia have also suggested that a recession is underway in the US economy. Both the Commonwealth Bank of Australia (ASX:CBA) and National Australia Bank Limited (ASX:NAB) have forecasted that a recession is imminent for the US.

Should experts worry about Australia?

Surprisingly, Australian authorities have not been shaken much by the recessionary talks. The Reserve Bank of Australia (RBA) and even some of the nation’s big banks are expecting the country to survive this incoming crisis without taking much of an impact.

While slow economic growth could certainly affect expectations for the Australian economy, many positive factors could keep the economy going. Australia’s unemployment rate stands at a record-low value, and the recent bump to minimum wages has further strengthened the labour market. The economic growth has also surpassed expectations, rising 0.8% over the first three months of 2022. This was much higher than expected.

Alternatively, worries have stemmed from the fact that a fall in Australian GDP forecasts could prompt a halt in business activity. As recession talks take the spotlight, GDP forecasts in Australia could start to decline, potentially weighing on consumer and business confidence.

If this decline in confidence is large enough to impact national demand, then the economic growth may stall. To put things into perspective, high consumer demand has kept the Australian economy bustling during the post-pandemic era and has brought back much of the lost momentum. Thus, reduced demand could snatch away much of the economic revival of the country.