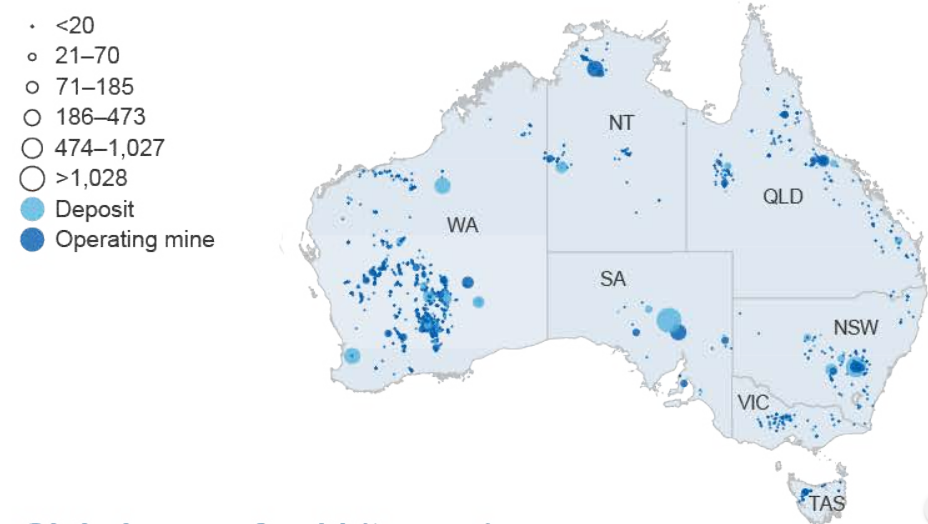

Metals and mining perhaps, is the most looked upon sector in Australia. Rightly addressed as âThe Lucky Countryâ, the Aussie soil is home to a hoard of metals and minerals, the richness of which is not solely centred towards the countryâs geography, but forms part of a well-established business network.

The Recent updates on Resources and Energy sector in Australia: As per the latest report released by the Department of Industry, Innovation and Science, Australiaâs major resource commodities prices have had reached its seven-year highs, but are expected to shift downwards in the future, on the back of weaker demand and increasing supply. The sector has been pounded by the US-China trade tensions and weaker than expected exchange rate. Further, according to the report, in 2019â20 period, Australiaâs energy and resource-related exports is bound to set a new record of $285 billion but are likely to fall back in the consecutive years, 2020â21.

In our article, we would look into the recent announcements made by the two metals and mining players listed on the ASX, Rex Minerals Limited (ASX:RXM) and Tietto Minerals Limited (ASX: TIE), both of them deal with gold. The DIIS report states that Australiaâs gold export earnings would be at its highest point between 2020â21, and would surpass $22 billion, catalysed by higher prices and robust export volumes.

Major Australian Gold Deposits in tonnes (Source: DIIS)

Major Australian Gold Deposits in tonnes (Source: DIIS)

In the context of this information, let us delve into the recent updates of RXM and TIE, and acknowledge their stock performances on the Australian Securities Exchange, along with the returns generated:

Rex Minerals Limited

Company Profile: A minerals exploration and development company, Rex Minerals Limited (ASX: RXM) has been in discussions due to its Hillside Project, which is located in South Australia, where RXM deals with large-scale copper-gold projects. At the Hillside Project, the company bears a Mining Lease, which has been approved. RXM was listed on the ASX in 2007 and has its registered office in Melbourne.

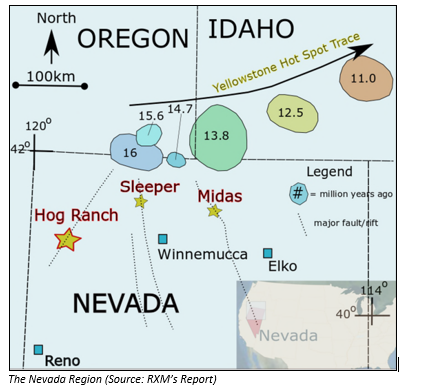

Acquisition of HRG: On 20 August 2019, RXM pleasingly notified the media and shareholders that it had successfully concluded the acquisition of Hog Ranch Group Pty Ltd, and owning the Hog Ranch Gold Project in Nevada, USA as per the non-binding Heads of Agreement, which was notified on 17 July 2019. Hog Ranch Group Pty Ltd was established in the year 2013 and is an Aussie private player, with a Mining Lease along with the Purchase Option over the Hog Ranch Gold Project situated in Nevada.

Before and after signing the HOA, the company completed six months of due diligence, and concluded the decision in accordance to review by an independent subcommittee. The consideration was based on RXMâs share price at completion date, which was 9 cps, and would be A$900,000 along with an additional imputed value at the share price of A$1.8 million, in case the milestone outcomes are attained.

The consideration would be paid as 10 million fully paid ordinary RXM shares and 5 million Hog Ranch Consideration Rights which would be converted into the companyâs share on completion of an Inferred Mineral Resource (by 31 October 2024 ) in addition to any Indicated and Measured Mineral Resource in total of 2Moz or higher of contained gold, with minimum grade of 0.4g/t of gold in addition to a minimum tonnage of 100Mt. Additional 15 million Hog Ranch Consideration Rights would be paid once the Board gives a nod to mine the Hog Ranch Project (by 31 October 2024).

These terms are subject to shareholder approval and would be cleared at the RXMâs AGM in November 2019. Currently, the company has issued 9,353,849 fully paid ordinary shares as consideration to the vendors other than CEO.

As per the companyâs Board, the investment is an attractive and strategic fit to the companyâs Hillside Copper-Gold Project in South Australia and diversifies RXMâs commodity spread and risk of geographies. As an icing on the cake, the investment provides the companyâs shareholders an opportunity to get acquainted with the gold sector in one of the worldâs loaded gold zones.

Stock Performance and Returns: On 21 August 2019, the RXMâs stock was trading flat at A$0.083 on ASX (at AEST 2:00 PM). The market capitalisation of RXM is A$24.62 million and has approximately A$296.59 million shares outstanding. In the past one, three and six months, the stock has delivered returns of 16.9 per cent, 62.75 per cent and 6.41 per cent, respectively. The YTD return of RXMâs stock was 6.41 per cent as well.

Tietto Minerals Limited

Company Profile: Focussed on enhancing the development of its Abujar Gold Project in Côte dâIvoire, West Africa, Tietto Minerals Limited (ASX: TIE) is awaiting a resource upgrade of the Project, which is expected by the end of 2019. A 30,000 metres drilling program is underway in 2019, along with multiple exploration targets. The company is focussed on development and exploration of gold projects and was listed on the ASX recently in 2018; TIEâs registered office is in Perth.

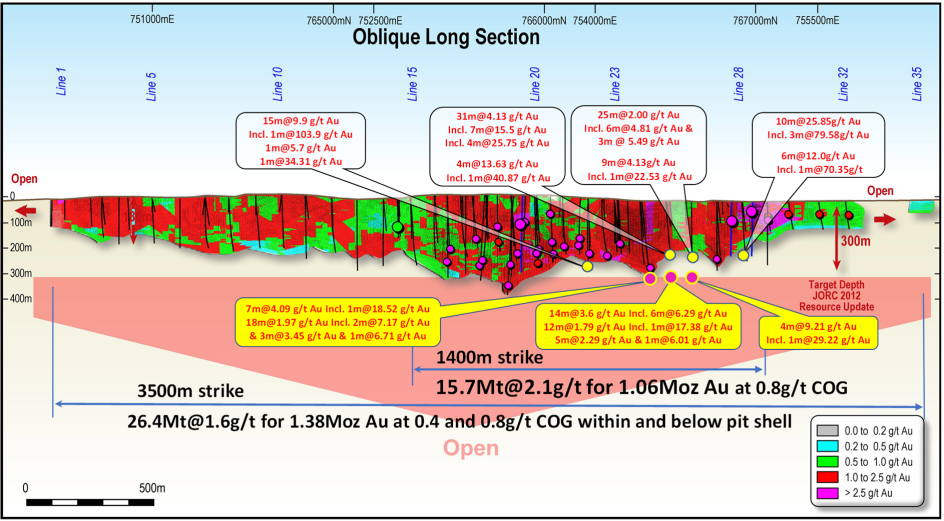

Update on the Abujar Gold Project: On 20 August 2019, TIE pleasingly updated the media and its shareholders about the progress made on AG deposit, part of its Abujar Gold Project in West Africa. The company is eagerly waiting for the completion of the drill and is on track to conclude 30,000m this year, with the resource update expected in Q4 CY19. As per the recent reports, multiple intercepts of high-grade gold mineralisation had extended the present depth limits of the deposit, up to 130m.

The new intersections at Abujar Project includes of the following:

| Diamond Hole | Line | Details |

| ZDD064 | 24 | 7m @ 4.09 g/t Au from 308m including 2m @ 10.95 g/t Au from 312m 18m @ 1.97 g/t Au from 321m including 2m @ 7.17g/t Au from 321m, 3m @ 3.45 g/t Au from 327m and 1m @ 6.71g/t Au from 338m |

| ZDD062 | 25 | 6m @ 6.29 g/t Au from 298m within a broad zone of 14m @ 3.36g/t Au from 292m including- 1m @ 7.27 g/t Au from 300m and 1m @ 19.33 g/t Au from 305m |

| ZDD060 | 26 | 4m @ 9.21 g/t Au from 325m including 1m @ 29.22 g/t Au from 328m |

Commenting on the positive result, TIEâs MD, Dr Caigen Wang stated that there is much more in store for TIE, and the Abujar shear remains underexplored with 90 percent of the 70km stretch still remaining to be tested. Moreover, the company would host a resource analyst visit on the site during September 2019, given the recent interests in the activities of the company.

Oblique long section view of the AG JORC 2012 gold Mineral Resource model (Source: TIEâs Report)

Oblique long section view of the AG JORC 2012 gold Mineral Resource model (Source: TIEâs Report)

Stock Performance and Returns: On 21 August 2019, the TIEâs stock was trading flat at A$0.220 on ASX (at AEST 2: 21 PM). The market capitalisation of TIE is A$58.09 million with ~A$264.04 million shares. In the past one, three and six months, the stock has delivered returns of 25.71 per cent, 51.72 per cent and 120 per cent, respectively. The YTD return of TIEâs stock was 238.46 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.