Australia-based minerals exploration and development company Gold Mountain Limited (ASX:GMN) is exploring for gold and copper in the highly prospective Papuan Mobile Belt, Papua New Guinea (PNG), an attractive destination for mining investment with one of the highest densities of Tier 1 gold-copper projects in the globe.

Papuan Mobile Belt is host to many world-class deposits, including

- Porgera (24 Moz)

- Ok Tedi (17 Moz)

- Frieda River (17 Moz)

- Hidden Valley (29 Moz)

For GMN Overview, Do Read: Gold Mountain Seeking to Create Shareholder Value through Flagship Project in Heart of PNG.

GMN has identified multiple targets within eight Exploration Licences (ELs) and two Exploration Licence Applications (ELAs), covering an area of approximately 2,500 km2 in the Enga province.

The current focus of the Company is on the exploration and development of its Flagship Project, Wabag Gold Project, which lies just 70 km ENE of the Porgera gold mine, in an identical geological setting. With access to key services like road link to coast, road to main GMN exploration camp, power, water, airport and mining support services, and strong mining labour force, GMN expects to make exceptional gains from the flagship project in PNG.

On the basis of results to date, GMNâs Flagship Wabag Project has multiple high-calibre targets, each of which has significant potential.

Monoyal:

This target demonstrates a strong coherent Cu-Mo-Au in-soil signature, with a well-defined envelope of low Zn and Mn coincident with the Cu-Mo-Au anomaly, which is a substantial anomaly with a diameter of 1,200 m and covering > 1.35 km2.

Mongae Creek:

In September 2018, two deep drill holes hit peripheral highly elevated Cu grades, including 55m @ 0.11% Cu and 49m @ 0.12% Cu. Recently identified large, high-tenor copper-in-soil anomaly: Monoyal much higher grade and 4.5x larger area.

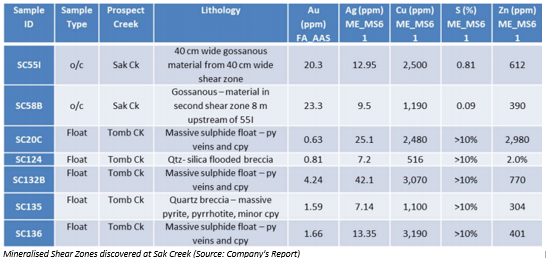

Sak Creek:

Located in the valley adjacent to Mongae Creek, Sak Creek shows features characteristic of porphyry-style mineralisation with best rock chip sample from gossanous shear zone returned 23.3g/t Au and 0.30% Cu.

Lately,

- Approximately 600 soil samples collected from Sak Creek,

- NW-SE-orientated structures visible in the Zn and Cu geochemistry,

- Similar orientation to the regional structural corridor and the orientation of the mineralisation observed at Mongae and Monoyal,

- Cu and Zn anomalism show vital zoning fingerprints.

K-Lam:

K-Lam is in the valley between Sak Creek and Mongae Creek, and a rock chip sampling program has highlighted 2.01 g/t Au and 0.40% Cu. The Company has generated exciting early results at the K-Lam prospect, with additional high-resolution mapping and creek sampling planned to connect Sak Creek and Mongae Creeks, with detailed trenching of the exposed outcrop.

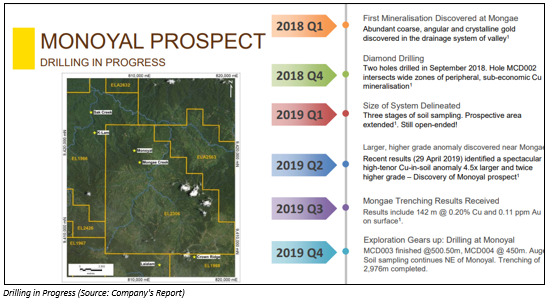

Drilling Update - Monoyal Creek

The Company recently completed drilling of the first hole, MCD003, at the Monoyal copper â porphyry prospect, approximately one km northwest of Mongae Creek where two diamond holes (MCD001 and 002) were drilled by GMN in the year 2018.

The MCD003 hole, targeted at an area of anomalous copper geochemistry, is part of GMNâs initial 9-hole diamond drilling programme, designed to assess highly anomalous copper geochemistry that was identified in grid-based soil sampling.

The hole was completed up to a depth of 500.50 m, which was planned to a depth of 450m.

For More Details, Do Read: Gold Mountain Completes Drilling at Monoyal Copper; Encouraging Mineralisation Observed.

Following the completion of drilling at MCD003 on 8 November 2019, the rig was moved to MCD004, where drilling started on 12 November 2019 with the hole being drilled to a depth of 47.50m, as announced by the Company in a market update on 21 November 2019.

The MCD004 mineralisation comprises of semi-massive sulphide mineralisation of 50% at 129m and quartz vein at 292m with 30% precipitated sulphides. The total drilling work done by the Company at Monoyal is to the depth of 950.50 m, which is planned to the depth of 1,325 m.

Apart from the current 9-hole drilling programme, planning and designing for the additional holes to cover a larger area at Monoyal are underway with a view to assess the extensive copper in soil anomaly.

GMN is emphasising on the continuous analysis of the results from the current programme in order to identify the final location for the planned holes. Moreover, GMN is actively pursuing a regional exploration campaign alongside the highly prospective structural corridor extending from Mongae Creek to the Mt Wipi area, subject to an Exploration License Application.

Stock Price Information

At the market close on 20 December 2019, the GMN stock settled at a price of $ 0.077, up 1.316% from its previous closing price, with a market capitalisation of $ 48.24 million and approximately 634.68 million outstanding shares. In the last six and three months, the GMN stock delivered a 68.89% and 38.18% return, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.