Highlights

- MercadoCoin is the latest cryptocurrency on the block, launched by e-commerce platform Mercado Libre

- It can be categorised as a utility token with much of the utility confined only to the native project

- Most dominant utility tokens include ETH, BNB, and XRP, all with their own native blockchain network projects

The cryptocurrency world is not limited to Bitcoin and altcoins like BNB and Ether (ETH). The space is evolving with new products like exchange traded funds (ETFs). Canada launched the first Bitcoin ETF in 2021, which was later followed by similar launches in the US and Australia.

Other products in the cryptocurrency verse include digital assets launched by established brands. These include names like Tiffany and Hot Wheels, which have unveiled their non-fungible tokens (NFTs) in the recent past. Now, in a major push to the cryptocurrency sector, the stock market listed entity Mercado Libre has announced its own cryptocurrency. The announcement comes in a year when a majority of cryptocurrencies, including Bitcoin, ETH, and BNB are reeling from losses.

Let us explore the Mercado Libre cryptocurrency announcement and also look at the top utility tokens that rule in the cryptocurrency space.

Mercado Libre cryptocurrency

The company, which is a prominent e-commerce platform in Latin America with operations in more than a dozen countries, has said that its MercadoCoin would be Ethereum’s ERC-20 standard cryptocurrency. The crypto will be available to Mercado Libre customers, who can use it to make purchases on the e-commerce website. MercadoCoin crypto will also be a tradable asset, it is being reported.

It is also being said that the initial set of MercadoCoin tokens will be available to 500,000 customers in Brazil. There is no confirmation yet on whether this cryptocurrency offering by Mercado Libre will expand beyond Brazil.

Notably, Mercado Libre is not new to the world of blockchain and digital assets. In January this year, the company announced an investment in Paxos, a blockchain infrastructure platform. In the press release, Mercado Libre declared its intention to “democratise commerce” in Latin America. The new cryptocurrency, MercadoCoin, could be a major step in this direction.

Also read: Tiffany, Nickelodeon NFTs -- 2 latest collections on the block

What are utility tokens?

There is no definitive definition of utility tokens, which are considered a category within the wider cryptocurrency sector. Bitcoin is widely recognised as the first cryptocurrency. Later entrants include Ethereum’s ETH token and Binance’s BNB. These are sometimes also considered native tokens or utility tokens. These cryptos have a specific utility within their respective ecosystem. For example, ETH is used to pay the transaction fee for works done using Ethereum’s blockchain.

On its website, Binance defines BNB as one of the most popular “utility tokens”. Besides being used within their respective projects, such utility tokens can also be traded in the anticipation of capital gains. Both ETH and BNB are listed on multiple exchanges. In contrast to utility tokens, digital assets like Dogecoin (DOGE) are categorised as meme tokens.

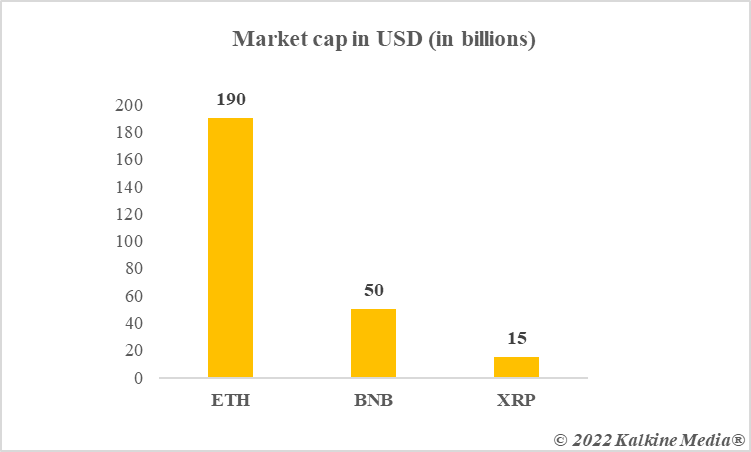

Top utility tokens by market cap

1. Ethereum (ETH)

ETH is the closest competitor of the world’s largest crypto Bitcoin. However, the fundamental difference is that while Bitcoin is a pure cryptocurrency that harnesses decentralised traits of a blockchain, ETH functions more like a tradable native token. ETH has most of its utility within Ethereum’s own ecosystem, which includes the use of the network in the deployment of new decentralised apps.

ETH has a market cap of over US$190 billion as of writing. The value is down as compared to what it was at the beginning of this year. This also comes as a caution for cryptocurrency enthusiasts who might be looking at MercadoCoin as a tradable asset. At one point, ETH token’s price was as high as US$4,800, which is now under US$2,000, as of writing. The impending shift of Ethereum from proof-of-work to proof-of-stake might support the price movement over coming weeks, analysts expect.

2. BNB

BNB belongs to the wider ecosystem that has an exchange titled Binance and a blockchain network known as BNB Chain. BNB and ETH are two of the top utility tokens by market cap. BNB’s market cap is close to US$50 billion as of writing. Similar to ETH, the price of BNB crypto is also under pressure this year. At one point, BNB was as high as US$650.

BNB crypto is used within the BNB Chain network as a medium of exchange. The token is tradable, and the price can swing in any direction depending on demand and supply forces. BNB is also used as a form of payment on a limited scale. For example, smartphone maker HTC supports BNB payments.

Data provided by CoinMarketCap.com

Also read: BNB crypto back to US$300: Why is it rising?

3. XRP

XRP is also a very wide ecosystem, just like the above two. It has its own blockchain XRP Ledger, which claims to facilitate the low-cost and quick cross-border movement of funds. XRP crypto is almost one decade old, and it has expanded its use beyond the XRP blockchain ecosystem. It is claimed the XRP token can act as a “bridge currency” for the low-cost transfer of money. Like ETH and BNB, XRP is also more famous as a tradable asset among cryptocurrency enthusiasts.

The market cap of the XRP token is over US$15 billion as of writing. The losses this year are comparable to losses suffered by the above two utility tokens.

Bottom line

The launch of a cryptocurrency by e-commerce player Mercado Libre can be viewed as a new entry in the already crowded utility tokens space. Among tens of thousands of cryptocurrencies that exist today, many are utility tokens with the top three mentioned above. Utility tokens are considered a separate asset class, with some features that can be similar to stablecoins, meme tokens and other categories. Blockchain tech underpins all these categories, and even the new MercadoCoin token will be Ethereum’s blockchain-based asset.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.