Highlights

- Voyager, which had applied for Chapter 11 bankruptcy, has the native token VGX

- The VGX crypto is trading in the green right now, with its price up more than 100%

- Voyager has reassured its users that they might soon get access to their crypto holdings

The ongoing year has rarely brought any positive news for the wider cryptocurrency world. One of these was the stunning rise of a new token, ApeCoin (APE), on its debut in March. Over the past few weeks, the news around crypto firms like Voyager and Celsius halting withdrawals has dominated headlines.

However, what might bring a little optimism in the market is the fact that the native token of Voyager Digital has registered a whopping upward movement in its price. Let us explore why Voyager’s VGX token is on the rise right now.

What is Voyager’s VGX token?

Like most other altcoins, VGX is the native token of a particular project. This project is Voyager, which has two primary offerings -- a smartphone app that can “earn up to 12%” rewards in a year, and a debit card that earns crypto rewards on all spendings. Voyager claims it supports close to 40 cryptocurrencies, including Bitcoin (BTC).

The VGX token is used within the ecosystem to “boost” existing rewards. It is said that the staking of the token can lead to 7% reward on a monthly basis. Voyager’s official website promotes holding the VGX token for long, which it states can help accrue more rewards.

Also read: Who is Miss Teen Crypto? Can influencers be followed blindly?

Why is the VGX token rising now?

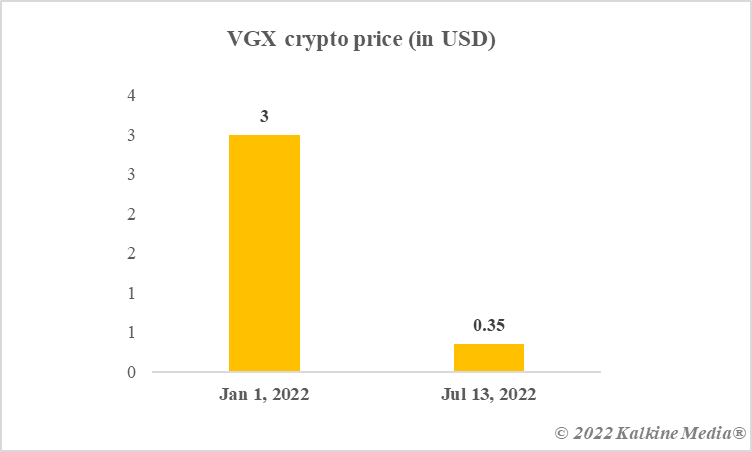

As of writing, the VGX token is up more than 100% within less than 24 hours. It is notable that the VGX token started this year with a price tag of nearly US$3, but it has continually lost value. The price is now over US$0.35, and the market cap is under US$100 million.

One of the reasons why VGX is gaining right now could be the recent announcement by Voyager on how users might regain access to their USD and crypto deposits. The company has reiterated that the USD deposits are Federal Deposit Insurance Corporation (FDIC)-insured. Voyager had recently applied for Chapter 11 bankruptcy and once the restructuring is done, crypto holders might get a proposed combination of cryptoassets and VGX tokens.

Data provided by CoinMarketCap.com

How are cryptoassets faring?

The VGX token is one of the few assets that are in the green right now. BTC has failed to regain the US$20,000 price tag over the past trading sessions, and Ether is trading just above US$1,000.

Bottom line

Voyager’s statement on July 11 with regard to access to crypto holding might have brought back some optimism. However, the rise of the VGX token must be seen with extreme caution. The company has been struggling after a crypto hedge fund Three Arrows Capital faced headwinds.

Also read: Understanding basics of cryptocurrency taxation in Australia

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.