Highlights

- Cryptos like Aventus (AVT) and Unifi Protocol (UNFI) have recently logged steep gains

- Aventus provides Layer 2 solutions for Ethereum, with support for dApps and digital assets

- The AVT token is used within Aventus as a medium of exchange and also for staking during voting

Optimism seems to have found its way back into the crypto market of late. After hovering under US$30,000 for a few weeks, Bitcoin is now over US$31,000. One cryptoasset, Unifi Protocol DAO (UNFI), has accumulated nearly 1,000% returns in the past one day. The UNFI token rose from under US$5 to almost US$40 in a matter of few hours.

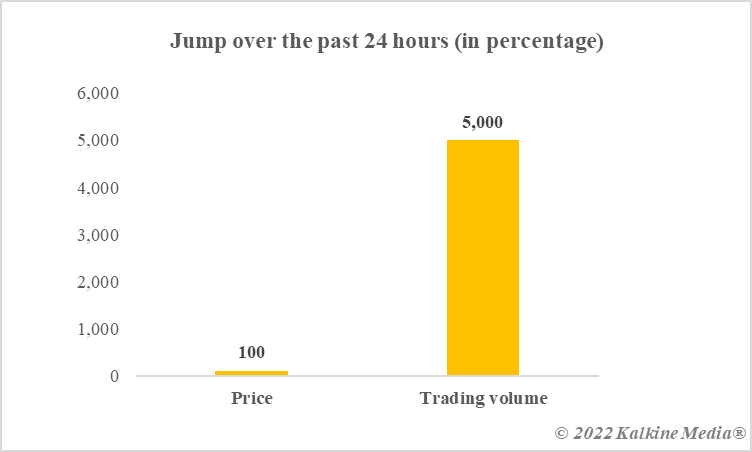

Another asset enjoying the same optimism is Aventus (AVT). Aventus has more than doubled in the last 24 hours, with a huge jump in its trading volume. Let’s know more about AVT and why it is rising.

What is Aventus?

Aventus is a blockchain network provider, with focus on Layer 2 solutions. While some other networks, including Solana and Cardano, are competing directly with Ethereum, Aventus has built on Ethereum. It adds a layer to Ethereum’s blockchain, which it claims brings more scalability and speed, aside from helping trim costs.

Aventus states its network can be used to deploy decentralised solutions and digital assets. Non-fungible tokens (NFTs) and dApps are also supported on this network, Aventus claims.

Also read: Top three NFT cryptos by market cap

What is AVT token price?

AVT is the token used by the Aventus blockchain project for purposes like staking and payment of fee.

AVT is yet to become a large-cap crypto like Solana (SOL), Cardano (ADA), and some other blockchain network tokens. As of writing, Aventus’ market cap is over US$13 million, which places it among the top 1,000 cryptos. Solana and Cardano both have multi-billion dollar market cap and rank in the top 10.

The AVT price has, however, surged more than even large-cap cryptos over the past few hours. From nearly US$1, the token jumped to over US$3, before paring gains. As of writing, the AVT token is trading at nearly US$2. The 24-hour trading volume, according to CoinMarketCap, has shot up by nearly 5,000%.

Data provided by CoinMarketCap.com

Why is Aventus crypto rising?

The Aventus crypto was recently listed on the Bittrex exchange, which can be one of the causes behind a sudden surge in trading volume and price. Another major event within the Aventus ecosystem was voting on a proposal related to AVT wallet.

It is notable that the AVT token has started to shed some of the gains, which suggests caution for crypto enthusiasts.

Bottom line

Aventus claims that its services can make Ethereum’s blockchain more efficient. Ether is native to Ethereum, and it has lost over 2% in the past 24 hours. During the same period, Aventus’ native token AVT has more than doubled. The AVT token was listed by Bittrex earlier this week, which can be one of the reasons why AVT’s trading volume has soared.

Also read: What is dotmoovs metaverse and why is MOOV token rising?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.