Summary

- Gold has been the darling commodity of the year 2020 with its impeccable price appreciation and safe-haven attributes.

- The surge in the gold price has been providing an impetus to ASX-listed gold stocks with many such as Saracen Mineral Holdings Limited (ASX:SAR) and Northern Star Resources Limited (ASX:NST) climbing to a record high in the recent past.

- The rush in the gold spot towards a record high has cemented many ASX-listed gold mining companies strong to sail through these unprecedented times with strong financial positions.

- Elevated gold prices have been now transcending into strong financial positions for ASX-listed gold mining companies with Regis Resources Limited (ASX:RRL) and Perseus Mining Limited (ASX:PRU) reporting a record NPAT.

A bullish setup has been simmering in gold for quite some time, and with the coronavirus outbreak, the gold spot has shattered all record to reach a record high of USD 2,073.41 (as on 7 August 2020).

To Know More, Do Read: Why Should Every Investor Closely Track Gold Price?

The surge in gold prices has been an impetus for ASX-listed gold mining companies with many witnessing a consistent rally in share prices on the exchange over sentiment splash.

To Know More, Do Read: Gold Hits life highs: Eight ASX-listed Gold Stocks Under Sentiment Splash

An impeccable performance from gold has been translated into strong financial positions for many ASX-listed gold stocks such as Saracen Mineral Holdings Limited (ASX:SAR) and Northern Star Resources Limited (ASX:NST).

To Know More, Do Read: Elevated Gold Spot Prices Transcending into Strong Financial Position for Saracen and Northern Star

In the wake of a substantial rise in the gold price and strong production, many ASX-listed gold mining companies such as Regis Resources Limited (ASX:RRL), Perseus Mining Limited (ASX:PRU) have witnessed a record surge in profitability with their NPAT contouring a record high for FY2020.

Regis Resources Limited (ASX:RRL)

Regis Reports a Record NPAT For FY2020

RRL managed to sell 353,182 ounces of gold at an average price of $2,200 per ounce, leading to an EBITDA of $394 million and a strong EBITDA margin of 52 per cent.

- Revenue for the period surged by 16 per cent against the previous corresponding period (or pcp) to stand at $757 million, leading to a 22 per cent increase in Profit Before Tax of $285 million.

- The Net Profit After Tax (or NPAT) soared by 22 per cent to reach a record of $200 million, with an NPAT margin of 26 per cent and a Return on Equity (or ROE) of 24 per cent, reflecting on the strength of the financial position.

- The basic earnings per share jumped by 22 per cent for the financial year ended 30 June 2020 against pcp to stand at 39.3 cents a share.

- The Company generated a cash flow of $343 million from operational activities and held cash & bullion of $209 million at the end of the financial year net of dividend payment of $81 million.

- RRL declared a final dividend of 8 cents a share, which took the total dividend for FY2020 to 16 cents a share, representing a payout ratio of 11 per cent.

On the operational counter, the gold production for the period declined by ~ 10.55 per cent to stand at 352,042 ounces; however, considerably high realised price on gold sales kept the financial position afloat.

- While the other operating parameters such as ore mined, stripping ratio, ore milled, head-grade, and the recovery rate remained largely in line with the prior year, the cash cost pre-royalty surged by ~ 11.59 per cent to stand at $914 per ounce.

- Moreover, the all-in sustaining cost (or AISC) for the period also jumped by ~ 21.0 per cent.

Also, RRL has proposed a Dividend Reinvestment Plan (or DRP) (election date – 29 September 2020), which includes a 100bps discount to the applicable 5-day volume-weighted average price.

Future Guidance

The Company anticipates a strong year of growth within the operations as production continues to lift and move towards the targeted profile of 400,000 ounces per annum.

- RRL kept the production guidance in the range of 355,000 to 380,000 ounces of gold for FY2021.

- The Company anticipates the cash cost (including royalty) in the range of $1,030 to $1,090 per ounce.

- The guidance for AISC is in the range of $1,230 to $1,300 per ounce.

- The estimation of growth capital and exploration is at $35 million and $15 million, respectively.

The stock of the Company last traded at $5.410 (as on 26 August 2020 01:55 PM AEST), down by 2.52 per cent against its previous close on ASX.

Perseus Mining Limited (ASX:PRU)

NPAT Skyrocketed From $7.6 Million To $94.4 Million

The West African gold producer reported total production of 257,639 ounces of gold for the financial year ended 30 June 2020 (FY2020) with an AISC Of USD 972 per ounce of gold produced, which remained a unit per cent up against pcp.

- PRU sales revenue for the period climbed by 16 per cent against pcp to stand at $591.2 million, and the Company trimmed its cost of sales by 8 per cent at $317.4 million.

- The Company realised ~ 15.91 per cent higher average sale price of gold during the period, and highlighting its successful transition to a multi-mine, multi-jurisdictional gold produce, PRU recorded an EBITDA (from operations) of $273.8 million, up by 67 per cent against the prior year.

- PRU reported a record NPAT of $94.4 million, which translated into 8.1 cents per share, which remained substantially up against the previous year NPAT of just $7.6 million or 0.7 cents a share.

An impeccable surge in NPAT was primarily led by a 16 per cent increase in revenue over 16 per cent higher average realised on sales and an 8 per cent decline in cost of sales.

Moreover, a 13 per cent decline in depreciation and amortisation expense also contributed towards the higher profitability.

Apart from that, a foreign exchange gain of $13.8 million and a ~ 31.66 per cent decline in financing cost at $4.1 million also contributed to the record NPAT for FY2020.

- For FY2020, PRU reported a write-down and impairment expense of $4.5 million concerning written off exploration expenditure on the Zanikan and Papara prospects in Côte d’Ivoire and the Dadieso prospect in Ghana.

At the end of the period, the Company held cash & bullion of $237.5 million, which remained ~ 41.11 per cent up against the prior year.

PRU Updates Mineral Resources and Ore Reserves Across Multi Prospects

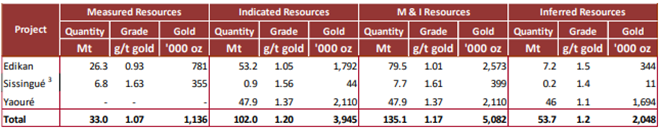

- The current Measured Mineral Resources of the Company stood at 33.0 million tonnes at an average grade of 1.07 g/t of gold, accounting for 1,136k ounces of gold.

- The Indicated Mineral Resources stood at 102.0 million tonnes at an average grade of 1.20 g/t, accounting for 3,945k ounces of gold.

- Likewise, The Inferred Mineral Resources stood at 53.7 million tonnes at an average grade of 1.20 g/t, accounting for 2,048k ounces of gold.

The breakup of Mineral Resources w.r.t to various prospects is as below:

Source: Company’s Report

Furthermore, PRU estimates that Proved Ore Reserves of the group stand at 19.7 million tonnes at an average grade of 1.20 g/t of gold, accounting for 758k ounces of gold.

Likewise, Probable Ore Reserves of the group stood at 53.3 million tonnes at an average grade of 1.47 g/t of gold, accounting for 3,281k ounces of gold.

The breakup of Ore Reserves w.r.t to various prospects is as below:

Source: Company’s Report

The stock of the Company last traded at $1.375 (as on 26 August 2020 01:55 PM AEST), down by 1.43 per cent against its previous close on ASX.