Summary

- Gold as a strategic asset is making its relevance more pronounced with prices reaching a record high in the recent past.

- Perceptions around gold have taken a paradigm shift from the safe-haven commodity to a crucial strategic asset.

- Gold has marked its place as a strategic allocation over its unique attributes such as liquidity and imperfect correlation with other assets.

- As per the recent data from the World Gold Council, the share of non-traditional assets among global pension funds surged from 7 per cent in 1998 to 26 per cent in 2018.

- Gold performance attributes and strategic relevance as a hedge against unprecedented times.

Perceptions around gold have taken a paradigm shift from the safe-haven commodity to a crucial strategic asset, especially since the onset of the year 2020, reflecting the growing appetite of the market for gold, which could be gauged by witnessing the gold spot price, which in the recent past had climbed to a record high of USD 2,073.41 per ounce (as on 7 August 2020).

Also Read: Gold- A Sprinter in the Marathon, Is the Price Rally Sustainable?

Gold has marked its place as a strategic allocation over its unique attributes such as liquidity and imperfect correlation with other assets. Moreover, the safe-haven attributes are now turning into strategic attributes over gold’s dual appeal as an investment and a consumer good, and such dynamics is likely to persist over the long-term amidst economic uncertainty, low interest rate environment, and shifting consumer spending behaviour towards more savings.

Furthermore, as unprecedented times begin, the investing community is standing against an array of headwinds concerning asset allocation and portfolio diversification.

For example, the persistently falling interest rate across the global front is now prompting the investing community to explore risk assets for better returns, which could surely disturb the way some investors measure and act on the risk and reward expectations.

Additionally, the continued financial market uncertainty, which is stemming from rising geopolitical tension between the United States and the red dragons to economic meltdown or consumption reduction instigated by the COVID-19 outbreak, is further leading to higher implied volatility, putting investors under the risk of getting whiplashed over headlines.

Gold has secured its place among institutional investors, who are embracing gold as alternative to traditional stocks and bonds in pursuit of diversification and higher risk-adjusted returns. The increased interest of institutional investors in gold could be further inferred from a large buying of gold via gold-backed ETFs and a higher net inflow of HNIs into physical gold.

ETFs Inflow and Capital Influx in Gold: Australian Gold-Backed ETFs – Massive Capital Influx, Impeccable Performance, And Record Values

As per the recent data from the World Gold Council, the share of non-traditional assets among global pension funds ballooned from 7 per cent in 1998 to 26 per cent in 2018.

Apart from a surge in net buying from global gold-backed ETFs and large investors, central banks across the globe are also showing a mounting interest in gold to hedge their risk against falling U.S. dollar, which is now encouraging other investors to consider gold’s positive investment attributes.

Gold Performance Attributes

Gold, which has been traditionally considered as a go to asset during unprecedented times, has generated positive and better returns in the status quo as compared to other traditional assets. Gold as a commodity of diversified uses such as jewellery, luxury goods, investment, electronics, shows resilience over its dual-nature as a consumption-based commodity and a hedging tool, in difficult times.

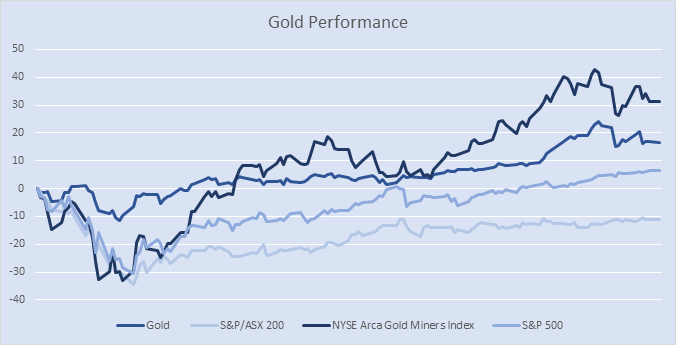

Over the last six months, the gold spot has delivered a total return of 16.44 per cent, outperforming major equity indices such as S&P/ASX 200 and S&P 500.

However, there has been a lot of interest from the investing community around gold mining companies, prompting them to emerge among the top-performing sectorial class to even outperform gold in unprecedented times.

As can be witnessed from the above graph, the NYSE Arca Gold Miners Index has delivered an impeccable total return of 31.42 per cent over the last six months, outperforming gold.

Also Read: Gold Hits life highs: Eight ASX-listed Gold Stocks Under Sentiment Splash

The better performance of gold mining stocks on the global front is a mere reflection of changing risk appetite and behavioural setup of the investing community. The low interest rate environment along with a lower valuation or cheap stock prices (as compared to pre-crisis level) have diverted investors towards risky assets for value, leading to a sentiment splash in gold mining stocks, which after all is also an indirect way of parking investment in gold.

Gold Strategic Relevance

Like traditional assets, alternatives assets does not conform to most of the valuation methods or frameworks, as for being a zero-coupon bearing asset, many cashflow-based discount models such as DCF model fail to capture the relevance of gold.

Thus, it becomes paramount to value gold in terms of its relative demand and supply metrics, which at present, is directly favouring gold price.

Demand Influencing Factors

Market downturns, which so far has been the common language of the global equity front, often boost investment demand for gold, which we all have witnessed recently, with the buying from global gold-backed ETFs contouring a record high during the second quarter of the year 2020.

Moreover, not just market uncertainty and economic contraction fan gold, periods of growth are also very supportive for the gold price, as it often boosts demand for gold in the form of jewellery. So, in a nutshell, while the market uncertainty is already providing a cushion to gold prices, the period of following recovery, which is estimated to begin in 2022, could also be supportive for gold.

Thus, gold has its own strategic relevance!!

Furthermore, while the demand side captures only half a side of the valuation attributes, another half belongs to the supply, which has taken a considerable hit due to mining disruptions and limited workforce mobility, aligning gold as a commodity or an asset to capture a tranche of a large portfolio.

For Supply Side Story, Do Read: Gold Supply Disruptions and Paradigm Shift in Gold Miners’ Business Strategy