Cobalt prices have witnessed a sharp decline from its peak in early 2018 amid reduced exposure of cobalt in the battery-tech. The prices of Cobalt Futures CFD have dropped from the level of US$93,550.0 (in March 2018) to the present level of US$25,666.0 amid adoption of different metals such as nickel, silicon, graphene in the battery-tech.

Due to the falling prices, the ASX-listed cobalt miners are progressing on projects with multi-commodity exposure to reduce the negative impact of the cobalt price drop. Let us take a look over the ASX-listed miners with cobalt and other commodity exposures.

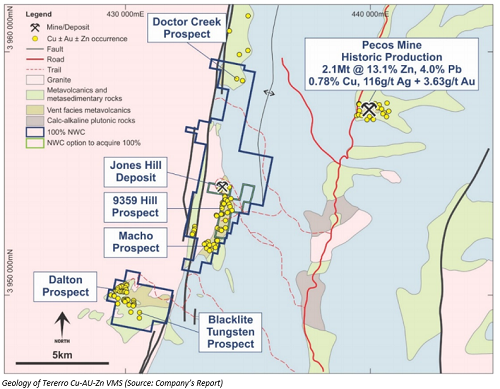

New World Cobalt Limited (ASX: NWC)

NWC an ASX-listed cobalt player recently presented its quarterly activities report for the quarter ended 30 June 2019.

In early June quarter of 2019, the company completed due diligence on the Jones Hill VMS Deposit, which is at the centre of the NWCâs New Mexico project- Tererro Cu-AU-Zn VMS. The due diligence led towards the commencement of a 5-year option agreement to acquire 100 per cent interest in 20 mining claims over the John Hill Deposits.

Systematic Work at John Hill Deposit:

Historic Work:

During 1977 to 1984, 57 diamond drill (DD) holes were drilled at the John Hill deposit, and post the completion of first 39 holes- Conoco Inc in 1981 estimated the Mineral Resources of the deposit to be at 5.7 million tonnes with an average grade of 1.96 g/t of gold , 1.02% of copper, 1.46% of zinc, 0.24% lead , and 22.0 g/t of silver.

Despite vast extensions along the strike and depth the John Hill Deposits remain underexplored, and thick mineralisation over the surface, where a historic DD intersected 94.8m @ 5.24 g/t of gold, 0.83% of copper, 0.32% of lead, 0.68% of zinc and 24.3 g/t of silver, provides the company with a potential of low-cost mining.

NWCâs Aim:

NWC intends to rapidly complete the work program at the John Hill Deposits to achieve the mine development along with the aggressive exploring of the deposits to identify for possible mineral extensions.

The company further sees a resource extension potential at its Tererro Cu-Au-Zn VMS in New Mexico, USA, which holds the possibility of near-term production.

Copper Anomalism:

During the June 2019 quarter, NWC reviewed over 400 historical reports, which in turn, suggested that during 1978-1989 several soil-sampling programs were undertaken over the John Hill Deposits. As per the company, these surveys delineated strong copper-in-soil anomaly, which spread across 250m with an assay of 700 parts per million of copper.

As per the company, the data suggested that there are many untested soil geochemistry anomalies present towards the immediate south of the John Hill Deposit, which include Varella (300m Cu-Au-Zn), 9359 Hill (750m soil anomaly) and Upper Macho (250m Cu-Au-Zn).

NWC intends to complete the ground geophysics survey over these anomalies, and the survey would start in early August.

Cobalt Prospects:

Colson Cobalt-Copper Project:

NWC hosts a 100 per cent stake at the Salmon Canyon Cobalt-Copper Deposit, which is in a highly endowed high-grade cobalt district in the western World- Idaho Cobalt Belt. The deposits and the surrounding are underexplored and last significant work at the prospect was undertaken in the 1970s.

Post securing the rights at the prospect, the company commenced implementing a multi-pronged exploration and development program. After receiving the supporting results from the exploration program, the projected area has been expanded by the company from 200 acres to 6,300 contiguous acres.

NWC identified several strong anomalies during the second phase of an induced polarised survey completed in late 2018.

Apart from the Colson Cobalt -Copper Project, the company also hosts Elkhorn Creek Cobalt-Copper Project, Badger Basin Cobalt-Copper Project, Iron Dyke Cobalt-Copper Project and Goodsprings Cooper-Cobalt Project, where the company did not complete any significant work during the June 2019 quarter.

The shares of the company settled unchanged at A$0.016 on Friday, 2 August 2019, as compared to its previous close on ASX.

Northern Cobalt (ASX: N27)

N27 finished its last quarter of the Financial year 2019, and the company recently presented its last quarter- ended on 30 June 2019, update on ASX.

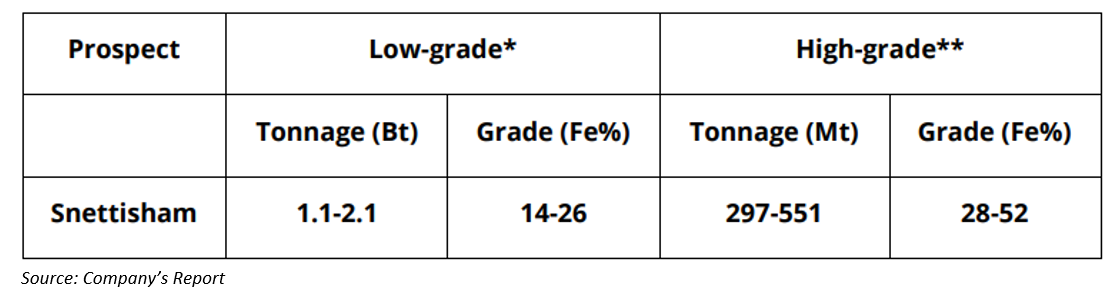

During the quarter, the company staked 48 mineral claims in south-western Alaska at the Snettisham Vanadium Project. N27 identified the potential for large scale mineralisation amidst its global search for a vanadium project.

In June, the company released a geophysical Exploration Target over the Snettisham Project, which underpinned N27âs assessment of value addition through exposure in magnetite iron ore, which in turn, could support the economics of the Snettisham Project by giving additional exposure of other minerals apart from the conventional vanadium.

The magnetite iron ore exploration target contains both high and low grades and is as following:

Apart from such grades, the prospect contains many critical infrastructures, which provides the project proximity to electricity, bulk material access, access to USA & China deep water channels and experienced workforce.

However, N27 mentioned that the potential quantity and grade of the exploration targets are conceptual in nature, and there has been no sufficient exploration to estimate the Mineral Resource.

A DTR test produced from the surface sampling at the Snettisham Project revelled a 63 per cent Fe and 0.64 per cent vanadium oxide.

The shares of the company settled at A$0.033 on Friday, 2 August 2019. up by 3.125 per cent as compared to its previous close on ASX.

Aeon Metals Limited (ASX: AML)

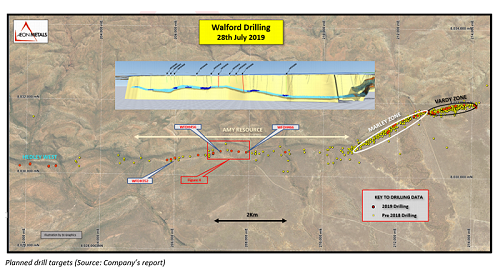

AML recently presented its last quarter update for the financial year 2019 on ASX, in which the company emphasised on the development made over its wholly-owned Walford Creek project.

Walford Creek:

The company started a drilling project at the Walford Creek prospect in May 2019 with a single drill rig undertaking RC (reverse circulation) pre-collars and simultaneously a second rig joined the drilling activities on 13 May 2019 and started diamond drilling of the RC pre-collars.

The drilling undertaken by the company consisted of a combination of exploration, which remained outside of the current Resource boundaries and planned drill holes, which in turn, reflected the part of companyâs priority work for the Pre-Feasibility Study (or PFS) for the Walford Creek.

Planned Areas for Drilling in 2019:

The areas at the Walford Creek outlined for drilling in 2019 includes the western Amy extension, space below the PY3 lode, a 5.8km strike within the Amy Resource and area which consists of eastern Vardy extension continuations.

The Amy Western Extension:

The initial RC exploration drilling has focused on the area that is approx. 2.0-2.5 west of the Amy Resource boundary and about 12.0-12.5km distanced from the eastern end of the Vardy pit design.

To locate the Fish River Fault (or FRF) and to identify the prospective stratigraphic horizons, AML completed six reverse circulation step-out holes at the prospect, and all the six holes intersected PY3 mineralisation, below which the company plans for further drilling in 2019.

AML received the assay results from first four holes, which includes some significant intersections such as 7m @ 0.80% of copper, 0.13% of cobalt from 93m (including 3m @ 1.31% of copper, 0.25% of cobalt and 22g/t of gold from 97m).

The company plans to target the area below the PY3 lode is strategic as the two additional step-out RC holes intersected similar sulphide minerals as received from the first four holes assay just 20m below the surface of the PY3 lode.

Vardy Zone:

The company received high-grade assay results from the infill drilling of the current resource zones during the June 2019 quarter. The best intercept received by the company was from the hole identified as WFDH419, and the intercept was as:

37m at 1.27% of copper, 0.17% of cobalt and 41g/t of gold from 285m, including 24m at 1.69% of copper, 0.20% of cobalt and 41g/t of gold from 288m.

The Bioleach Process Selection and Cobalt:

The company undertook a metallurgical testwork during the June 2019 quarter which resulted in indicative cobalt recoveries to cobalt intermediate concentrate of approx. 75 per cent and the company conducted a series of bioleach tests on Walford Creek Vardy PY1 cobalt intermediate concentrate, which in turn, resulted in an average cobalt extraction from concentrate to the solution of 97 per cent with a 24-hours resonance time.

The shares of the company settled flat at A$0.185 on Friday,2 August 2019, as compared to its previous close on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.