The developments in financial technology (Fintech) and regulatory technology (Regtech) have gained a front seat of the digital revolution that is driving the ways of operating businesses, consumers and government bodies across the globe.

The Fintech sector in Australia has shown exceptional growth and increased competition with fresh players coming into play with unique products and services to disrupt the market opportunities fuelled by technological advancements. Australia’s Sydney and Melbourne hold a place among the top 15 global financial centres, while Australia is ranked 5th in the top 20 markets for fintech consumer adoption.

To learn more about the Australian Fintech market, read- Guide to the Fintech World: 5 things that are trending now.

And

Australia’s Fintech Companies and the Advantage of Fair Winds from Asia

The increasing unique financial products and services offered by the Fintechs has increased the need for regulation of the Fintech companies and ensuring compliance by them. This has furthered the rise of Regulatory tech (Regtech) companies in Australia.

According to Austrade, market-changing repercussions and opportunities for innovative fintech and regtech firms can be expected following the recommendations from a recent government review.

The Parliament of Australia mentioned that during September 2019, a Select Committee on Financial Technology and Regulatory Technology will be formed by the Senate to undertake a comprehensive inquiry into the advancements taking place in the Regtech sector and report the same by the first sitting day in October 2020.

The committee shall examine issues including:

· Size and scope of the opportunity for Australian consumers and business arising from financial technology and regulatory technology;

· Barriers to the uptake of new technologies in the financial sector;

· The progress of Fintech facilitation reform and the benchmarking of comparable global regimes;

· Current Regtech practices and the opportunities for the Regtech industry to strengthen compliance but also reduce costs; and

· The effectiveness of current initiatives in promoting a positive environment for FinTech and Regtech start-ups;

· Any related matters.

The committee looks forward to hearing from the Fintech and Regtech start-ups directly while also recognises confusion that might arise since most start-ups do not regularly deal with the government.

Considering this as the early stage, from informal feedback and early submissions, the committee identifies five major themes emerging:

· access to capital;

· skills;

· taxation;

· regulation (including specific FinTech regulations); and

· culture.

In the modern-day financial sector, financial reporting is believed to become more numerous and complex, which has placed upon companies an increased burden in the form of compliance cost.

It has been noted in many quarters that Artificial Intelligence (AI) could be harnessed to automate compliance processes which would facilitate costs and time effectiveness. Subsequently, Regtech has become a fast-growing field dedicated to easing compliance processes.

Let us take a break from the Government’s interventions in the Regtech sector and discuss a key Australian Regtech player, Imperium Markets, which is leading the digital transformation of wholesale capital markets.

Imperium Markets

According to Austrade:

“Imperium Markets was the first Fintech to get an Australian Markets License from the Australian Securities and Investment Commission (ASIC)”

With the objective to transition the wholesale deposit and fixed interest market to a platform, Imperium Markets was founded by financial markets practitioners in December 2016.

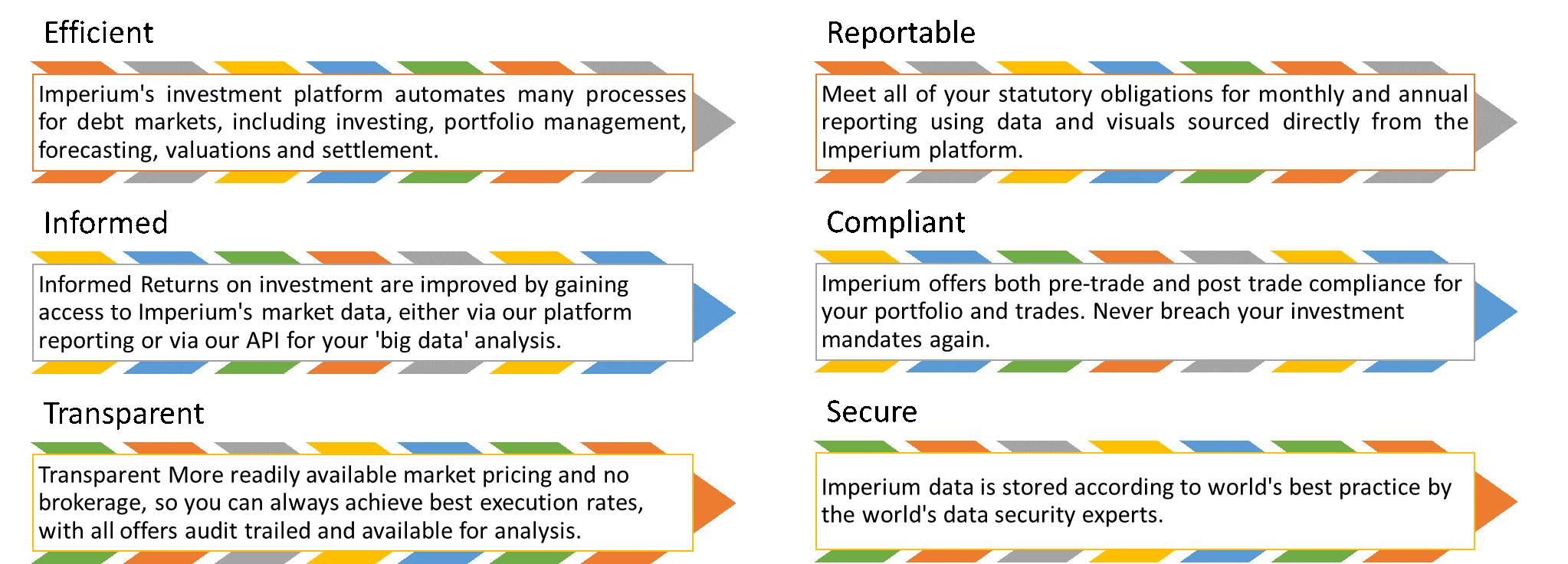

Some of the features of the Imperium Markets’ solutions are-

The technology designed by Imperium Markets allows the transition of money and bond markets to platform trading globally and allows the market participants to transact via electronic mode.

Kyckr Limited (ASX: KYK)

Global regulatory technology company, Kyckr Limited, provides global company intelligence from the legally trustworthy as well as compliant sources across the globe with solutions connected to 200+ regulated primary sources in 120+ countries.

KYK offers prompt company registry information on over 170 million businesses across the globe, along with access to automated technology solutions that boost the efficiency of Corporate KYC (Know Your Customer).

Instead of storing the information, KYK connects its clients to the registry at each search, ensuring the quality and accuracy of the information that it returns. Further, KYK’s automated solutions present access to tools that support in managing compliance processes from any location.

KYK helps the businesses to strengthen the KYC & AML compliance monitoring for the businesses.

Smart online monitoring service, Kyckr Company Watch, notifies about changes in company information (such as Status, Name, Address, Director, Shareholder, Capital Structure or Ultimate Beneficial Owners (UBO)) and enables the business to be at the forefront of changes to company information and use automation for the compliance monitoring process.

ASIC recognises the massive potential of the Regtech sector, which would assist the businesses to develop a culture of compliance, recognize learning prospects, and to establish efficiency relating to regulatory matters.

ASIC is of the view that Regtech has recently been functioning in various areas such as trading supervision and regulatory reporting, and is, therefore, contributing further towards the promotion of:

· Regulatory compliance,

· Market integrity, and

· Positive consumer outcomes.

Regulation technology for financial institutions

More and more regulators around the world are dependent on technology to monitor regulated entities.

The implementation of algorithms for their own function by the banks and financial firms in the current-day scenario could possibly ease the supervision by the regulators for using real-time data and predictive technology for risk-based regulatory action.

Using technology in regulation would not only deliver the advantage of speed but also reduce the cost of regulatory compliance to the financial services industry through automation in compliance, which is estimated to be USD 100 billion globally

Besides reporting and compliance, other areas of the use of Regtech identified are:

· Identity management and control

· Risk management

· Transactions monitoring

· Trading in financial markets

It is expected that through modernisation of the financial supervision, it shall be simpler for new, user-friendly solutions to reach consumers faster and at a reduced cost of compliance for the whole sector along with the freshly formed fintech firms.

Adoption of Regtech is anticipated to yielding both short-term and long-term benefits, wherein the short-term benefits include:

· Reduce the cost of compliance through automation of compliance processes;

· Aid in firms’ enjoying flexibility as the risk management systems can be constantly updated in accordance with growth requirements;

· Leveraging advanced data analytics to aid firms identify potential risks and device suitable mitigating measures.

In the longer run, using Regtech would:

· Yield tangible benefits such as improved stability in operations;

· Effective corporate governance;

· Easier regulatory reporting benefiting both the firms and the regulators.

Regulatory Sandbox and Regtech as a Service (RaaS) are the innovations in Regtech that are steering greater engagement between regulators and financial institutions by enabling faster, safer and easier regulatory compliance for financial institutions.

Bottomline

Regtech is seen as evolving in present-day scenario and innovations are anticipated to lie ahead, with much of the effort in development thus far focused on digitization of manual processes.

The AI applications, especially, have the potential to help firms detect compliance risks and make better-informed decisions about how to mitigate them and can reduce firm-level compliance risks and also reduce supervisory risks.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.