The concept of 'Buy Now Pay Later' or BNPL that did not even exist a few years ago has now become an emerging space of the Australian economy. The BNPL service providers enable the consumers to receive the desired product in full by paying a fraction of price at the time of purchase. The BNPL provider pays the retailer in full and collects the balance amount from the consumer in instalments, accepting the default risk of the payment.

The BNPL providers are not categorised as credit provider entities as do not generally charge interest. Also, the BNPL providers can operate free of obligations in Australia that are usually applied to credit providers. The National Credit Act 2009 does not apply to these BNPL providers, which means that they do not need to hold the Australian credit license to offer their services.

In a review conducted by the Australian Securities and Investment Commission in November 2018, it was found that the use of buy now pay later arrangements has increased about five-fold between FY 2015â16 and FY 2017â18 as more and more users are using the facility regularly.

ASX-Listed Buy Now Pay Later Stocks

There are many BNPL providers operating in Australia, including Z1P, APT, FXL, SPT etc. that are listed on the ASX. Recently, a US lender Sezzle Inc has also hit the ASX boards, joining the emerging Buy Now Pay Later space. Let us know more about a few of the ASX-listed BNPL stocks below:

Sezzle Inc.

A technology driven payments company, Sezzle Inc. (ASX: SZL) has recently got listed on the ASX with an aim to financially empower the next generation. The company offers a payments platform that promotes secure and fast payments between customers and retailers. It has an interest-free, short-term instalment payment plan that provides budgeting and financing benefit to customers.

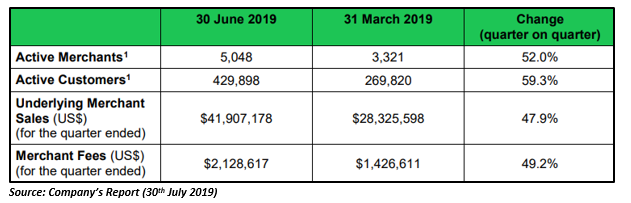

Operational Performance

Recently, the company informed through an ASX announcement that its operating metrics are moving actively in a positive direction. In June 2019 quarter, the company had around 5,048 Active Merchants using its platform relative to 815 Active Merchants in the prior corresponding period. The Underlying Merchant Sales of Sezzle has also improved from US$2.9 million in pcp to US$41.9 million in June quarter.

Financial Performance

The company completed its Initial Public Offering oversubscribed recently due to a strong demand from institutional and retail investors. The applications for the companyâs CDIs exceeded the capital raising target of US$30 million, leading to a significant scaling back of applications. The company issued 35,714,286 CDIs at an issue price of $1.22 per CDI for raising US$30 million.

Stock Performance

The companyâs stock closed the trading session lower on ASX on 2nd August 2019 at AUD 2.390, down by 4.4 per cent. The stock has delivered a return of 13.64 per cent since it got listed on the ASX (i.e. 30th July 2019). The stock jumped on the first day of trading itself, ended ~80 per cent above its AUD 1.22 IPO price at AUD 2.20.

Z1P Co Limited

New South Wales-headquartered, ZiP Co Limited (ASX: Z1P) provides digital payment services and point-of-sale credit to health, retail, travel and education industries. The company leads in the digital payments and retail finance industry. It operates under Pocketbook, Zip Pay and Zip Money brands.

Operational Performance

In an ASX-update on 1st August 2019, the company notified that it has entered into a partnership with Big W, part of Woolworths Group Ltd (ASX:WOW) to provide Zip interest free payments to its clients.

Recently, the company also informed that it has mandated NAB (National Australia Bank Limited) for the establishment of its Master Trust Programme. NAB will arrange a series of ABS investor meetings for the programme.

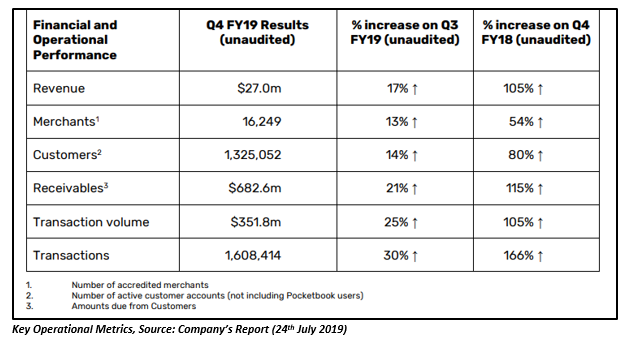

Financial Performance

In its Q4 FY19 Quarterly Update, the company has reported a rise of 17 per cent in its quarterly revenue to $27.0m. The receivables of the company improved 21 per cent on the previous quarter to $682.6 million.

Stock Performance

Z1P ended the trade at AUD 3.330 on ASX on 2nd August 2019, up by 1.21 per cent in comparison to the last closed price. With ~1.02 million shares of the company in rotation, the market cap of the stock stood at AUD 1.16 billion. Z1P has generated a tremendous return of 199.09 per cent on a YTD basis.

Afterpay Touch Group

The Australian-headquartered technology-driven payments company, Afterpay Touch Group (ASX:APT) is working with a motive to make purchasing feel great for its customers. The company allows retailers to offer BNPL service that does not require a payment of upfront fees or interest from the customers.

Operational Performance

The company recently provided an update related to AML/CTF matters. The company informed that Mr Neil Jeans of AML/CTF firm Initialism has been appointed as the external auditor by AUSTRAC to conduct the audit. This was done in response to the external audit notice issued by AUSTRAC to the company on 12 June 2019.

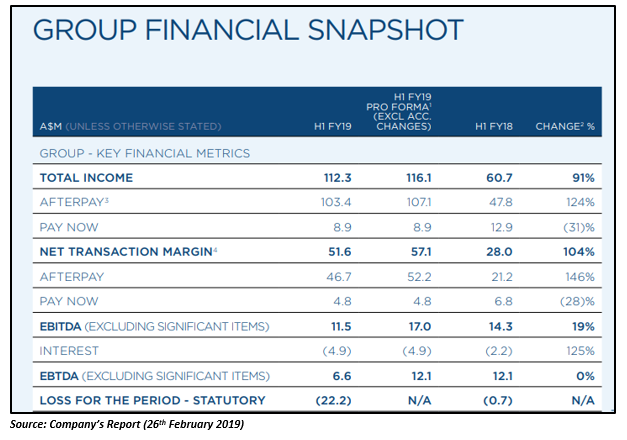

Financial Performance

Afterpay released its first-half results for the financial year 2019 in February this year. The company reported Underlying sales of $2.3 billion during the period that was 147 per cent more than the pcp figure. On a pro forma basis, the companyâs total income rose by 91 per cent on pcp to $116.1 million.

Stock Performance

On 2nd August 2019, the companyâs stock closed at AUD 25.490 on the ASX with a fall of 3.95 per cent in comparison to the previous closed price. The 52-week high and low value of the stock stood at AUD 28.760 and AUD 10.360, respectively. APT has generated a YTD return of 121.17 per cent while it has delivered a return of 63.73 per cent in the last six months.

FlexiGroup Limited

The Australian-headquartered FlexiGroup Limited (ASX: FXL) offers a wide range of finance solutions to business and consumers with the help of its business and retail partners. The company provides services like credit cards, BNPL products and consumer and business leasing.

Operational Performance

On 22nd July 2019, the company informed that it has added several high-profile retailers to its BNPL platform, Humm. The company also mentioned that humm is driving large value sales with ATV of more than $400 for âlittle thingsâ online and ATV of ~$3,760 with its âbig thingsâ wallet. According to flexigroup, the transaction volume has improved by 16 per cent, and the total number of transactions has increased by 22 per cent after the launch of humm.

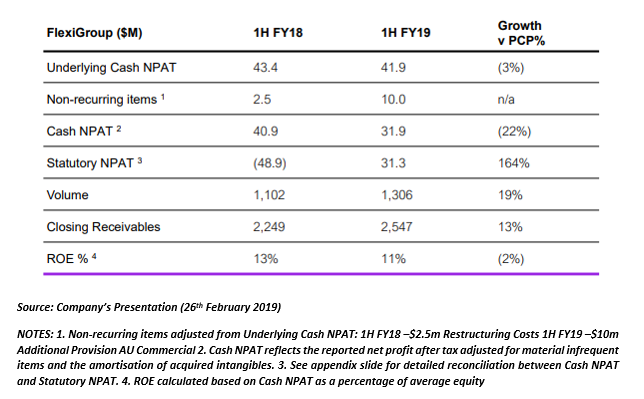

Financial Performance

In its 1HFY19 results, the company reported a rise of 17 per cent in its active customers to 1.2 million relative to pcp. The transaction volume and the receivables of the company were 19 per cent and 13 per cent up on pcp to $1.31 billion and $2.55 billion, respectively. The Cash NPAT of flexigroup was22 per cent down on pcp at $31.9 million.

Stock Performance

FXL ended the dayâs trade at AUD 1.825 on 2nd August 2019, up by 1.389 per cent relative to previously closed price. With ~851k number of companyâs shares in rotation, the market cap of the stock stood at AUD 709.9 million. The stock has delivered a return of 35.19 per cent on a YTD basis.

Splitit Payments Ltd

A payment method solution company, Splitit Payments Ltd (ASX: SPT) offers the service of splitting the cost of the purchase to customers into interest and fee-free monthly payments through their existing debit or credit card. It also allows merchants to provide an easier payment method to their customers with instant approval.

Operational Performance

In its recently released quarterly updates for the June 2019 quarter, the company reported that around 72 new active merchants joined the company during the period, taking its total active merchantsâ figure to 509. The company also recorded a rise of 108 per cent in its Merchant Transaction Volumes on pcp to A$31.9 million. Splitit signed two new partnerships subsequent to end of the quarter, with EFTPay and GHL.

Financial Performance

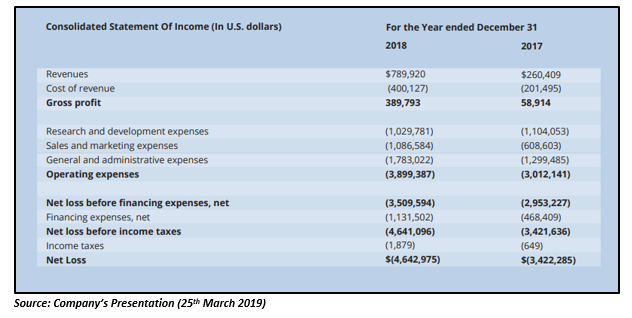

During the year ending 31st December 2018, Splititâs revenue was 203 per cent up on pcp at USD 789k from USD 260k in FY 17. The company also observed a 117 per cent rise in its active merchants to 380. The underlying merchant transactions of the company also improved 253 per cent to AUD 80.2 million from AUD 22.7 million in FY 17. Splitit posted a net loss of USD 4.6 million during the period.

Stock Performance

As on 2nd August 2019, SPT closed the trading session lower at AUD 0.553 with a fall of 6.14 per cent. Around 1.42 million shares of the company were trading on ASX with a market cap of AUD 175.29 million. The stock got recently listed on the ASX on 29th January 2019 and has delivered a negative return of 16.18 per cent since then.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.