Small-cap companies are gaining high traction among investors around the world. NASDAQ US Small Cap Index (NQUSS) is the index which tracks the performance of small-cap securities in NASDAQ US Benchmark Index. As on 29 January 2020, NQUSS has delivered a positive return of 28 per cent and 8 per cent in the last one-year and five-year, respectively.

Similarly, for Australia, the S&P/ASX Small Ordinaries tracks small-cap companies listed on the ASX. S&P/ASX Small Ordinaries has ~196 constituents and has delivered a positive return of 15.44 per cent in a one-year span.

Investing in a small-cap company can be beneficial to the investors as these companies possess high growth potential for reaching a mature stage in business cycle. Being in a developmental stage of business, small-cap companies have a significant amount of time to reach the maturity level.

Today, in the era of digitalization, a lot of small-cap companies are growing their businesses in terms of updated technology such as artificial intelligence and machine learning.

Let’s deep dive to understand the business and stock performance of two small cap companies from the healthcare and information technology sector.

Alcidion Group Limited (ASX: ALC)

An ASX-listed company, Alcidion Group Limited (ASX: ALC) has been operating in the health care sector since over 25 years. It provides a set of solutions that backs interoperability, software products and services that generates a unique offering in the global healthcare market.

ALC’s products include Smartpage, Patientrack, Miya MEMRs and Miya Precision, which are created using predictive analysis / algorithms. Alcidion has well integrated the use of technology in the healthcare sector and its digitally inclined products have been gaining momentum in the market.

Recently, the Company has entered into two different agreements-

Contract signed for medications management solution for $1.9 million:

- On 27 December 2019, Alcidion Group Ltd notified the market that the company has signed an agreement with Dartford and Gravesham NHS Trust in UK. This contract will enable ALC to execute Medications Administration (ePMA) system and OPENeP Electronic Prescribing which is produced by Better. Also, it was mentioned that the contract’s total value is approximately $1.9 million.

- The contract is an extended relation of ALC with Dartford and Gravesham in UK which allows the implementation of ALC’s full product suite in the country, including Patientrack solution and upcoming plan to implement the Smartpage solutions and Miya Precision.

- Dartford and Gravesham have an ambitious strategic plan of being Paperless by 2020 at the Point of Care. Also, to fully achieve digital maturity by the adoption of best of breed technology solutions. Thereby, Neil Perry, Director, Digital Transformation, stated that ALC will bring a range of technologies which will help ALC to achieve their objectives.

Contract signed for monitoring and patient assessments for $500k:

- On 19 December 2019, Alcidion Group Limited announced that it has entered into a contract with Taunton and Somerset NHS Foundation Trust, which allows ALC to bring its solution, Patientrack in the UK market. The total value of the contract signed with NHS is worth $500K.

- Patientrack is an electronic observations and patient evaluation solution.

- Taunton and Somerset are looking forward to the implementation of Patientrack software solution as it will help improve patient safety and care.

ALC’s Financial Standpoint

Key highlights of ALC’s Quarterly result for FY 2020 for the period ending 31 December 2019 are mentioned below-

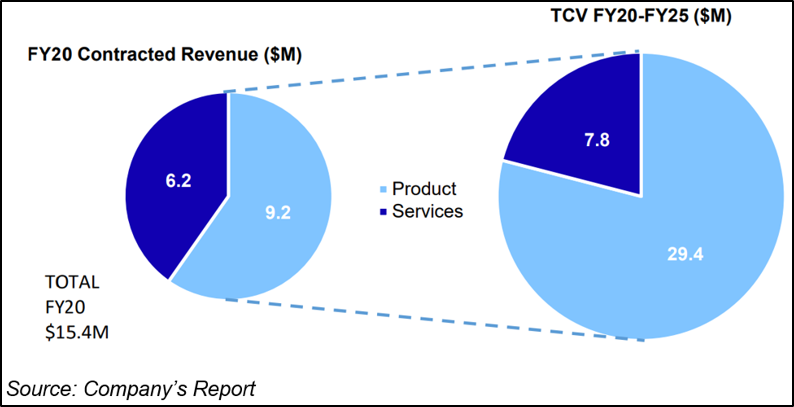

- ALC’s revenue stands at $15.4 million in FY2020 as compared to the total revenue of $16.9 million for FY2019

- Increase of 22.7 per cent in recurring revenue for Q2 FY2020 as compared to Q2 FY2019

With increasing customer base coverage in the UK with implementation of its technology driven products via the above-mentioned contracts and a positive Q2 FY 2020, ALC foresees a positive outlook in the long-term.

Stock performance

The stock of this small-cap player has been performing extraordinarily while considering its one-year and five-year stock return performance which is 365.12 per cent and 700 per cent, respectively (as on 31 January 2020).

Bigtincan Holdings Limited (ASX: BTH)

An ASX-listed company, Bigtincan Holdings Limited (ASX: BTH) helps companies enhance their sales productivity and increase the customer engagement by providing them with a mobile-first solution. BTH provides effective ways for teams to deliver improved business results as it induces efficient buying experience for customers.

The Company caters to 8 industries- Life Sciences, Retail, Financial Services, Technology, Manufacturing, Telecommunications, Government and Energy.

BTH was formed in 2011 as a software solution provider with its core operations in Sydney, Australia. Currently, BTH is headquartered in Boston, Massachusetts and the resources to support the operations are spread out in these countries across the global- Glasgow, Israel, London, Los Angeles, Singapore and Tokyo.

BTH has entered in mainly two contracts, as mentioned below.

Contract signed with Sephora USA Inc. for $2.8 million:

- On 2 December 2019, Bigtincan Holdings Limited announced that it has entered into a contract with Sephora USA Inc. via a competitive bid for a retail deployment.

- The contract is valid for three and a half years with a total value of $2.8 million

- As Sephora operates in 34 countries worldwide with more than 2,600 stores, the coverage of BTH’s software platform, Bigtincan® Zunos will be used by wide number of frontline retail staff.

Contract signed with DXC Technology Services LLC for $6.2 million:

- On 31 January 2020, BTH notified the market about its contract with DXC Technology Services LLC. The total value of the contract is $6.2 million for an initial period of 2 years and DXC has an option to extend the contract to 3 years.

- This contract helps BTH to attain its strategy of associating with enterprise customers to meet their need for a platform that can be used for Learning, Content, Add-ons and other features. This consequently makes the Bigtincan platform distinctive for key vertical markets.

Stock performance

The BTH stock had delivered a significant return of 80.21 per cent and 183.3 per cent in the span of 6 months and one-year, respectively.

On 31 January 2020, the stock of BTH settled at $ 0.99, an increase of 14.451 per cent compared to the previous closing price. The company has outstanding shares of around 308.36 million and a market capitalisation of nearly $ 266.73 million. The 52 weeks low and high price of the stock is $ 0.291 and $ 1.08, respectively.