2019 was an exciting year for the technology sector as it surpassed its benchmark index ASX/S&P 200. In 2019 ASX/S&P Information technology sector delivered a return of 32.96% while ASX/S&P 200 delivered a return of 20.27%.

The technology sector is an exciting sector having the potential to deliver attractive returns for an investor.

In 2019, the Australian government laid stress on four technologies which would boost the Australian tech sector. These comprise of AI, Blockchain, IoT & Quantum computing.

As per a report from Data61, digital innovation over the decade might deliver $315 bn in gross economic value to the nation. Thus, this sector is going to be an important component of Australia’s ongoing economic success. The report by Data61 identified 8 strategic domains where the country can be successful in developing new digital services or products.

The technology sector index in 2020 from 2 January 2020 till 13 January 2019 went up by 3.185%.

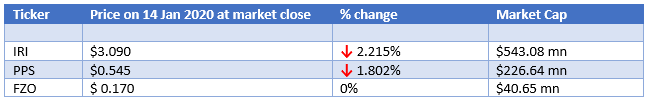

In this article, we would look at three technology companies and check their recent updates.

Integrated Research Limited (ASX: IRI)

On 13 January 2020, Integrated Research Limited (ASX: IRI), the leading global provider of proactive performance management software for key IT infrastructure, payments & communications ecosystems provided its profit guidance for six months to period ended 31 December 2019.

Integrated Research Ltd confirmed that it is into the early stages of the preparation of its half-year financial statements. According to the internal management accounts as well as depending on the auditor review, the company is hopeful about positive results for this period.

- Net profit after tax is expected to lie in between $11.5 million to $12.0 million. This was $11.7 million in the prior corresponding period (pcp).

- Revenue is anticipated to be in between $52.5 million to $53.5 million, representing a growth in the range of 4% to 6% on pcp.

- License sales would lie in between $32.5 million to $33.5 million, reflecting an increase in between 4% to 7%. The increase in the license sales would be backed by strong performance through the Unified Communications product line of Integrated Research Limited along with the continuous growth in the APAC operation.

Praemium Limited (ASX: PPS)

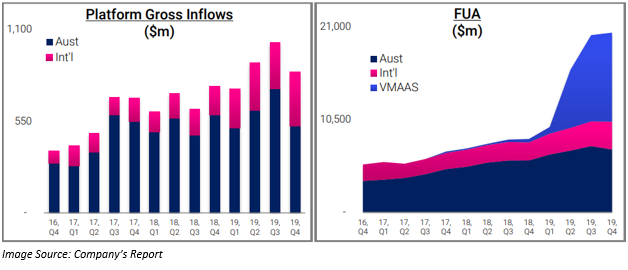

On 13 January 2020, Praemium Limited (ASX: PPS), the global leader in the providing technology platforms for managed accounts, investment administration & financial planning released its December 2019 quarterly update and reported that its funds under administration have increased to $20.3 bn.

December 2019 quarter witnessed record results for the international platform with gross inflows of $325 mn, net inflows of $228 mn along with funds under administration exceeding $3 bn for the first time. The quarterly gross inflows were $0.84 bn.

Important Milestones of December 2019 Quarter:

- International platform FUA increased by 54% to $3.1 bn on pcp.

- Australia platform FUA went up by 21% to $7.1 bn.

- PPS’s non-custodial VMA Administration Service surpassed $10 bn which was $0.3 bn 12 months ago.

- There are more than 500 range of managed funds with more than 1,700 domestic and international assets.

- UK pensions increased 79% on the previous year to 1,403 schemes.

- Australian Government Bonds got added to Praemium’s Australian licence for custodial platform assets.

- A new range of multi-asset index models was launched during the period which is being managed by Morgan Stanley.

- A range of expanded reporting and governance features were added that is appropriate for the growing no. of MDA Operators using PPS’s facilities.

- Offered access to further 50+ global ETFs on NYSE and LSE that can be held in and have income settled in the domestic currency.

- Extended options for Asset Allocation & Performance reports plus added a new Infographic client report created to support advisers in providing portfolio results to their customers in a simple & effective manner.

- A fully digital application process for the UK was created with the addition of paperless direct debits.

- Introduced electronic asset re-registration to accelerate shifts from other UK platforms.

- Junior ISA, the new account type added to promote savings for young people.

Family Zone Cyber Safety Limited (ASX: FZO)

Family Zone Cyber Safety Limited (ASX: FZO), an emerging leader in the fast-growing global cyber safety industry provided an update on the business development achievements in the December quarter of 2019.

- Added a quarterly record of 183 school clients. Thus, the total has grown up to 1,168 which represents a growth of 19% since 30 September 2019 and 89% growth since 31 December 2018.

- Added a quarterly record of 88k student licenses. As a result, the total student has increased to 615,000. The number shows a 17% growth since 30 September 2019 and 70% since 31 December 2018.

- Total contract value for the quarter was $1.8 mn with education customers and attained a 300% increase in the annual value of contracts entered during the quarter.

- 13,100 paid premium control account was added across the direct, education & wholesale channels of the company. Thus, total paid subscribers reached 187,000.

- Soft launched the company’s freemium Insights product and were able to add 7,200 accounts across its education & wholesale channels.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.