Now that the world has been witnessing â the most elongated bull run in the history of mankind, which might get cut short. Growing scepticism around the purported recession is also gathering a pace. In the meantime, predicting a recession is not the easiest job in the world. However, it is well-known that the late phase in the business cycle follows a recession.

As the signs of recession appear more significant, possible investment avenues for capital allocation signify a shortage. Moreover, the expected return from a majority of asset classes looks to be in jeopardy.

Recessionary pressure often forces the investors to book profits and return to safe haven assets or even cashing profits in a bid to reduce exposure to any possible widespread sell-off that might erode the value created in the recent past.

A recent report published by a global bank on the family office had surveyed 360 global family offices. The report outlines that the majority of the family offices around the around have been piling up cash reserves. It suggests that the global economy could be in recession by 2020.

Letâs have a look at possible disruptions that changed the sentiments across investors â

German PMI

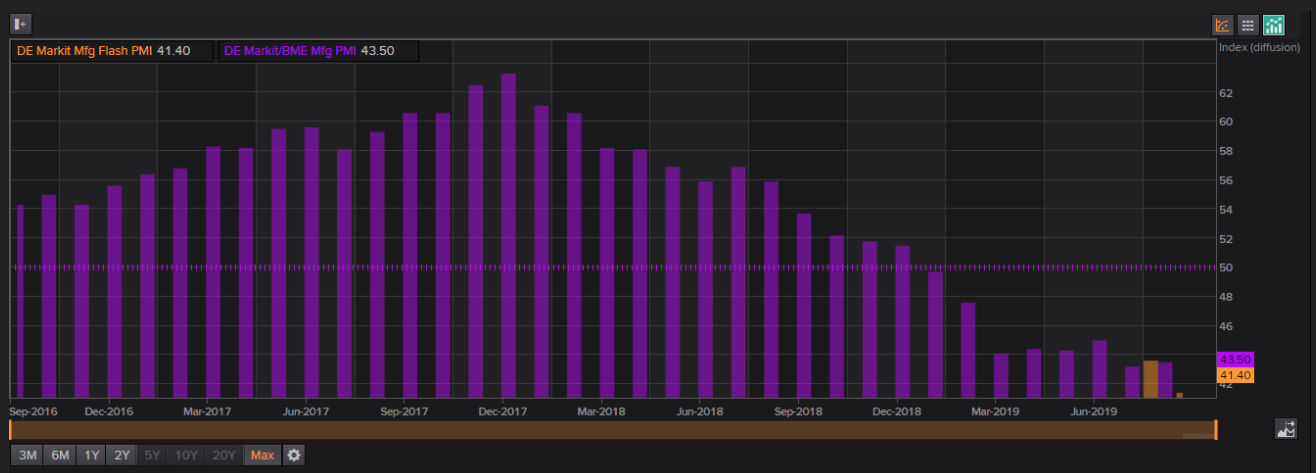

Recently, the manufacturing sector Purchase Managerâs Index (PMI) in the country dropped to a decade low of 41.4. Broader German PMI was down to 49.1, implying the lowest value in the record in the last 83 months.

Manufacturing sector PMI, Source: Thomson Reuters

These signs had sent strong signals suggesting the fourth largest economy could be in a recession. Germany is emerging as a view that quantitative easing is not having material impacts on improving economic growth. In some cities, rent controls and discounts have been introduced, attributing rising house prices suppressing affordability.

OECD Forecast

Recently, the Paris headquartered, Organisation for Economic Co-operation and Development (OECD) has cited that the global growth has decelerated to the slowest pace, since the 2008 financial crisis due to increasing trade conflicts hampering the global trade flow.

The global body is expecting a world growth of 2.9 per cent in the current year, and 3 per cent in 2020. The latest forecast is well below the growth rate achieved in 2018 â 3.6 per cent. The ongoing trade conflict between the US & China has subdued investments, increased risk to the financial markets, and escalated political uncertainty.

In May, the organisation has forecasted the global growth to be around 3.2 per cent for this year and 3.4 per cent for 2020. The Chief Economist of the body has cited that the governments have to capitalise on the availability of cheap credit (low rates) to spur the economic activity and boost investment in infrastructure in order to build the economy of the future.

Besides, OECD had slashed its growth forecast for most of the counties in G20 economies for 2019 and 2020, citing trade and geopolitical tensions. The forecast from the OECD has trimmed the US GDP growth to 2.4% from 2.8% earlier for 2019. China was cut down to 6.1% from 6.2% for 2019. Additionally, the forecast for UK & Eurozone were also revised. However, the forecast for Japanese growth was upgraded to 1% from 0.7% in 2019.

Deglobalisation

The level of uncertainties arising out the trade conflict between the worldâs two largest economies (US & China) is leading to a retaliatory tariff war that has been slowing down the manufacturing sectorâs growth.

Manufacturing sector slowdown would impact the labour markets, and householdsâ income/spending. Escalating trade tensions had disrupted the business confidence, resulting in a fall in investment growth to 1% at present from 4% in 2017, according to OECD. China GDP forecast for 2020 was slashed to 5.7% from 6% in the earlier forecast.

Among the latest triggers, the US had presented its desire to leave from the Universal Postal Union (UPU), citing the existing system is more skewed towards China, resulting in unfair advantages to China. The US had argued that the fees paid by the shipments arriving from a developing nation like China are cheaper than what is being paid by the domestic supplier to move goods within the country.

On 25 September 2019, according to a few media reports, UPU was able to get the consensus on a new deal. The deal would enable the US to have its own postal rates in July, and allow other nations to implement higher rates starting from January 2021.

Under the new deal, there are volume thresholds that declare self-rates, among other controls. Policymakers from the US had cited savings of close to half a billion at the top end. Additionally, the existing system was criticised by many e-commerce companies from the US as well.

Brexit Getting Closer

On 31 October 2019, the United Kingdom is scheduled to leave the European Union, following a referendum vote held in June 2016. According to the UK Prime Minister, the UK must leave the EU, even if that is without a deal.

It means that the UK would leave the multi-economic cooperationâs custom union and single market overnight. Presently, the MPs from the country casted their votes through the legal way coercing the government to pursue third Brexit referendum.

If another referendum comes into play that would result in a further extension of the deadline to leave the EU. However, if MPs approve a deal or vote in favour of no deal, the October deadline could be a turning point.

According to media reports, the Bank of England forecasting that the shock of no deal Brexit can tumble substantial GDP, is somewhat comparable to 2008âs financial crises. Currently, the Supreme Court in Britain has defended the democracy of the country and cited the prorogation of the countryâs parliament as unlawful. If failed to meet the October deadline, the country would seek a three-month extension under article 50 of the EU treaty.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice