Index Rebalancing

Index Rebalancing is a systematic re-assessment of the stocks listed in the Index, based on certain methodologies and essential evaluation criteria. On account of eligibility & future potential, stocks are added to the index, and if the performance is not satisfactory then existing stocks are removed from the Australian Stock Exchange index (ASX), besides, several other reasons.

The stocks to be listed in the index are identified and selected by S&P (Standard & Poorâs) together with ASX. Index rebalancing occurs on a Quarterly basis conducted by S&P with an exception of any significant event or acquisition & merger etc., in which case a mid-quarter rebalancing can also take place with a prior minimum business daysâ notice.

S&P/ASX 200 Index

S&P Dow Jones Indices is the worldâs leading resource for vital benchmark index-based investable ideas as well as data and research. Two main indices included in this are S&P 500® and the Dow Jones Industrial Average®, classical financial market indicators.

Established in 2000, S&P/ASX 200 Index is a diversified Australian stock market index with mining, energy, technology, healthcare and financials as major sectors. This index mainly accounts for the performance of the 200 largest stocks listed on ASX and used as a catalog for different purposes including index-based derivatives, index funds as well as a guideline of fund portfolios.

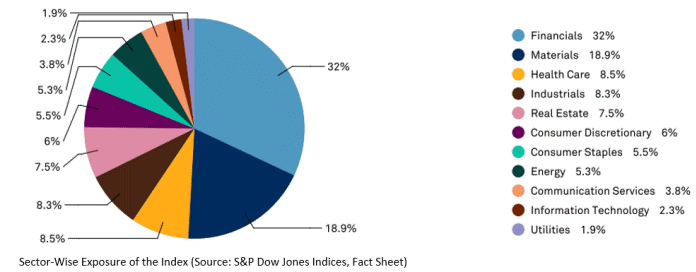

Sector-wise Classification

All S&P/ASX indices are categorized as per the Global Industry Classification Standard (GICS), with aim to classify its components based on their main business activity. As on 30 June 2019, the sector-wise classification is depicted in the chart below with the financial (32%), materials (18.9%), health care (8.5%) sector topping the list. Further, S&P/ASX 200 Health Care Index is a prominent health care benchmark with the code XHJ.

PolyNovo Limited

Recently, S&P Dow Jones Indices made quarterly rebalancing announcement, which would be effective from 23 September 2019. The only Health Care Company included in this periodic rebalancing is a biopharmaceutical company that develops novel, biodegradable, proprietary polymers used in the manufacturing of medical devices, PolyNovo (ASX: PNV), headquartered in Melbourne.

Currently, PolyNovo is focused on the development and commercialisation of its flagship device, NovoSorb, used in the treatment of surgical cuts, burns, hernia reparation, orthopedic and reconstructive surgery.

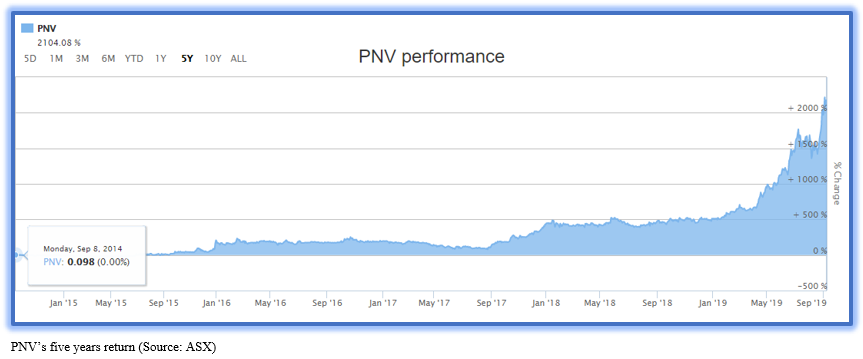

PolyNovo secured its place in ASX 200, on Friday, 6 September 2019 with a remarkable improvement in share prices since last five years. The Companyâs stock has recorded a gigantic five years return of 2271.13%, ever since its stock prices fell to the bottom in 2014 as evident from the below figure:

FY 19 Report Highlights

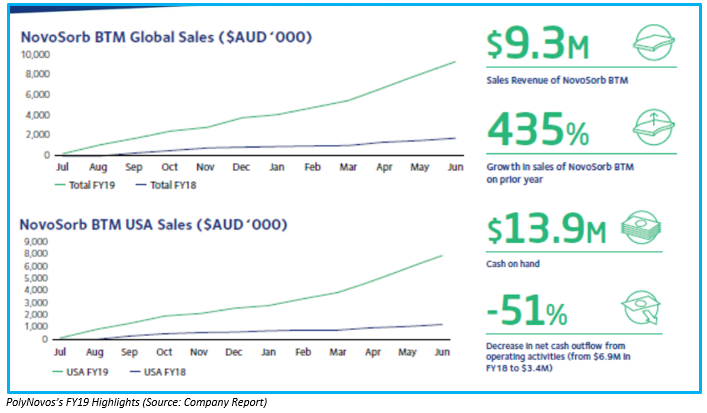

- FY19 has been a crucial year with the 435% increase in the sale of its leading product NovoSorb BTM.

- 128% increase in revenue from $5.989 million in the previous year to $13.683 million for FY19.

- Revenue from sales of goods jumped by 435% from $1.747 million in FY18 to $9.348 million in FY19.

- Reduction in losses by $2.784 million in FY19 from the previous year. The total loss after tax was recorded as $3.190 million for FY19 as compared to $5.974 million for the FY2018.

- Even though the Companyâ operating costs is continuously increasing as it was planned, because of increased global sale of NovoSorb BTM, its group loss has dipped by 46.6% on the prior year.

- As on 30 June, the Company held $13.9 million cash on hand with the net tangible asset backing per ordinary security of $0.039 for FY2019 compared to $0.042 for FY2018.

Significant Developments in Sales Team

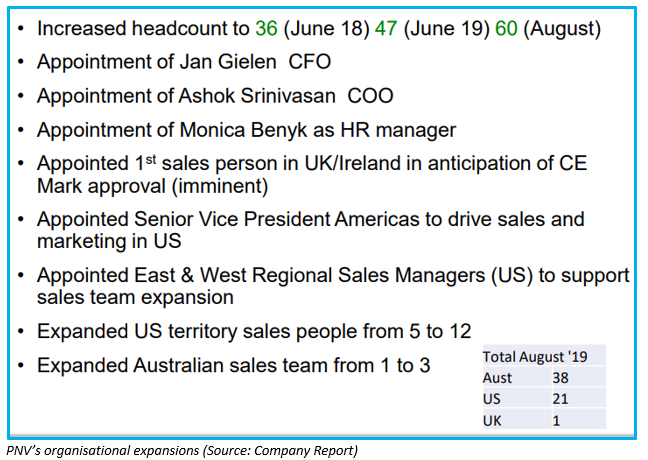

- Expanded its US sales infrastructure with 20 salesperson and five marketers; further plans to appoint more salespeople in UK, and Ireland.

- Expected growth in revenue from its direct market in Australia, New Zealand, USA along with India and Southeast Asia; still waiting to mark its entry in Europian markets. For Indian markets, a distribution agreement was made with Myovatec.

-

Received clearance for the sale of NovoSorb BTM to the United States Department of Defence & Veteran Affairs.

- Appointed direct salesperson in UK sales awaiting CE Mark

- Selected PMI as distributor for Germany, Austria & Switzerland with CE Mark in anticipation.

Clinical Trial Update

- PolyNovoâs European/Australian burn trials is completed with results publication pending by the year-end 2019. A sound progress in Feasibility trials funded by BARDA with results is expected to be published around March 2020 next year.

- On commencing the Pivotal burn trial, the Company would continue to receive BARDA funding.

- The US FDA approval is anticipated in October/November 2019.

- PolyNovo, in partnership with the Establishment Labs, is currently developing its new breast product line, the finalization of regulatory and clinical requirements as well as the product design to be completed in coming years.

- Recently gained successful regulatory clearance for NovoSorb BTM and is registered with Health Sciences Authority of Singapore.

- New regulatory approval in Malaysia has been announced in January 2019.

Infrastructure/ Capital

- Exciting new product for Hernia and Breast is in pipeline for commercial scale up.

- New building has been purchased in Port Melbourne, adjacent to the PolyNovosâ Head Office, for commercial manufacturing of Hernia/Breast equipments.

- NovoSorb family of products are protected by 47 patents and additional patents have been filed.

Organisational Talent Building

The PolyNovo group has invested in establishing an exceptional pool of management professionals as CFO, COO and sales manager in the USA, to bring greater role diversity and to provide support to the existing sales and marketing teams with plans to re-invest in it.

FY2020 Outlook

- Expand the BTM sale in the US, AU & NZ significantly, including the expansion of sale territories across the globe.

- New Breast and Hernia product pipeline are also expected.

- PolyNovo to file Hernia US FDA 510(K), Complete US DoD sales as well as initiate sales in Europe, United Kingdom and Ireland pending CE Mark

Stock Performance

PolyNovoâs shares settled the dayâs trading session at $2.265, down by 1,52% on 10 September with a market capitalization of $1.52 billion and 661.09 million outstanding shares. The stock demonstrated 76.92% and 210.81% three and six months returns respectively. The 52 weeks high and low price has been $2.360 and $0.510 respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.