Cyclical stocks are believed to be a vital element of oneâs stock-trading arsenal, as they are reliable profit generators in a value investorâs portfolio. As suggested from the term, âcycleâ is an important word to break down while understanding cyclical stocks.

The Global Scenario with Cyclical Stocks

The current times are hovered over by economic uncertainty, mainly driven by the protracted trade war between two of the biggest economies of the world adversely impacting trade relations across the border. As the worldâs economy continues to slow down, amid the ongoing fear of a recession, several questions arise pertaining to the best possible ways to invest. In Australia, the economic outlook, as per industry experts, has tanked of late.

Considering the fact that cyclical stocks strictly follow economic cycles, they are often regarded as a safe bet.

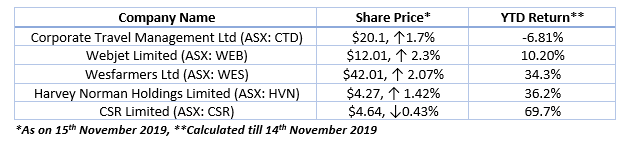

Let us browse through a few examples of cyclical stocks, listed and trading on the Australian Securities Exchange, their stock performances and YTD return (as on 15 November 2019):

It should be noted that in the investing world, cycle refers to the economic cycle, which can be quite volatile. So how are cyclical stocks related to the economic cycle, and how can one trace them on the Australian Securities Exchange (ASX)? Letâs find out:

What Are Cyclical Stocks?

The equity securities whose price are impacted by the macroeconomic events and systematic changes in the overall economy are referred to as cyclical stocks. These stocks follow âcyclesâ of the economy- expansion, peak, recession and recovery.

Ideally, the cyclical stocks (often referred to as offensive stocks) pertain to companies that deal with discretionary items (purchased more in the boom cycle). They also pertain to companies wherein customers cease to spend and cut back their expenditure during a recession cycle. Having said this, cyclical stocks are investments that follow the up and down trends of the market.

Breaking Down Cyclical Stocks

Cyclical stocks have the tendency to rise and fall with the economic cycle, depicting a predictability in their movement to investors who usually buys the shares at a low point in the business cycle and sells them at a high point. It should be further noted that:

- As cyclical stocks are largely affected by the macroeconomic changes, their returns follow the cycles of the economy;

- They have higher volatility and are likely to produce higher returns during periods of economic strength;

- Companies whose stocks are cyclical include airlines, furniture retailers, car manufacturers, clothing stores and restaurants (to name a few);

- It is believed that if a recession is severe enough, these stocks tend to be worthless;

- Cyclical stocks, though volatile in nature, offer great potential for growth as they are likely to outperform the market during periods of economic strength;

- ETFâs are used by investors to gain exposure to cyclical stocks during booming economic cycles.

- Some examples include- Ford, Whirlpool, Nike, Target and Netflix.

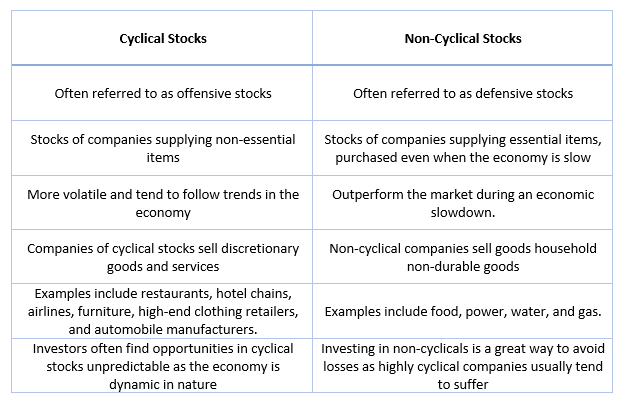

Difference between Cyclical Stocks and Non-Cyclical Stocks

Investors use cyclical and non-cyclical stocks to diversify their stock portfolio. Let us understand the difference between these contrasting, yet famous stocks:

Should You Invest in Cyclical Stocks for Profit?

It is globally believed and accepted that there are two reasons to own an investment- to secure the present-day income and safeguard the future income. Synonymous to income and capital growth, investors are always on a look-out to diversify their stock portfolio to satisfy these reasons.

Market experts believe that investors should own cyclical stocks for yield as they are critical to a modern economy. Even though they are unpredictable and considered highly volatile, it should be understood that periods of consistency and predictability are only temporary.

Therefore, if tapped at the right price, cyclical stocks make attractive long-term investments. Moreover, one cannot ignore the fact that several cyclical industries tend to provide goods and services that the economy consumes on a daily basis, like commodities (metals and mining).

Where to Find Cyclical Stocks On ASX?

The answer to the above is simple- look out for the consumer discretionary sector (XJD on ASX). However, cyclical stocks can be found in other sectors as well, be it the metals and mining (materials) or the consumer retail sector. Concentrating on the consumer discretionary, this sector is home to discretionary products and services (those which are considered non-essential by customers, but desirable if their existing income is adequate to purchase these products and services).

Cyclical stocks are categorised under this sector as shares in the consumer discretionary companies face the highest risk of decline in cycles of wider economic downturns, though they tend to bounce back (and bounce back well!) when the economy stabilises.

Letâs move ahead from the consumer discretionary section to Banks. The Australian share market is heavily influenced by the performance of its listed banks, which have remained to be among the top products of the economy.

Interestingly, banks are very cyclical in nature, as they make money by borrowing and lending and during the tough times, there is reduced ability to fund borrowings, and consequently, the bank lending falls away. Bankruptcies amid borrowers in this cycle is a common phenomenon.

Another classic sector example to tap is the material sector, whose products and services are very dependent on the level of economic activity in the economy.

As investors, one needs to keep an open eye and vigilant mind on all sectors that have the potential to deliver good returns in the short and long run. The fact that an economy goes through its natural cycles of expansion and contraction stands true, and this heavily impacts the stock market at a micro and macro level.

The trick of the trade town should essentially be to recognise the cycle being followed and anticipated (if foreseeable) and weigh oneâs portfolio in accordance to the same.

Now that we understand the stance of cyclical stocks on the ASX, we leave you with this fact- A wide section of experts believe that all stocks are to some extent cyclical, but some are far more so than others.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.