Impact of RBA Rate Cut and Sluggish GDP Growth

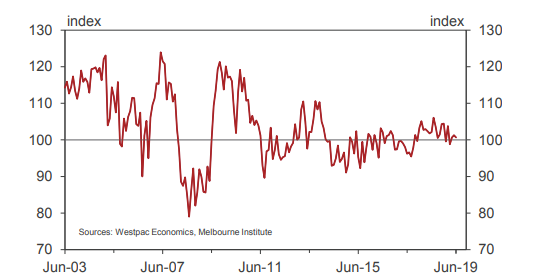

The Australian consumer confidence recorded a dip of 0.6% to 100.7 in June 2019, according to the Westpac-Melbourne Institute Consumer Sentiment Index released on 12th June 2019. Though the index is above 100, the point mark which represents the breakeven point between optimism from pessimism, but it is below 101.3 reported in May 2019.

The index, released on 12th June 2019, is based on a survey of 1,200 adults aged 18 years and above, who responded to phone interviews during 3rd June-7th June 2019. Interviews were related to the cash rate cut announced by the Reserve Bank of Australia on 4th June and GDP figure announcement on 5th June.

The consumer confidence dipped, over concerns about general economic outlook, including employment opportunities after GDP data revealed the weakest annual expansion in a decade. The drop highlights how consumer mood deteriorated owing to concerns about the economy, outweighing the boost experienced following the cut in official interest rates announced by RBA.

Consumer Sentiment Index

Survey Results

- June consumer sentiment dipped 0.2% on âwhether it is the time to purchase a major item for householdâ to 115.5, reflecting growing unease among households, as the figure is quite below the 127 long-run average. This highlights that currently consumersâ major focus is on making savings rather than spending, owing to the current market scenario. Even in the near term, consumer spending is expected to remain low.

- For the next 12 months, the sub-index recorded a 4.7% drop in consumer sentiments to a pessimistic 99.3. However, finances for the next one year registered a rise of 3.1% in the index.

- Consumer confidence in purchasing a dwelling registered an increase of 1.8% to 116.9 in June 2019, showing a positive response to the official rate cut.

- The index tracked unemployment expectations for June 2019. The Westpac-Melbourne Institute Unemployment Expectations Index posted a 5.1% increase in the reported month, compared to a decline in May 2019, highlighting looming job insecurities among more people. Both Victoria and New South Wales showed a 7.9% rise, demonstrating that the index level in these Australian states is better than average.

- In June 2019, house price-related sentiment showed a 22.7% spark, demonstrating the highest level reported in the Westpac Melbourne Institute Index of House Price Expectations Index since August 2018, however, it was below the 126 long-run average. Moreover, the index was positive for all the states in the reported month.

- In terms of savings options, 64% of the respondents preferred deposits, superannuation or debt payment as the safe options.

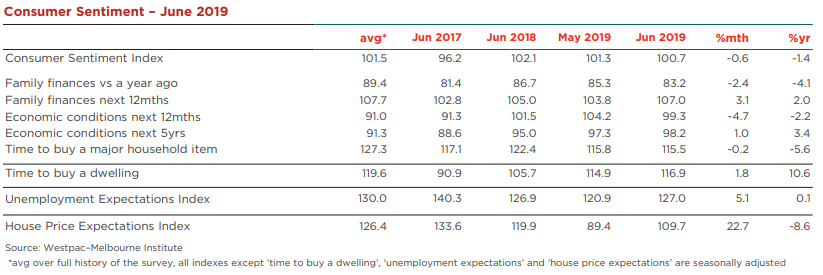

ANZ-Roy Morgan Consumer Confidence Index

Meanwhile, ANZ-Roy Morgan Consumer Confidence Index also unveiled a similar trend, highlighting a slump in consumer confidence and a drop in current economic conditions.

For the week ended 8th June 2019, the index dipped by 2% week-on-week. The index representing the consumer confidence in the Australian economy primarily attributed the drop to weak GDP growth during Q1 ended March 2019.

The index for current financial conditions and future finances reported a decline of 2.7% and 2.2% during the last week. While the only respite was in the consumer sentiment towards âthe time to purchase a household itemâ, which recorded a 4.9% rise. The survey involved face-to-face interviews of around 1,000 people across Australia.

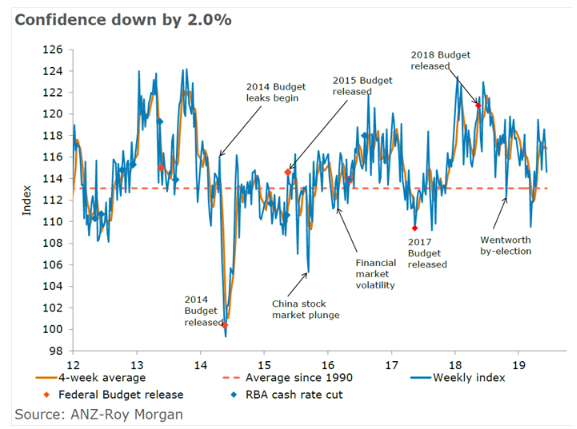

March Quarter GDP Growth Update

Australia economy grew by 0.4% in Q1CY19; the growth was the slowest since the quarter ended in September 2009. The slowdown highlights the need for monetary and fiscal initiatives to support from the economy from slipping into recession after an expansion for straight 28 years. The March quarter GDP growth rate is below 0.5% increase expected during the period.

RBA Official Rate Cut Update

On 4th June 2019, the Reserve Bank of Australia lowered interest rates by 25 basis points to 1.25%, representing the first rate cut in nearly three years. The move is aimed at dealing with the effects of global trade tensions and a slowdown in the Asian country, China. With the rate cut, RBA aims at reducing unemployment and achieving sustainable economic growth and inflation target. Next meeting of the Reserve Bank Board is scheduled on 2nd July 2019.

A Brief on WestpacâMelbourne Institute Survey of Consumer Sentiment:

Westpac: Westpac Banking Corporation (ASX:WBC) is one of the big four banking corporations in Australia. It is also the oldest bank in the country and one of the largest financial service providers in New Zealand. The bank, via its a range of financial service brands and businesses, caters to personal, business or corporate banking needs. Founded in 1817, the bank is headquartered at Sydney, Australia.

Stock Performance: With a market cap of A$96.67 billion, WBC is trading at A$28.040 on 13th June 2019 (As at 3:00 PM AEST). Westpac has 3.45 billion outstanding shares. Its annual dividend yield stands at 6.7%, while EPS is A$2.061.

Melbourne Institute of Applied Economic and Social Research: Located in Victoria, Australia and established in 1962, Melbourne Institute is an economic research-based institution, which measures a variety of macroeconomic indicators, including economic growth drivers and consumer sentiments towards economic outlook. It is engaged in developing research tools, serving government, business and community groups. The institute is well-known for its economic and social indicator measurements, in addition to HILDA and MABEL Surveys.

WestpacâMelbourne Institute Index of Consumer Sentiment: This is a monthly survey of consumer confidence in Australia. It gathers and then measures consumer sentiments towards the overall economy of the country. The index is based on below mentioned five indices:

- First and second represents the perception of consumers about their household financial situations â âFamily finances vs a year agoâ and âFamily finances next 12mthsâ.

- The third and fourth indices are consumers sentiments towards expected economic conditions â âEconomic conditions next 12mthsâ and âEconomic conditions next 5yrsâ.

- The last index represents consumerâs buying conditions for major household items â âTime to buy a major household itemâ.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.