Westgold Resources Limited (ASX: WGX), one of the top 10 Australian gold producers, has announced that the Company would be re-entering the S&P All Australian 200 Index on 22 June 2020, as announced by S&P Dow Jones Indices on 12 June 2020 whereby the entire S&P/ASX index hierarchy is reviewed, including the All Ordinaries.

The Company was in the index until June 2019 when it was removed due a reduction in its rolling market capitalisation. The recovery enabling re-entry, 12 months later, validates the refocus of Westgold Resources on its core Murchison assets and the efforts of its staff and stakeholders in its gold operations. The Company also added that being a member of the ASX200 provides exposure to a much larger investment audience, appreciative of the group’s status as a growing and purely Australian gold business.

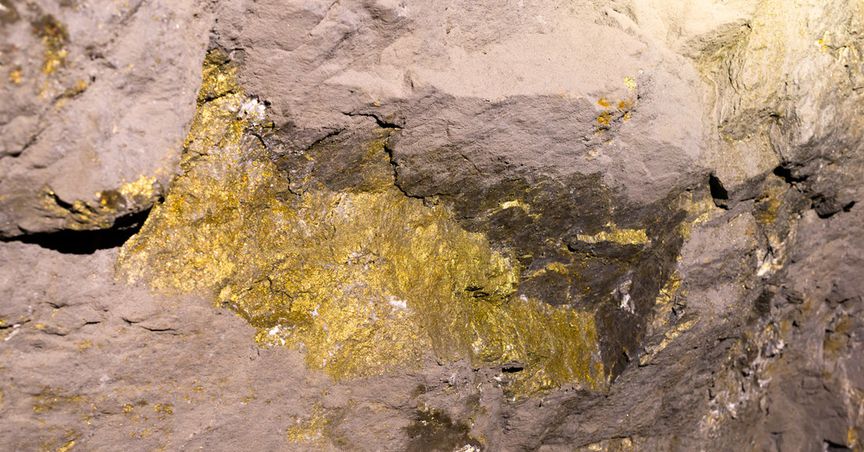

Reset, Refocus, Restart: Westgold, over the years, has built a strong foundation to secure increasing gold production from its three commissioned and operational production facilities - the Murchison Gold Operations, Fortnum Gold Project, and the recently started Cue Gold Operations in Western Australia.

For corporate simplification, the Company also divested its older high-cost operations including South Kalgoorlie Operations and Higginsville Gold Operations; began divestment of Lithium interests & royalties; and De-merged its Gold-Copper and other Polymetallic NT assets and listed Castile Resources. In addition, the internal contract mining services division, Minterra Pty Ltd, of the company has also been expanded.

In the last three years, Westgold Resources has reported gold production of over 750,000 oz. built on cash flow and minimal equity & debt, the Company assets boasts of three (3) processing plants (~4 million tonne per annum) and four (4) villages (750 beds).

Co-operation agreement with AVL: Recently, Westgold Resources signed a letter agreement with Australian Vanadium Limited (ASX: AVL) for co-operation and assistance allowing water access for AVL’s Australian Vanadium Project, south of Meekatharra, in Western Australia.

Several active and inactive mines are located within Westgold Resources’ Meekatharra Gold Operations, located 25 km to the west of Australian Vanadium Project. Thus, significant amount of water is generated due to continuous inflows into a number of these active and inactive pits, with the water being surplus to Westgold’s requirements. This water can be utilised in processing AVL’s vanadium ore.

Australian based AVL is focussed on production of high value vanadium products and aims to offer investors a unique exposure to all aspects of the vanadium value chain – from resource through to steel and energy storage opportunities. Currently, the company is advancing its world-class highest-grade Australian Vanadium, with 208.2Mt at 0.74% vanadium pentoxide (V?O?) and containing a high-grade zone of 87.9Mt at 1.06% V2O5 (JORC Code 2012 compliant)

The agreement also enables friendly collaboration over access and the use of new and existing roads to move ore, materials and products within the companies’ tenements in the future. Most importantly, it indicates responsible and innovative management of water resources. The potential benefits to arise from the agreement include:

- Reduced groundwater and environmental impacts.

- Substantial de-risking of the water volume and quality requirements.

- The opportunity to provide community benefits with new pipeline and road.

Also Read: Gold Moves that are Charging Up – 5 Minnows

March Quarter 2020 & COVID-19 Response: Westgold Resources responded to the COVID-19 pandemic via implementation of a number of measures to ensure the stability of its operations and the safety of its employees, contractors, site visitors and their families.

With no cases of COVID-19 within the workforce or any significant disruptions to operations, critical operating supplies or product logistics, Westgold has plans in place to address any disruptions should they arise.

During the March Quarter 2020, the Company’s operations remained normal and the Group achieved a gold output of 55,234 oz for the quarter at Cash Costs (C1) of AU$ 1,275/oz (~US$* 803/oz) and All In Sustaining Cost (AISC) of AU$ 1,525/oz (~US$* 961/oz).

For the reporting period, the Group gold sales of 53,265 oz at an average price of AU$ 2,087 per ounce led to revenue of AU$ 111 million (~ US$* 70 million). Around AU$ 28 million (~US$ *18 million) of Mine Operating Cash Flow was generated during the period while re-investment resulted in a Net Mine Cash Outflow of AU$ 7 million (~US$*4 million) with capital spent on the start-up of two new underground mines (Bluebird and Triton), preproduction and growth capital at Big Bell, pre-strips in open pits and exploration.

As Westgold is passing through the tipping point of heavy cash investment to fresh cash flow, it is primed for growth basis a disciplined and deliberate approach as the gap on market metrics is compelling. The Company is also aiming for dividends and yield of 40% of NPAT.

Stock performance: The WGX stock last traded at AU$ 2.040, down 2.39% on 17 June 2020, with a market capitalisation of around AU$ 815.33 million.

Good Read: 6 Stocks that Weathered the COVID-19 Storm