Constantly adapting to ever-changing customer needs is a must for consumer-focused companies. In a legacy example, the ignorance of this phenomenon had caused serious damage to the company. We are talking about Nokia â a highly sophisticated cell developer in the early years of the ongoing century.

However, Nokia was late in adopting new trends in the cell phone market, resulting in other players edging past Nokia with more sophisticated products than Nokia. As such, the emergence of Apple Inc. (NYSE: AAPL) with touch capability had widespread ramifications in the cell phone market.

Wesfarmers â an unmatchable brand?

In a similar way, Wesfarmers Limited (ASX: WES) â the $45.08 billion (approx.) dollar group, as per market capitalisation on 1 November 2019, is constantly evolving its business to keep up with ever-changing customer needs.

Home delivery has become the new normal in consumer-focused companies. Concurrently, the players in the consumer space are also adapting to these changes with delivery capability, including home delivery, store pick-up, same-day delivery and even free-delivery.

Wesfarmers is reportedly moving with subscription-based free-delivery offerings like Amazon, and other e-commerce platforms. However, it should be noted that Amazon could hardly match the number of physical stores Wesfarmers operates, allowing the customers to feel the Wesfarmersâ brands.

Wesfarmers is a large-cap multi-business outfit, having a presence in selling shirts to lithium, following the acquisition of Kidman Resources most recently. It has brands that cater to the needs of household consumers to mining giants like BHP Group Limited (ASX: BHP).

In case you didnât know, Wesfarmers sells ammonia to BHP, ammonium nitrate to Rio Tinto (ASX: RIO), among others. In addition, the group produces and sells sodium cyanide, PVC resin/specialty chemicals, LPG & LNG, fertilisers and decipher. All these activities fall under its Industrials portfolio.

Wesfarmers continues to remain a testament to the Australian heritage, and its origin from 1914 as Western Australian farmersâ cooperative depict that testament. Although, the multi-business outfit continues its growth trajectory, having passed through multiple corporate restructurings to deliver shareholder value.

Gearing-up for Festive Season

Bunnings says it would beat the price by 10% (below image), this depicts a lot about the stance of the retailer in the festive season. As Halloween has passed while Christmas, Boxing Day and New year are approaching, the highly-busy time for the retailer has already started.

Source: Bunnings Website

Bunnings

In its 2019 Annual Report, it is mentioned that the group is focussed on developing the digital capability of Bunnings. The brand caters to heavy commercial customers across the home and lifestyle markets, and the brand is a leading retailer in home improvement and outdoor living products in Australia and New Zealand.

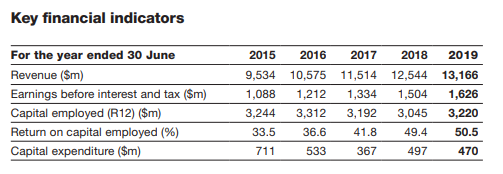

FY 2019 Key Indicators (Source: WESâ 2019 Annual Report)

More importantly, the ongoing housing pick-up along with low interest rate environment only suggest optimistic times for the brand.

Kmart Group

In its 2019 Annual Report, it is said that the brandâ focus remains on creating a better to place to shop at lower prices. In the current financial year, the brand intends to emphasise on online growth, category growth opportunities.

Further, the brand now houses recently completed acquisition Catch Group, an established online retailer. Kmart Group also houses Target, and online offering continues to be a priority for Target with focus on website content, website personalisation and click & collect.

Kmart & Target operates in the clothing, homewares and general merchandise retail sector. According to media reports, the brand has started to offer free-delivery with its subscription-based model.

It is being said that the free-delivery offering is available for customers of Kmart, Target & Catch. The group would be charging a monthly-subscription fee to customers for free delivery service on orders above $45.

FY 2019 in Review

In FY 2019, the group had significant segments in discontinued operations, which included Coles, Bengalla, KTAS and Quadrant Energy. Meanwhile, there were substantial gains from these transactions as well, including $2,264 million after-tax gain on Coles demerger, $645 million after-tax gain on disposal of Bengalla, $244 million after-tax gain on disposal of KTAS, and $120 million gain on disposal of Quadrant Energy.

The revenue from continuing operations was $27,920 million compared to $26,763 million in the previous year. Finance costs for the period came down to $175 million compared to $210 million in the previous year.

In addition, the profit after tax from continuing operation was $1,940 million compared to $1,409 million in the previous year. More importantly, the profit after tax from discontinued operations was $3,570 million for the period.

Consequently, the profit attributable to members of the parent was $5,510 million. Besides, the basic EPS from continuing operations was 171.5 cents compared to 124.6 cents in the previous year.

At the year-end, the balance sheet was carrying interest-bearing loans and borrowings of $356 million under current liabilities. Under non-current liabilities, the balance sheet had interest-bearing loans and borrowings of $2,673 million compared to $2,965 million in the previous year.

For FY 2019, WES had declared a total fully-franked dividend of 278 cents per share that included interim dividend of 100 cents per share, a special dividend of 100 cents per share, and final dividend of 78 cents per share.

Stock Performance

On 1 November 2019, WES last traded at $39.96, up by 0.5% relative to the previous close. Over the past one year, the stock has delivered a return of +22.89%. On a year-to-basis, the stock has delivered a return of +29.70%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.