Nobody wants to keep all their eggs in one basket, and this applies to building one’s portfolio as well. When one of the sectors is booming, generally all the stocks under that particular sector also rises, but what if the sector is not performing well? Here, comes the term which has been utilised by many fund managers, popularly known as diversification. Diversification is a common technique a fund manager uses to hedge his/her losses against a bear market. It is a management strategy that mixes different investments in a single portfolio to diversify the funds and yield a higher return. It also reduces the risk one could have by keeping one type of stocks in their portfolio.

Let’s look at the ten stocks from different sectors that have been under spotlight.

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited provides banking services, credit and access card facilities, leasing, housing and general finance services, with a market capitalisation of $72.42 billion as on 03 January 2020. As per ASX, the stock was trading at $24.69, rising up by 0.488 percent (at AEDT 3:31 PM) and has given a negative return of 15.33% in the time period of three months. The company’s price to earnings multiple stood at 14.360x on TTM basis and its annual dividend yield is 6.76%.

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited mainly operates in Australia and New Zealand and has about 3,292 stores. The company provides retail operations across Australian food, endeavour drinks, New Zealand food, Big W and hotels. The company has a market capitalisation of $45.76 billion as on 03 January 2020. As per ASX, the stock was trading at $36.390, edging up by 0.303 % (at AEDT 3:35 PM) and has given total return of 10.17% in the time period of six months. The company’s price to earnings multiple stood at 17.590x on TTM basis and its annual dividend yield is 2.81%.

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited provides provision of telecommunications and information services, including mobiles, internet, and pay television with a market capitalisation of $42.58 billion as on 03 January 2020. As per ASX, the stock was trading at $3.600, moving up by 0.559% (at AEDT 3:40 PM) and has provided a negative return of 5.28 % in the time period of six months. The company’s price to earnings multiple stood at 19.780x on TTM basis and its annual dividend yield is 2.79%.

The company has informed that it expects the total operating expenses after excluding restructuring costs and impairments to decline, with reductions in underlying fixed costs to offset increased NBN (National Broadband Network) network payments and other variable costs.

Transurban Group (ASX: TCL)

An owner, operator and developer of electronic toll roads and intelligent transport systems, Transurban Group has a market capitalisation of $40.72 billion (as on 03 January 2020). As per ASX, the stock was trading at $14.94, going up by 0.268 percent (at AEDT 3:45 PM) and has increased 4.43% in the time period of six months. The company’s price to earnings multiple stood at 225.76x on TTM basis and its annual dividend yield is 4.09%.

Recently, the company announced that Hills M2 Motorway, a 100% owned subsidiary of TCL has raised $403 million through non-recourse debt via a new debt facility of 12 months term.

Sydney Airport (ASX: SYD)

Sydney Airport is engaged in the business of airport operations and has a market capitalisation of $19.47 billion, as on 03 January 2020. As per ASX, the stock was trading at $8.675, marginally up by 0.638 percent (at AEDT 3:49 PM) and has increased 6.55% in the time period of six months. The company’s price to earnings multiple stood at 48.810x on TTM basis and its annual dividend yield is 4.52%.

Recently, the company provided its traffic performance for the month of November. The company experienced an international passenger growth of 0.3% during the month of November 2019. Countries like India, France and South Korea showed the maximum growth and grew by 10.6%, 4.2% and 3.7%.

MFF Capital Investment Limited (ASX: MFF)

Australia based MFF Capital Investment Limited makes investment in a portfolio of companies listed with International and Australian exchange with lucrative business traits. The company has market capitalisation of $1.96 billion, as on 03 January 2020. As per ASX, the stock last traded flat at $3.620, edging up by 0.277 percent from its last close. Also, it has increased 21.14% in the time period of six months. Recently, the company released its portfolio performance for December 2019. The company’s NTA per share stood at $3.610 pre-tax and $2.988 after providing for tax as at 31st December 2019.

WAM Global Limited (ASX: WGB)

Australia based, WAM Global Limited is an investment management entity with an international and Australian equity market expertise. WGB’s market capitalisation was recorded at $495.72 million (as on 03 January 2020). As per ASX, the stock was trading at $2.330, slipping by 0.427 percent (at AEDT 3:51 PM) and has increased 17% in the time period of six months.

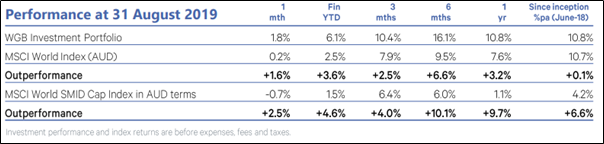

The WAM Global Investment portfolio increased by 1.8% in August, which outperformed the MSCI World Index (AUD) that increased by 0.2% and the MSCI World SMID Cap Index in AUD terms which fell by 0.7%. The best performing sectors were consumer staples, real estate and utilities, while energy, financials and materials underperformed.

Performance of Portfolio (Source: Company’s Report)

Medibank Private Limited (ASX: MPL)

Medibank Private Limited provides underwriting and distribution of private health insurance policies under its two brands ahm and Medibank. The company is also a provider of health-related services through the Medibank Health businesses, which capitalise on Medibank’s expertise and experience, and support the Health Insurance business. To broaden the provision of health-related services, the company acquired Home Support Services Pty Ltd in August 2018.

The company has market capitalisation of $8.76 billion, as on 03 January 2020. Also, the stock last traded at $3.210, (as on 3 January 2020) moving up by 0.943 percent from its last close and has given negative return of 8.23% in the time period of six months. The company’s price to earnings multiple stood at 19.040x on TTM basis and its annual dividend yield is 4.12%.

Tabcorp Holdings Limited (ASX: TAH)

Australia based, Tabcorp Holdings Limited offers provision of gambling and other entertainment related services. The market capitalisation of TAH was noted at $9.24 billion, (as on 03 January 2020). Recently, the company appointed Anne Brennan as a Non-Executive Director of the company and earlier she served as CFO at CSR and the Finance Director of Coates Group.

On 3 January 2020, the stock last traded at $4.570, edging up by 0.219 percent from its previous close and has given negative return of 0.44% in the time period of six months. The company’s price to earnings multiple stood at 25.360x on TTM basis and its annual dividend yield is 4.82%.

WAM Research Limited (ASX: WAX)

Australia based WAM Research Limited is a listed investment company that offers investors with an opportunity to experience a diversified portfolio of undervalued growth entities. The company has a market capitalisation of $287.23 million, as on 03 January 2020.

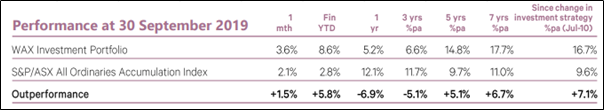

WAM Research investment portfolio increased by 3.6% in September as compared to S&P/ASX All Ordinaries Accumulation Index, which increased by 2.1% in September and the portfolio outperformed the S&P/ASX All Ordinaries Accumulation Index by 1.5%.

On 3 January 2020, the stock last traded at $1.500, edging up by 0.334 percent from its previous close and has given negative return of 7.94% in the time period of six months. The company’s price to earnings multiple stood at 175.880x on TTM basis and its annual dividend yield is 6.49%.

Performance of WAX’s Portfolio (Source: Company’s Report)

As per ASX, the stock is trading towards 52-weeks high and has provided return of 7.94% in the time period of last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.