Summary

- The home-grown tech market darlings, WAAAX stocks have put on astounding gains with their market cap back to February 2020 level.

- Companies in technology have led the way amid COVID-19 crisis, keeping society functional in a time of lockdown and quarantine, and continue to spark further creativity and innovation. The WHO, too received, tremendous pro-bono assistance from tech companies to combat the pandemic.

- The outlook for WAAAX stocks, though driven by uncertainty, remains resilient.

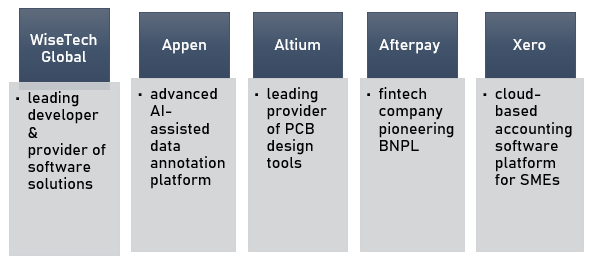

Amid the coronavirus market mayhem where technology is perhaps the biggest boon only second to medical science, Australian investors have their exclusive technology darlings to obsess over who keep Australia’s burgeoning technology sector in headlines. WAAAX stocks for Australia are akin to what FAANG stocks are for the US and BAT, for Asia- the group of Australia’s better-known technology stocks (which some believe bear great potential to outperform their American and Chinese peers).

WAAAX Stocks Amid COVID-19 crisis

Let us understand the stance of WAAAX stocks with their market capitalisation trend that portrays a typical dip and rebound sinusoidal trend-

In February, when COVID-19 had not picked up the steam, the way it did in the following month, the collective market capitalisation of WAAAX stocks was approximately $40 billion. This came down to close to $ 20 billion in mid-March and after, and in the recent times has doubled back. March was the period which saw one of the fastest descents into bear market territory. However, a dramatic reversal of one of history’s fastest return to a bull market followed suit, though not without pockets of volatility.

As on 6 June 2020, the collective market capitalisation of WAAAX stocks is ~$ 40.7 billion, showcasing that the February or pre-COVID-19 level as some may say, is back. Moreover, the home-grown WAAAX stocks have put on astounding gains relative to their American and Asian peers. These stocks are earlier in their lifecycles which makes one fathom about the plenty of potential growth that is left, while they continue to grow fast (at least, as long as circumstances stay favourable).

WAAAX Stocks Updates

WiseTech Global Limited (ASX:WTC)

WiseTech is engaged in empowering and enabling the global supply chains through its innovative technology. The continual demand for its logistics technology is shown by the freight-forwarding rollouts in progress already. The rollout with Hellmann Worldwide Logistics, the world’s leading logistics providers, will start in 2021.

As on 31 March 2020, WTC’s net cash position was $ 230 million. A debt facility of $ 190 million stays undrawn. The Company has reaffirmed its FY20 guidance and anticipates FY20 revenue of $ 420 million - $ 450 million (growth of 21% - 29%) and EBITDA of $ 114 million - $ 132 million (growth of 5% - 22%).

More recently, WTC renegotiated earnout deals for various tactical acquisitions to facilitate better positioning of resources and bolster its balance sheet. The Company had worked with 17 purchased businesses, through 2H20, that were undertaken to slash and close future earnouts and use equity to replace substantial cash payments. Negotiations resulted in reduction in contingent liabilities overall from $ 215.5 million to $ 68.5 million, removal of $ 151.5 million of future contingent cash liabilities and equity issuance of $ 81.4 million of which $ 45.7 million remains escrowed for 12 months.

Appen Limited (ASX:APX)

APX’s distributed working model is allowing it to adapt well to the challenges. The Company entered this year strongly with a strong balance sheet and over $ 100 million in cash resources. Despite the COVID-19 crisis, the fact that AI market is growing at 28% can work in the Company’s favour.

The Company intimated that investments would soften 1H20 margins to mid-teens and margins are expected to be high teens for FY20. APX reaffirmed its guidance with YTD revenue plus orders in hand for delivery in FY20 of ~$ 350 million at May 2020, EBITDA for the year ending Dec 31st, 2020 is expected to be in the range $ 125 million - $ 130 million.

Altium Limited (ASX:ALU)

The Company remains operationally and commercially well positioned, despite volatile market conditions. However, the prolongation of restrictions is likely to impact Altium during May and June and cash preservation priorities of SMEs is likely to affect the timing of closing sales in typically strongest months of the year being May and especially June.

However, ALU has launched attractive pricing and extended payment terms to drive volume in challenging market conditions and speeded up the introduction of its new digital online sales capability. Though the digital sales model will take some time to fully ramp up, the Company remains on track to climb to the 100k subscriber target by 2025.

Current cash balance of the Company exceeds US $77 million though the long-term aspirational goal of US $200 million revenue for the full year seems like a low probability at present.

Afterpay Limited (ASX:APT)

The leader in “Buy Now, Pay Later” payments now has over 5 million active shoppers in the US using the service at Afterpay merchant partners. Also, by May this year, ~9 million US consumers had joined the platform, with over 1 million new customers using the platform during the COVID- 19 period of the last ten weeks (as reported on 20 May 2020). In April of 2020, APT had over 15 million app and site visits. This illustrates that the Company is one of the fastest growing e-commerce payment companies in the market.

All this owes to the fact that the coronavirus outbreak is a time in which ecommerce has become the primary way people are shopping.

Xero Limited (ASX:XRO)

Focussed on supporting customers during COVID-19, XRO reported top-line growth and an encouraging free cash flow and net profit in its FY20 earnings to 31 March 2020. The Company achieved its first FY NPAT of $ 3.3 million, an improvement of $ 30.5 million relative to $ 27.1 million loss in FY19.

Commenting on COVID-19, CEO Steve Vamos said that XRO’s long-term strategic ambitions stays the same, and it remains committed to propel cloud accounting globally, expand the small business platform, and to carry on developing for international scale and innovation.

Technology Sector & Australia’s Stance

The novel coronavirus (COVID-19) outbreak has (and continues to) caused widespread concern and economic hardship for customers, businesses, and communities worldwide. Global GDP is expected to take a dip of 3.4% in 2020, as per a report by Ernst & Young (EY). The COVID-19 pandemic has impacted the technology sector considerably - affecting raw materials supply, triggering an inflationary risk on the goods and services, and upsetting the electronics value chain.

However, the invisible enemy (coronavirus) brought along an array of opportunities for the sector. An acceleration of work from home policies, a rapid focus on evaluating and de-risking the end-to-end value chain, with lockdowns and the “new normal”, potential carbon emission reductions that can renew focus on sustainability practices- all are prospective landscapes that the sector can benefit from.

We will let the numbers do the talking here- The EY report states that just in the US alone, weekday internet traffic has increased by over 40%. Air quality too has improved by up to 40% and Microsoft Teams recorded 2.7 billion meeting minutes as on 31 March 2020, a record figure.

Experts remain optimistic about the technology sector’s current and future stance as it has weathered past storms and found novel ways to emerge tougher each time. Companies in technology space have led the way and the COVID-19 crisis too can potentially spark further creativity and innovation.

The pandemic can be a game changer for the Australian technology sector. Previous business-as-usual practices might not continue even when the crisis is over. Paradigm shifts in personal and social behaviour could continue in near future. While dealing with the new normal, one must remember that Australians have been at the forefront of innovation, inventing and developing world-class technologies in industries like defence, medicine and information technology.

We will now let instances do the talking, showcasing how Australia has led by example- Wi-Fi, Google Maps, the cochlear implant, electronic pacemakers, use of robotics in mining- all are believed to have been honed in the country and their global stance is no mystery.

(Note: Currency denoted in AUD unless otherwise specified)