It looks like a potential bidding war for Australian mass media company, Village Roadshow Limited (ASX: VRL) has started. After receiving an acquisition proposal from Pacific Equity Partners Pty Ltd, the company has now received one more proposal from BGH Capital Pty Ltd.

The later was announced on Friday 24 December 2019, as VRL received an unsolicited, non-binding indicative proposal from BGH Capital to acquire all of the shares in VRL by way of a scheme of arrangement at an indicative price of $4.00 cash per share.

Notably, the indicative price of BGH is $0.10 higher than the price offered by the Pacific Equity Partners, as announced on 19 December 2019.

Pacific Equity Partners had sent a conditional, non-binding and indicative proposal to acquire all the shares of VRL via scheme of arrangement at an indicative price of $3.90 per ordinary share of the company.

Both BGH and Pacific Equity have indicated that they are willing to offer full cash consideration or a combination of cash and scrip (subject to caps and scale back provisions) in a newly incorporated acquisition entity and both the proposals subject to a number of conditions, including completion of due diligence, arrangement of financing, FIRB approval and recommendation by the VRL Board.

VRL Board of Directors are currently accessing the PEP Proposal and have commenced its assessment of the BGH Proposal. As the proposals are conditional and there is no certainty that either one of them will result in a transaction, VRL has advised its shareholders not to take any action in relation to either the PEP Proposal or the BGH Proposal at this stage.

Stratford Advisory Group and MinterEllison, have been appointed as financial adviser and legal adviser, respectively by VRL.

Village Roadshow Performance Summary

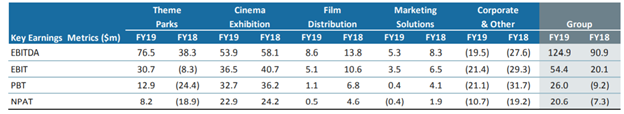

During the last financial year, Village Roadshow delivered EBITDA of $124.9 million, up 37% on last year. NPAT (Net Profit after tax) for the year was $20.6 million in FY19 (year end 30 June 2019), compared to a loss of $7.3 million in the last year, driven by the outstanding customer experiences, first class staff, higher theme park ticket yields and control of costs. The improvement in normalised earnings demonstrates the company’s commitment on the careful execution of its operating strategy while its divisions continued to focus on their core businesses which include: Cinema Exhibition, Film Distribution, Theme Parks Business as well as marketing solutions.

Financial Summary (Source: Company’s Report)

During last financial year i.e., FY19, the company’s Theme Parks division saw its EBITDA improve by 100%, driven by:

- the successful execution over the last two years of a high-yield ticket strategy at the Gold Coast theme parks which has resulted in a 25 per cent increase in ticket yields

- Dynamic marketing used to differentiate the company’s parks in the market and demonstrating the exceptional value in the company’s offering

- initiatives driven by Project Voice, which focuses on the Voice of the Customer and the Voice of the Employee

The company’s commitment to cost reduction saw financial year 2019 corporate overheads significantly lower than the prior year, however, the costs are expected to increase in the 2020 financial year with additional IT costs, and the reinstatement of senior executive bonuses if the relevant KPIs are met. With debt reduced to a conservative level, the company intends to keep its focus on carefully managing the capital and the delivery of outstanding experiences as well as driving sustainable earnings and free cash flow.

Outlook

Theme Parks Outlook

- FY20 has started well with 1Q20 admissions up on the prior corresponding period

- Deferred revenue as at 30 June 2019, from the sale of passes which remained active as at that date, increased by $6.9 million from FY18 ($10.7 million) to FY19 ($17.6 million), reflecting the strength in ticket sales

- This deferred revenue will be recognised over the course of FY20 as these passes expire (new annual pass sales will also contribute to the FY20 deferred revenue balance)

The company intends to keep its focus on driving its business through delivering outstanding guest experiences, supported by key marketing initiatives such as the company’s recently launched master brand campaign.

Roadshow Outlook

- Roadshow is working to exploit the increasingly diversified digital television market as opportunities with new SVOD platforms emerge

- Decline in sales of physical DVDs and Blu Ray is expected to continue

- Roadshow will continue to right-size the overhead structure to maximise efficiencies, including implementation of more streamlined management structure from July 2019

- Softness in the release schedule in early 1Q20, full year earnings result is ultimately dependent on the performance of upcoming titles – Key upcoming theatrical releases include Birds of Prey, Wonder Woman 1984, Miss Fisher and the Crypt of Tears, and The Gentleman

The Film Distribution division, the company has a strategy of more targeted and flexible film acquisitions. Further, the division stands to benefit from recent market consolidation and hence a less competitive environment for film product acquisitions. Roadshow also has a low-cost “risk-averse” approach to content creation.

On the stock performance front, VRL stock has provided a return of 39.49% in the last six months. By AEDT 3:56 PM, VRL stock was trading at a price of $4, up by 3.89% intraday, with a market cap of around $751.43 million. It is to be noted that VRL stock is trading very close to its 52 weeks high price of $4.100.