Introduction:

Investors tend to choose the best possible alternative for capital appreciation and use several methodologies, valuations, comparative analysis to bet on a stock that is likely to provide a higher return on his or her investment. There are two popular approaches which are commonly followed by investors namely, Value investing and growth investing.In case of value investing, Analysts emphasize on the current valuation of the stock and compare it with the relative valuation parameters of other stocks within the industry and sector. The most important consideration in this case is the construction of the peer group. This is known as the relative valuation approach. There can be another approach which is based on absolute valuation. The Analyst emphasizes on determining the intrinsic value of the business and if they find that the current valuation is considerably lower than the intrinsic valuation, then there is a change that the particular stock would be recommended as a Buy for Investor. The Investor may also look at the dividend yield of the stock and make sure that it is up to his expectation. Major blue-chip stocks donât fall in this category as the valuation of these stocks tend to lie on the higher side.

On the other hand, growth investing focuses on the future profitability of the company, which will lead to wealth creation. This approach prioritizes on the future earnings of the company and gives lesser weightage on the prevailing valuation of the stock. There are several instances, where the stock, even though purchased at higher price to earnings multiple than that of the peer group, has delivered stellar returns. The reason is simple; good businesses run by efficient management tend to trade at a higher valuation. In this case, investors or analysts give priority to the top-line growth, bottom-line growth and volume growth of the products. This culminates in the selection of blue-chip stocks, small-cap stocks and mid-cap stocks which have the potential to deliver higher growth in future. Many Analysts value a growth stock on the basis of average top and bottom-line growth delivered by the company in the last three, five or ten years.

We will be taking up Noni B Limited and would compare the stockâs characteristics with justified parameters of both growth and value investing.

Noni B Limited (ASX: NBL)

Innovative Offerings to Aid Higher Revenue: Noni B Limited is a retail-based company which specializes in womenâs apparel and accessories and operates across the geographies of Australia and New Zealand.

Recently, the company informed that Perpetual Limited, holding 5,296,097 number of shares of NBL with a voting power of ~5.46% became a substantial holder as on 4th September 2019.

Financial Performance for the year ended 30 June 2019

- The company reported revenue growth of 136.8% at $881.9 million as compared to $372.4 million during the previous year.

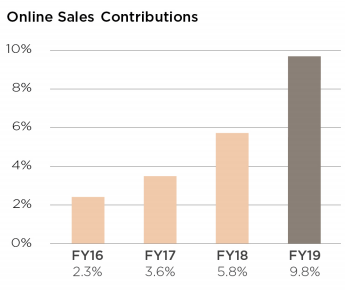

- Online sales during the year stood at 9.8% of the revenue as compared to 5.8% during FY18.

- NBL reported underlying EBITDA to $45.5 million as compared to $37.3 million in the previous financial year.

- The Business reported store network at 1,379 stores while delivering true multi-channel experience.

- The Company reported Cash-on-hand of $36.6 m and net cash position after debt at $7.1 million as on 30 June 2019.

- The company announced a fully franked final dividend of 5.5 cents per equity share held following up on a 9% share interim dividend paid during March 2019.

- In FY19, like â for â like sales of the company stood at -4.3%, which was in line with the earlier management guidance.

Operational Highlights:

- During FY19, the company has initiated a standardized operating platform which allows the business to cross-sell across all brands resulting in improved shopping experience for the customers which also results in increased volumes.

- During the year the company increased product inventory across all sites which currently create nine market places and provides the first stop last shop destination for the customers.

- The company has launched new websites (both domestic and international) to enhance customerâs experiences

- The companyâs database houses 4.4m email addresses and 3.4m phone numbers. During FY19, the company reported online sales growth on acquired brands at 15%, up from 9% in FY18.

- The business reported 14% higher online visits as compared to the previous corresponding year. NBL also reported that online conversion rate increased by 23% from the last year.

Online Sales Key Metrics (Source: Companyâs Reports)

Sectoral Outlook: As per the study by Australia Post 2019 e-Commerce Industry Report ~35.7% of retail spend is incurred on variety, ~27.1% on Apparel, ~11.5% on homewares, 8.4% for health and beauty, 7.2% for books and media, 6.5% on hobbies and recreational and the remaining 3.5% on others.

Guidance: The company will be emphasizing on product portfolio growth and higher online sales in the coming years. The company is targeting a growth of 100 stores per year during the next four years. The company will enhance its presence in several categories like beauty products, homewares, luggage segment for the next three years.

Stock Update: The stock of NBL closed at $2.660, down 2.206% as on 16 October 2019. The stock has a with a market capitalization of $263.62 million and is available at a price to earnings (P/E) of 32.38X. The stock has generated a return of 2.64% and -2.51% during the last three-months and six-months, respectively. The stock has generated dividend yield of 5.33% on an annualized basis.

Growth VS Value approach for NBL:

The stock can be considered to fall in the category of both growth and value stocks.

The stock has delivered stellar topline and bottom-line growth during Financial year 2019 and fulfills one of the criteria for growth stocks. Investors may choose to invest in the stock on the basis of price to earnings multiple, which stands higher at ~33x. In terms of long-term returns, the stock has generated a robust return of 457.83% during the last five years.

The dividend yield of the stock stands at ~5.33% which fulfils one the criteria of value investing methodology. The future growth of the stock seems to be progressing well, aided by new website launches, innovative offering to the customers, etc. Value investors may consider this stock depending on the potential return it can generate in the long term based on its expansion plans.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.