Recently we have introduced our readers to the concept of derivatives and gave an idea about swaps. In this article, we would take you through another type of derivatives which is known as forward derivatives. Like always, for a better understanding, we will start with the definition of derivatives and then discuss the forward derivatives.

Derivatives:

A derivative is a financial security whose value depends on the price of its underlying asset.

Forward Contract:

A forward contract is a contract between a buyer and seller to purchase or sell a particular asset at a pre-defined date and a pre-defined price on a future date. A forward contract is a non-standardised contract as it takes place between the two participants over the counter, and there is no standardised body/exchange between the two parties. Due to the lack of centralised clearing house, forward contracts give rise to huge default risk. The other risk associated with the forward contract is that they are not traded on an exchange; hence you cannot sell the contract to any third party.

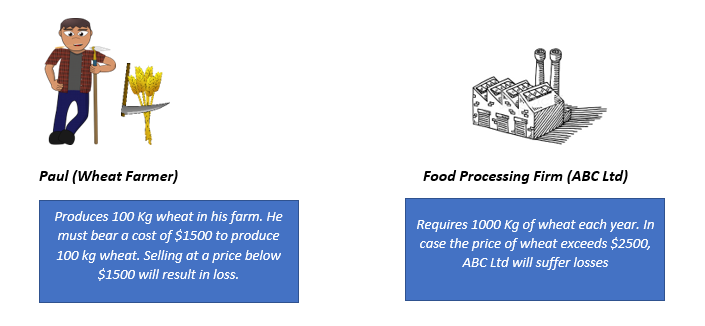

Letâs consider an example

There is a farmer named Paul, who produces wheat, and he sells the wheat to a food processing company. In this case, there is a scope of the price risk for both the parties because of the demand and supply of the product. In case the price of the product goes down, then the farmer might suffer losses. On the other hand, if the price of the product goes up, then the food processing company might have to suffer losses. In such a case, there is an option where both the parties can enter into a contract where they can fix a common price at which the seller will sell the product, and the buyer would also agree to buy that product and minimise the risk.

Case 1: If the price of the wheat goes below $1500, Paul will suffer losses. This is because $1500 is the cost of producing wheat. The more the price of the wheat goes up, the more will be his profit

Case 2: If the price of the wheat exceeds $2500, then ABC ltd will suffer losses. This is because there would be other costs also involved to produce the finished product using wheat.

So, to overcome this situation, both the parties enter into a forward agreement where both the parties agree to buy and sell 100 kg wheat at $2000. By this, both parties would be able to hedge their price risk.

Risk Associated with the forward:

- There is a chance of counterparty default. It may happen that Paul could not deliver 100 kgs wheat to ABC Ltd. In this case, what will happen to ABC Ltd? On the other hand, if the prices reach $1500, then ABC Ltd might disagree with paying $2000 to Paul for 100 kgs of wheat. Hence, parties may have to go to court for settlement.

- As these are not exchange-traded, then this contract cannot be sold to any third party.

These risks are taken care when parties trade through a future contract which works similar to the forward contract but in a standardised way. There is a role of exchange between the two parties.

Settlement of the Contract:

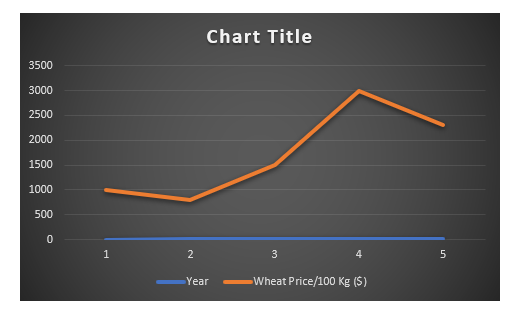

Letâs say in the fifth year, the price of the wheat reaches $2300. However, the price agreed in the contract per 100 Kg was $2000. In such a case, there are two ways the settlement can take place. The first is through delivery settlement, and the second is through cash settlement.

Delivery Settlement:

Paul delivers 100 Kgs of wheat to ABC Limited and ABC limited pays Paul $2000

Cash Settlement:

Paul is unable to deliver 100 Kgs of wheat. So, he requests ABC Ltd to purchase from some other sources, and he will pay the difference amount (the current market price of the wheat per 100 Kg â the price mentioned in the contract per 100 Kgs). In this case, Paul will not be delivering ABC limited with 100 Kgs wheat instead, he will pay $300 to ABC Limited.

Forward agreements can be categorised into two parts. These are short-term forward contract and long-term forward contract.

- Short term forward contract is the contract amongst buyer and seller for a period from 0 to 1 year, or we can say spot to 1 year.

- A long-term forward contract is a contract between the buyer and the seller for a period of more than 1 year.

How to execute a long-term forward contract and short-term forward contract?

Suppose there are two companies A and B. Company A is an importer while company B is an exporter. Company A wants to buy AUD while company B wants to sell AUD. In order to execute the process, they need to liaison with the bank.

Now company A can buy Short term forward contract, or it can also buy Long-term forward contract. If company A buys short term forward contract, it means they have short term import commitment and if it buys long-term forward contract long term import commitment. In both cases, company A would be paying a premium. So, the pricing would be:

Net Outright rate (importer of AUD) = Spot price + premium + brokerage.

The net would be known as net outright rate. The importer would receive an ask1 side premium.

On the other hand, company B can sell short term forward contract, or it can also sell Long-term forward contract. If company B can do either a short term forward transaction or long term forward transaction. In both cases, company B would be receiving the premium. Thus, in this case, the pricing would be:

Net Outright rate (exporter of AUD) = Spot Price + premium â brokerage.

Here also, the net would be the net outright rate. The exporter would receive a bid2 side premium:

In the upcoming article, we would try to take you through another interesting topic under forward contract i.e. deliverable and non-deliverable forward contract. Stay connected.

**Few Terminology for better understanding

- 1. Ask Price: Ask price is the least price a seller will accept for an underlying asset.

-

Bid Price: Bid price is the maximum price a buyer will give for an underlying asset.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.