Every Investor, while investing his/her surplus money, struggles with who key questions - Where to invest? and how to invest? They are also undecided on whether to save the money or to invest. Experienced investors and market professionals highlight that saving money cannot increase the value of money, thus, leaving just one option for the investors. There are many investment approaches to choose from such as top-down, Bottom-up, value investing, and growth investing.

A Brief on Growth and Value Shares

Turning the needle to value and growth investing approach, under the growth approach, an investor looks for companies that offer a robust earnings growth potential and are expected to deliver strong growth potential in the future period. In a value investing approach, investors focus on stocks that are undervalued.

Strictly focusing on earnings growth might be detrimental for a growth investing approach as earnings can be down in any year due to certain economic conditions. If a company has the potential to witness strong earnings growth, then it can be taken as an asset under growth investing. Shares that trade at a lower price compared to its peers within the same industry are termed as value shares or bargain shares.

Role of Valuation

A valuation can be seen while selecting the shares for investment purposes. Price-to-earnings ratio and price-to-book ratio can be considered as benchmarks to differentiate between growth shares and value shares. While the two mentioned ratios are on the higher side for growth shares, the ratios are relatively low for value stocks.

Price-to-earnings is calculated by dividing the share price by the current year's earnings per share. Price to book value is calculated by dividing share price with book value per share.

Characteristics of Growth and Value Shares

Growth Shares

- Financials of growth shares reflect consistent top line and bottom line growth for long periods. The business of such companies possesses growth capital in the shape of higher capital expenditure, marketing budgets, as well as R&D expenditure.

- Capital appreciation can be undertaken as a major characteristic as these companies generally reinvest their profits.

Value Shares

- Value shares are less preferred and cheaper compared to the other companies in the same industry.

- These companies possess low valuation and can be bought at a bargain.

For a deeper understanding, let us consider examples of growth and value companies such as Navigator Global Investments Limited and Pinnacle Investment Management Group Limited (growth), and DigitalX Limited and DEXUS (value).

Navigator Global Investments Limited (ASX:NGI)

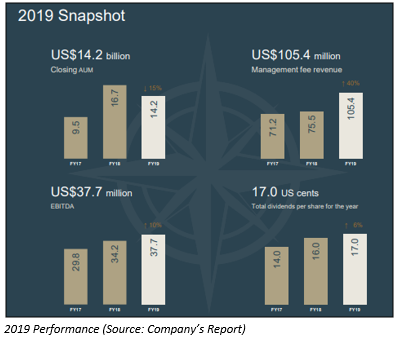

Navigator Global Investments Limited reported a management fee revenue amounting to US$105.4 million with a rise of 40% in FY19. The AUM of the group were U$14.2 billion as at 30th June 2019 with a rise of 15%. EBITDA of the company stood at US$37.7 million, up 10%. The company declared total dividends per share for the year of 17.0 US cent.

The aim of Navigator Global is to deliver on its investment objectives for clients as well as to maintain a high quality of service. The company would continue to promote its managed account platform, as it believes that it provides a better model for investing in hedge funds. NGI continues to seek opportunities for expanding its business. The company is often presented with opportunities because of a strong balance sheet as well as position in the market. NGI would be diligent in evaluating any opportunities to satisfy itself that a transaction would create and maintain value for the Group.

The stock of NGI closed at $2.790 per share 10 January 2020, with a fall of 0.357%. The market capitalization of the stock stands at $454.01 million. The stock has delivered negative returns of 10.26% and 24.73% during the last three months and six months, respectively.

Pinnacle Investment Management Group Limited (ASX:PNI)

Pinnacle Investment Management Group Limited experienced a surge of 32% in NPAT from continuing operations attributable to shareholders to reach $30.5 million in FY19. The earnings per share from continuing operations stood at 18.3 cents, with a rise of 28% from 14.3 cents in the previous year. The share of NPAT from Pinnacle Affiliates stood at $33.1 million, reflecting a surge of 33% as compared to $24.9 million in FY18. The company declared fully franked final dividend amounting to 9.3 cents per share, which was paid on 05 October 2019.

Recently, the company inked an agreement for the acquisition of 25% equity interest in Coolabah Capital Investments Pty Ltd. The company will purchase all the equity currently owned by AMB Capital Partners, pursuant to the satisfaction of certain limited conditions practice.

The stock of PNI closed at $4.880 per share 10 January 2020, with a rise of 3.609%. The market capitalization of the stock stands at $861.61 million. The stock has delivered returns of 10.30% and 5.84% during the last three months and six months, respectively.

The above-stated company shares can be considered as growth shares under the growth approach as these businesses reported a decent improvement in the financials.

DigitalX Limited (ASX: DCC)

DigitalX Limited is a blockchain-based software solutions company. Recently, the company signed an agreement to acquire Bullion Asset Management Services Pte Ltd, which is an investment management firm behind xbullion. The company has acquired shares via a share subscription, received advisory shares and entered into an agreement to acquire existing shares from an existing shareholder as part of the agreement.

Also, the company has rolled out its second asset management product, i.e. the DigitalX Bitcoin Fund. The Bitcoin Fund is available via a standard unlisted fund structure. This allows advanced investors, which include family offices as well as HNWIs, an inexpensive and familiar vehicle to gain exposure to the growing asset class.

The stock of DCC closed at $0.032 per share 10 January 2020, in line with the previous day’s close. The market capitalization of the stock stands at $19.38 million. The stock has delivered returns of 14.29% and -25.58% during the last three months and six months, respectively.

Dexus (ASX: DXS)

Dexus is a real estate investment trust of Australia and is one of the leading real estate leading group which manages a high-quality Australian property portfolio worth $31.8 billion.

On 06 January 2020, the company, through a release, stated that on 23 December 2019 the second tranche rights were implemented for GIC for acquiring a further 24% interest in the Dexus Australian Logistics Trust core portfolio, resulting in an increase of GIC’s total investment in DALT to 49%. Settlement of the same is anticipated to occur on 01 April 2020. The sale proceeds would be utilised in reducing debt as well as providing capacity for future funding commitments, which would include the company’s development pipeline.

For the six months ended 31 December 2019, the distribution amount stood at 27.0 cents per stapled security, which was consistent with the prior corresponding period, which is to be payable on 28 February 2020.

The company reaffirmed its market guidance for the distribution per security growth of around 5%, for the 12 months ended 30 June 2020. The distribution payout ratio is anticipated to remain in accordance with free cash flow.

The stock of DXS closed at $12.000 per share 10 January 2020, a drop of 0.415%. The market capitalization of the stock stands at $13.21 billion. The stock has delivered returns of 0.67% and -10.67% during the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.