During a strong and robust economic time period, the consumer discretionary stocks tend to outperform the stock market. This is so because such stocks follow the economic movements, falling at the time of economic shocks and outpacing at the time of economic growth. The companies that offer non-essential goods to the consumers are categorized under consumer discretionary companies. The performance of these companies can help investors predict the stock market performance outlook and future economic conditions. Due to their exclusive attribute, the consumer discretionary companies are usually termed as economic and stock market predictors.

At the time when the Australian economy is in the midst of several challenges due to historic low interest rates, US-China trade war concerns, subdued inflation and struggling property market, investors might be interested in predicting the Australian economic outlook. Considering this view, let us look at two key stocks from the consumer discretionary sector listed on the Australian Stock Exchange:

Think Childcare Limited

The Australian-based Think Childcare Limited (ASX: TNK) offers exceptional education and quality care for Australian children. The company manages, operates and owns around seventy-eight long day childcare facilities for children between the age group of six weeks and six years in Australia. The company seeks to become the âEmployer of Choiceâ in the Australian Childcare Sector.

Operational Performance

On 14th August 2019, the company notified that it has entered into a Scheme Implementation Deed with TNKâs wholly owned entity, Think Childcare Development Limited (TND). Under the Deed, both TNK and TND will form a stapled structure with a view to secure and enhance TNK's development pipeline by bringing the incubation and development function of new greenfield trade-up leasehold childcare facilities under TND. The company mentioned that TNKâs fully paid ordinary shares will be stapled to TNDâs fully paid ordinary shares under the stapled structure.

With the establishment of the stapled structure, TNKâs dividend (or capital) will be paid on behalf of TNK shareholders to TND in consideration for the issue to TNK shareholders of new shares in TND, which are then stapled to TNK shares. Apart from the dividend (or capital return), TNK shareholders are not required to contribute additional equity to capitalise TND.

Financial Performance

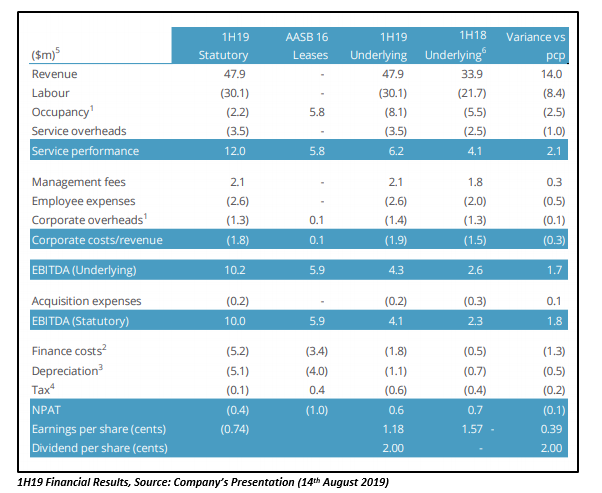

The company has recently reported its first-half financial results for FY19 and notified that it is on track to achieve 2019 guidance and operating model to support long-term growth. The Underlying EBITDA of TNK improved by 67 per cent from $2.5 million in pcp to $10.2 million during 1H19. The service performance of the company was 50 per cent higher than the prior year, driven by higher days of learning from the 2H18 acquisitions. TNK recorded a strong cash position at the end of the period with $9.1 million cash and $42.5 million facility headroom.

Dividend Announcement

The company achieved 13.5 per cent of total return during the first half of FY19, incorporating its franked dividends since the IPO. It has also determined a fully franked interim dividend amounting to 2 cents per share for a period of six months, payable on 20 September 2019.

Future Outlook

TNK believes that its 1H19 service performance was slightly below expectation. The company has maintained its Underlying EBITDAâs guidance range between 13.8 million and 14.8 million. The project Elevate activities (uncommitted) have been deferred until CY20 in order to bed-down initiatives rolled-out in 1H19. TNK has planned to complete 6 acquisitions in 2H19, 5 services from incubator 3 and 1 from incubator 4. The company is on target to complete capital improvement works and launch 14 priority services in 2H19.

Stock Performance

At 11:58 AM AEST on 16th August 2019, TNK is trading higher at AUD 1.310 on the ASX, up by 1.15 per cent relative to the last closed price. With ~21k number of companyâs shares in rotation, the market cap of the stock is at AUD 78.47 million. The stockâs 52 weeks high and low value at the time of writing the report was AUD 1.950 and AUD 1.10, respectively. TNK has delivered negative returns of 4.07 per cent on a YTD basis and 28.06 per cent during the last six months.

G8 Education Limited

One of the leading providers of education and quality care facilities in Australia, G8 Education Limited (ASX: GEM) aspires to become Australasiaâs leading provider of educational child care and high quality developmental services. Headquartered in Australia, the company was listed on the ASX on 5th December 2007.

Dividend Announcement

The company has recently declared a fully franked dividend amounting to 8 cents for its ordinary fully paid securities, payable on 5th April 2019. The dividend carried an ex-date and record date of 14th and 15th March 2019, respectively. The distribution was related to a period of six months, ending on 31st December 2018. The company also had a Dividend/Distribution Reinvestment Plan (DRP), with a DRP Price of AUD 3.10160 and DRP discount rate of 2 per cent.

The announced dividend was in line with the companyâs proportionate dividend policy, wherein the dividend is 75 per cent of NPAT.

Financial Performance

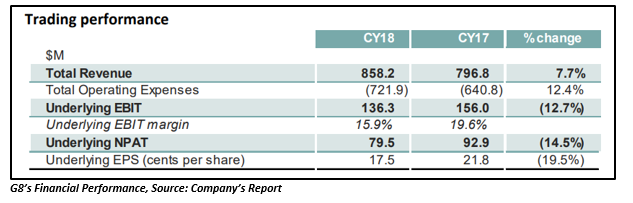

During the financial year ending 31st December 2018, G8 reported an Underlying CY18 EBIT of $136.3 million which was below the last yearâs Underlying EBIT figure but was in accordance with the companyâs management guidance. The average occupancy in CY18 was also 1.9 per cent points down to 74 per cent on a like?for?like basis. The company generated an operating cash flows of $105.9 million during the period.

Stock Performance

GEM is currently trading lower on the ASX at AUD 2.645 (as at 11:58 AM AEST on 16th August 2019 with a fall of 0.56 per cent in comparison to the last closed price of AUD 2.660. With ~218k shares of the company in rotation, the market cap of the stock stands at AUD 1.22 billion. The 52-week high and low value of the stock was at AUD 3.635 and AUD 1.880, respectively, at the time of writing the report. The stock has delivered negative returns of 24.86 per cent, 6.67 per cent and 2.92 per cent, respectively during the last six months, three months and one month, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.