Now that 2019 is finally over, investors have started to look for investments to earn good returns. However, due to the recently risen geo-political tensions between US and Iran, there is a sense of unrest in equity investors.

Interestingly, cryptocurrency market has gained from this situation as increasing number of investors are willing to invest in decentralized digital currency. This is a good new year start for the blockchain technology sector. This will surely boost the confidence of startups and enterprises that are working on their own blockchain solution.

Blockchain-as-a-Service (BaaS),

Blockchain-as-a-Service (BaaS), which was one of trending technologies in 2019, is expected to bloom further in 2020. Baas is basically third-party cloud-based infrastructure which allows businesses to use cloud-based solutions to build, host and use their own blockchain apps and promotes widespread adoption of blockchain technology. Blockchain is becoming software as a service (SaaS), supplied by the leading IT companies globally.

Along with blockchain technology, several other technologies including Artificial technology and Edge computing are coming out as emerging techs for 2020.

Artificial technology

AI has been one of the most popular technologies of the last decade. Each year, this technology has improved substantially and is now being used by various companies to improve their product offering. This year also, this technology is AI-driven innovation is expected to enter into new areas of industry. It is interesting to note that this technology is also being used in Neuromorphic computing, A Technology that Learns Like the Human Brain. Investors should keep a close on companies which are anyway related to the above-mentioned technologies.

To know about AI Stocks click here.

We have screened few tech stocks for investors which are utilizing these trending technologies to provide interesting and useful solutions to customers.

Security Matters Limited (ASX: SMX)

Security Matters Limited has developed a suite of integrated solutions to solve both authentication and track and trace challenges while serving various manufacturers’ needs: brand protection, authentication, track and trace for supply chain integrity and quality assurance.

The company recently launched its second generation blockchain product in collaboration with R3 and Quantum Crowd and expects its rapid adoption in a wide range of industries to help tracking of all kinds of physical assets.

Recent Updates:

- SMX delivers strong progress across all operations during Q3 2019

- SMX’s blockchain product launched, in collaboration with R3 and Quantum Crowd, providing customers an end-to-end tracking solution using the blockchain

- Equilibrium Economy business model launches, focussed on sustainability, circular economies and carbon credits within the plastics, fashion, timber, resources and electronics sectors

- Two patent applications submitted, significantly strengthening SMX’s IP and securing its technology while the Company executes is growth strategy

Notably, in the last one year, SMX stock price has risen by around 47% on ASX. At market close on 10 January 2020, SMX stock was trading at a price of $0.450, up by 2.273% intraday, with a market cap of around $48.4 million.

BrainChip Holdings Ltd (ASX: BRN)

BrainChip Holdings Ltd (ASX:BRN) is a leading provider of ultra-low power high performance AI Edge technology which has many attractive characteristics, including the ability to be trained rapidly, high accuracy and low compute overhead.

The company recently provided a year end 2019 update in which it highlighted the following updates:

- Introduction of AkidaTM Intellectual Property for Licensing to ASIC Suppliers

- Introduction of a Neural Network Converter for CNN to Event-Based CNN and Native SNN translation

- Definitive Agreement with Socionext for Akida Development and Manufacturing

- Convertible Note issued, to raise US$2.85 million

- Entitlement Offering Raised A$10.7 million

- Expansion of Sales and Marketing team

BRN recently responded to an ASX query letter which has noted the change in the price of BRN’s securities from a low of $0.045 to a high of $0.055 on 9 January 2020. In its response BRN has stated that it is not aware of any information concerning this and has confirmed that it is complying with the Listing Rules and, in particular, Listing Rule 3.1.

On year till date basis, BRN stock has provided a return of 17.02% to its shareholders. At market close on 10 Jan 2020, the stock was trading at a price of $0.051 with a market cap of around $73.56 million.

LiveTiles Limited (ASX:LVT)

LiveTiles is a rapidly growing enterprise SaaS (Software as a Service) company headquartered in New York City with 180 employees in the US, UK as well as in Australia. During the 2019 financial year, LiveTiles continued its joint initiative with Microsoft to promote the company’s recently launched artificial intelligence offering to Microsoft customers in the United States. The strategic partnership with Microsoft and ongoing joint promotional and co-selling activities provide a strong endorsement of LiveTiles and its products. In 2019, milestones included an airline AI solution to support staff at airport gates and inclusion in Microsoft’s integrated P2P solutions program.

The company recently completed the acquisition of CYCL, a leading intelligent intranet software business in Europe which empowers organisations across all industries to realise their intelligent workplace strategy.

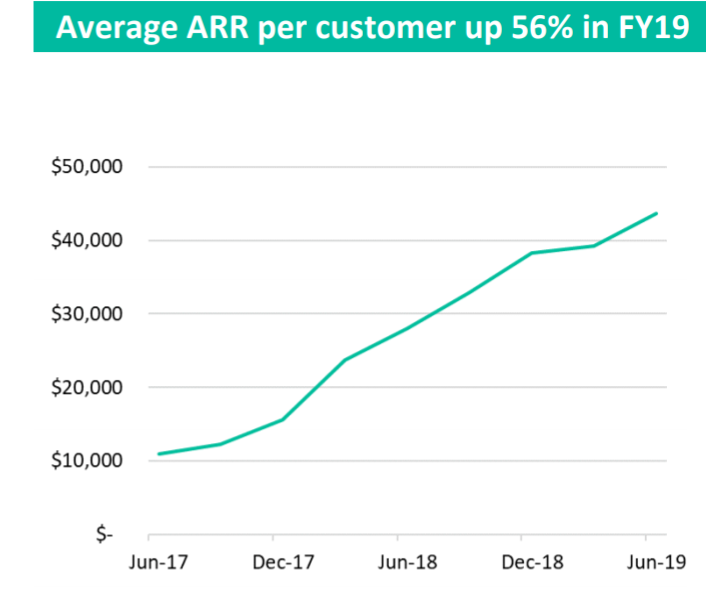

In FY19, the company experienced strong growth in average ARR per customer, driven by:

- A higher proportion of new enterprise customers

- Product cross-sell / bundling

- Increased penetration of existing customers

Source: Company reports

Main highlights of LiveTiles

- LiveTiles is more than 4x larger than its nearest competitor (by revenue)

- Most competitor software vendors are embedded within systems integrator (consulting) businesses

- Internal organisation intranets and portals have historically been custom-coded - common frustrations with cost, lack of features and lack of dynamic change

- LiveTiles pioneered the market for low/no-code intranet software in 2015

In the last six months, LVT stock has provided a negative return of 43.88% to its shareholders. At market close on 10 January 2020, the stock was trading at a price of $0.270 with a market cap of around $236.61 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.