Bitcoin (BTC/USD) at the time of writing was trading at US$10,363 (AEST: 1:08 PM, 9 September 2019). On June 26, 2019, it touched a level of US$13,764, and since then it has corrected by ~22%. Today, its use cases include social networks, blogging and tipping where people can tip, earn and record onchain data in unparalleled fashion, gaming and casino platforms allowing people to wager funds in order to win more cryptocurrencies, payments services, merchant directories, decentralized shopping, etc.

Bitcoin vs Cash

Now to answer the important question of preferring bitcoin over cash transactions, the following points would help to achieve certain clarity.

- Digital Currency â With Bitcoin, without any need of intermediaries, people may make a transaction in exchange of goods and services which would help them in gaining control (ownership). Moreover, it is cheaper, immutable, secure and faster. On the other hand, cash is controlled by central banks or the government.

- E-commerce â Bitcoin can help in doing easy online shopping with many platforms now accepting bitcoins given its underlying technology, Blockchain, which provides convenience in storing, tracking and spending digital money.

- Trackability â With the distributed network of several computers, the cryptographic technique is used to create a public and permanent record of every single Bitcoin transaction that has ever occurred, providing significance to the tracking of the payment. Cash on the other hand has no real way of tracking capability.

- Investment tool â At present, Bitcoin is considered at par with the gold, and provides best use case with the best of cash and gold while providing an open market with no restrictions imposed by governments or banks.

- Volatility impact - Going with the phrase that âVolatility is the best friend of a traderâ. Historically, Bitcoin, with its volatile nature, has generated quick money for traders and investors.

- P2P â Bitcoin allows peer to peer transactions, which means that Bitcoin allows exchanging value over the internet without any intermediary. This is possible because usersâ account balances are getting accessed through a password known as a private key, making it private, secure and open at the same time.

- International Digital Currency â Users get seamless transactions across geographies with a ledger getting maintained at the backend, where there are no third-party interventions, no exchange value, no boundaries to Bitcoin or cryptocurrencies.

- No Duplication â Unlike cash, there is no way to duplicate bitcoin, as blockchain technology is a distributed database in which the information transmitted by users is verified and grouped at a regular time interval into blocks.

Few stocks in the cryptocurrency space are DigitalX Limited (ASX:DCC) and Isignthis Ltd (ASX:ISX).

DigitalX Limited

DigitalX Limited (ASX:DCC) is involved in developing and delivering advisory related services to the blockchain market, which comprises ICO/STO advisory; blockchain consulting; funds under management; and media. The company recently announced change in directorsâ interest where Leigh Daniel Traversâs indirect interest increased by 538,889 after Leethal Pty Ltd acquired those shares at $0.027, taking the final holdings to 9,000,000 Performance Rights, subject to performance-based vesting conditions, and expiring 10 December 2023, and 5,000,000 indirect Fully Paid Ordinary Shares, effective from September 5, 2019.

In another update, DCC announced about its updates in relation to its recent activities for the start of FY20. On September 4, 2019, the company entered into a deed of termination and settlement with First Growth Funds Limited in relation to Futuredge Capital Pty Ltd. It has also restructured its two active business units to represent the two-business division, which will be pursuing blockchain consulting and development and funds management.

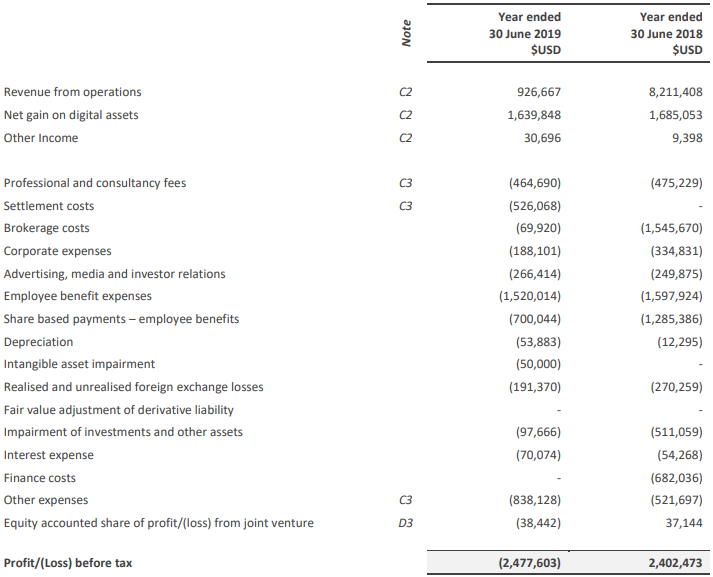

FY19 Key Highlights: Revenue from ordinary activities for the period was reported at US$926,667, which is a decrease of 89% as compared to the previous year. Loss from ordinary activities after tax attributable to members for the period was reported at US$2,524,151. Net tangible asset per ordinary share for the period was reported at US$0.021, as compared to US$0.022 in the previous year.

FY19 Income Statement (Source: Company Reports)

On 9 September 2019, DCC shares were trading at $0.029 (as at AEST: 1:08 PM), with the market cap of ~$16.1 Mn. Its 52 weeks high and 52 weeks low stand at $0.125 and $0.025, respectively. It has generated an absolute return of -75.65% for the last one year, -41.67% for the last six months, and -51.72% for the last three months.

Isignthis Ltd

Isignthis Ltd (ASX:ISX) is involved in payment authentication with deposit taking, remote identity verification, payment processing capability and transactional banking. The company partnered with Denmark-base Coinify ApS to provide identification solutions for bitcoin purchases on the Coinify platform.

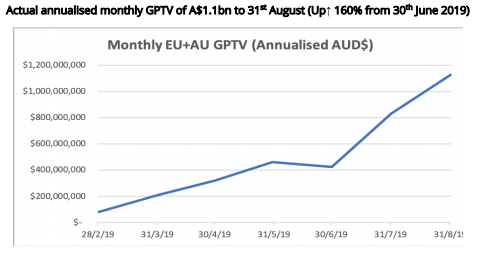

On 9 September 2019, ISX provided an update on its operations. As on 31 August 2019, the annualised monthly GPTV crossed AUD 1.1 bn reflecting a 160% jump from 30th June 2019. Business customer approvals were up 28% in August to 270 as against 210 at the end of June.

(Source: Company Reports)

(Source: Company Reports)

The company recently highlighted that; it has been added into the S&P/ASX 300 Index, effective from 23 September 2019.

In another update, ISX announced change in its directorsâ interest where Timothy Hart acquired 500,000 Ordinary Shares following conversion of Performance Rights as approved by shareholders at the AGM on 17/5/19, taking the final holdings to 16,141,220 fully paid ordinary shares, effective from 2 September 2019.

H1FY19 Key Highlights: Total audited operating revenue for the period was reported at $7.5 Mn, which is an increase of 49% as compared to $5 Mn on Y-O-Y basis. Total revenue, including other income was reported at $8.2 Mn, which is an increase of 48% on Y-O-Y as compared to $5.5 Mn reported in the previous year. Statutory loss after tax for the period was reported at $0.7 Mn, which is 75% lower than in H1FY18 at $2.9 Mn. EBIT for the period, adjusted for non-cash share-based payments was reported at $0.3 Mn as compared to $2.85 Mn in H1FY18. Cash balance as on 30 June 2019 was reported at $9.9 Mn, which excludes $3.1 Mn of options exercised early in July, taking the cash balance to ~$13 Mn post the end of the half-year. Client funds held at the end of the period was reported at $34 Mn.

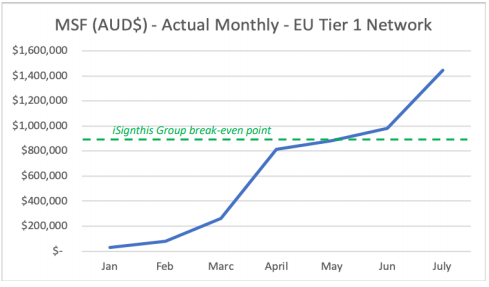

MSF-Actual Monthly-EU Tier 1 Network (Source: Company Reports)

MSF-Actual Monthly-EU Tier 1 Network (Source: Company Reports)

On the stock information front

On 9 September 2019, ISX shares were trading at $1.570 (as at AEST: 1:08 PM), with the market cap of ~$1.5 Bn. Its 52 weeks high and 52 weeks low stand at $1.490 and $0.105, respectively. It has generated an absolute return of 688.57% for the last one year, 441.18% for the last six months, and 109.09% for the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.