Undoubtedly, the Australian health care sector represents a lucrative market with great possibilities for significant returns to investors, alluring their attention to investing in health care stocks amidst global slowdown, geo-political tensions and coronavirus outbreak

In Australia, the healthcare and medical industry has witnessed a remarkable fast-track growth over the past few years. Since the life expectancy of humans has increased, people pursue the best health care opportunities to resolve medical challenges. Additionally, abundant funding grants by the government bodies and institutions is also a key factor in drawing attention globally. These facts place the Australian Biotech/Health Care system amid the best in the world.

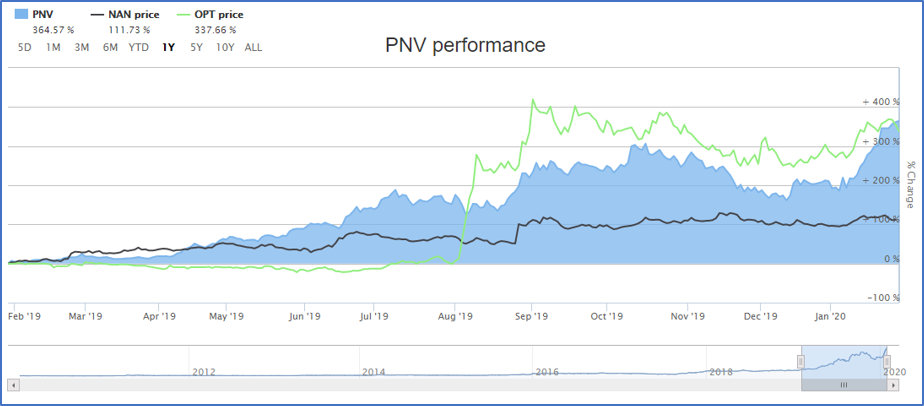

Three healthcare stocks namely PolyNovo Limited (ASX:PNV), Nanosonics Limited (ASX: NAN) and Opthea Limited (ASX: OPT), have shown a significant Year-to-date returns in the Australian stock market as shown in figure below and could serve as the top picks for investors in the year 2020. Let’s take a look into details of each stock.

Source: ASX

PolyNovo Limited (ASX:PNV)

Australian based medical device company PolyNovo Limited (ASX:PNV) is engaged in designing, development and manufacturing of dermal regeneration solutions known as NovoSorb BTM, leveraging its patented NovoSorb biodegradable polymer technology. PolyNovo’s development program involves Breast Sling, Orthopaedic applications and Hernia.

PNV’s share price has declined 5% on 31 January 2020 to $2.80 with market capitalization standing at $1.95 billion. However, PNV has generated an astonishing 364.57% return over a year.

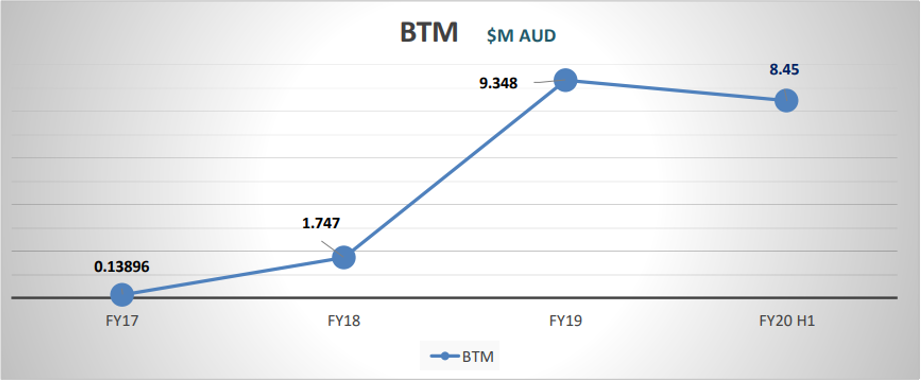

The PolyNovo’s growth in the past year has been exceptional. Its success is broadly attributed to the sales of its top product, the NovoSorb BTM that produces an excellent cosmetic result for patients and generated $ 9.348 million revenue for the financial year 2019.

The unaudited revenue from the sale of NovoSorb BTM has been reported to be over $2 million for December 2019, in comparison to $890,000 observed for December 2018, representing 134% uptick.

In 1H FY2020, unaudited revenues from NovoSorb BTM were registered at $8.57, when compared to $3.75 million for the 1H FY2019, reflecting an increase of 129%.

Source: Company Presentation

NovoSorb®

NovoSorb® is a novel range of bio-resorbable polymers with unique properties that provides-

- outstanding biocompatibility

- control over physical properties

- programmable bio-resorption profile

It is a dermal platform for regenerating the dermis when lost through massive surgery or burn.

The company has now expanded its footprints within UK/Ireland and European markets as well.

PolyNovo Reported First NovoSorb BTM Surgeries in UK/Ireland

Recently, PNV updated the market that its lead product NovoSorb BTM has been applied to the first 2 patients in the United Kingdom wherein, one was treated for Necrotising Fasciitis in an English NHS hospital and the other for a defect in scalp. Further, many other NHS hospitals are undergoing the process of selection of patients for surgeries.

PolyNovo had stock on the ground in England anticipating the launch in the UK/Ireland. The company was engaged in setting up a direct sales infrastructure and business processes in the UK during the last 14 months to be ready for the predicted requirement for NovoSorb BTM.

Recent Appointments

The company appointed additional staff for the sales of its product in UK and Ireland and recruited a Marketing Manager for UK and Europe operations to be centered in England. The new staff are being inducted and trained and expected to be in the field by March.

PolyNovo’ Europe Progress Update

Announced on 22 January 2020, PolyNovo has received its first product orders of BTM from PolyMedics Innovations (PMI) for use in Germany, Switzerland and Austria, with the 1st NovoSorb BTM orders dispatched to hospitals in preparation for the 1st surgery. In Europe, the first surgery took place in Germany on Sunday, 19th January.

The company recently provided updates on the Europe progress that further surgeries have occurred in Switzerland and Germany. PNV’s distributor, PMI, has also assigned the next order.

Nanosonics Limited (ASX: NAN)

Nanosonics Limited (ASX: NAN) is specialized in the development and commercialization of infection control solutions, and has created an innovative disinfector, Trophon® used for protecting patients from the risk of ultrasound-related cross contamination.

NAN’s shares settled the day’s trade at $6.940, up by 1.46% on 31 January 2020. With the market capitalization of $2.06 billion, and 300.48 million outstanding shares, NAN has generated a significant return of 111.08% over a year.

NAN’s outstanding performance was driven by its robust FY 2019 results. FY19 turned to be an impressive year with regards to great achievements and significant delivery of the company’s strategic growth agenda, further placing Nanosonics as a global leader in infection prevention space. The company delivered an impressive 39% increase in revenue amounting to $84.3 million, with a 201% upsurge in operating profit before tax valued $16.8 million.

It is important to note that the company had delivered a return on invested capital of about 15% exceeding the cost of capital, given the company’s expanded investment in research and development, operational competence including global promotion and sales growth.

Nanosonics next generation trophon technology, new trophon2 product, was launched at a global scale in the main markets of North America, Europe and Australia and is receiving very positive customer feedback and adoption, further increasing customer share of wallet, in turn, contributing to mounting revenue numbers as reflected by another 18% of global installed users now on board.

The trophon2 bagged a prestigious Australian Good Design Award Gold Accolade award, receiving industry acknowledgment for its exceptional design and innovation in July 2019.

Driven by striking growth of its product development pipeline, the company is seeking to launch a new product targeting the commercial introduction to initiate in FY 2021 and launch in several of international markets throughout the 1H FY2021, subject to individual market regulatory approvals.

Nanosonics had appointment Dr Lisa McIntyre as a Non-executive Director of Nanosonics with effect from13 December 2019.

Opthea Limited (ASX: OPT)

Opthea Limited (ASX: OPT) is a clinical biopharmaceutical company engaged in drug manufacturing and committed towards improvement in eyesight in patients with eye diseases. Opthea’s program revolves around innovative therapeutic product OPT-302, a VEGF-C/D ‘trap’ for retinal diseases.

OPT settled the day’s trade at $3.44, up 2.07% on 31 January 2020. With market capitalization standing at $907.06 million, and 269.16 million outstanding shares, OPT has generated a whopping 337.66% return over a year.

Opthea’s success is attributed to its Phase 2b trials of its product OPT-302 which is a soluble form of VEGFR-3. The trials results reflected statistically superior primary efficacy outcomes. OPT-302 has a novel mechanism of action that inhibits the activity of VEGF-C and VEGF-D proteins responsible for causing blood vessels to grow & leak.

OPT-302 is a combination therapy which has the potential to improve foresight results by further impeding the pathways involved in disease progression completely, in patients with wet age-related macular degeneration disorder.

Opthea Completed Phase 2a clinical trial of OPT-302 for Diabetic Macular Edema

The company recently announced patient’s enrollment for Phase 2a clinical trial of OPT-302 for evaluating the efficacy and safety of OPT-302 dosed in combination with aflibercept for treatment of diabetic macular edema.

This denotes an additional substantial achievement for Opthea in its 2nd disease indication as stated by Dr Megan Baldwin, CEO of Opthea. The CEO further showed her confidence about the potential for OPT-302 in DME on the groundwork of the encouraging results from Phase 2b wet AMD trial, and also its previous positive Phase 1b clinical results that demonstrated OPT-302 combination therapy dose escalation was well tolerated with enhanced visual and anatomic results in patients with treatment resistant and persistent DME.

She further mentioned that the Phase 2a DME study which is presently underway is further assessing OPT-302 therapy in a greater patient population for the confirmation of these observations.

Opthea anticipates reporting topline data in the Q2 2020.