A Take on Multibaggers

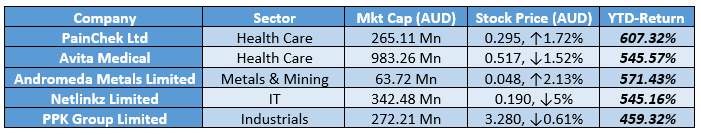

While picking the best performing stocks for the year 2019 to date, the following five companies caught much attention due to their characteristics of being a multibagger. A multibagger stock is essentially an equity stock that gives returns that are several times their cost, usually over 100% (see the figure below). Generally, multibaggers are undervalued but have strong fundamentals, which make them a great investment option. Moreover, multibagger stock companies mostly have strong corporate governance while their businesses are scalable in the foreseeable future.

Letâs take a detailed look at the five selected multibaggers for 2019-year-to-date. The stock performance for each as on 13 September 2019, AEST 12:29 PM is given below.

PainChek Ltd

Business Overview- PainChek Ltd (ASX: PCK) is an Australia-based company, engaged in the development of pain assessment technologies. It offers the PainChek® smartphone medical device that utilises AI to assess and score pain levels in real time and then update medical records in the cloud.

Currently, PainChek® is being introduced worldwide in two phases. The first phase world target adults who are unable to clearly voice their pain, like people with dementia, and the second phase would target children, who are yet to learn speaking.

UK Market Update â On 5 September 2019, PainChek announced to have appointed Mr Pete Shergill to the role of Head of Business Development for UK-based wholly-owned subsidiary, PainChek UK Ltd, with his tenure commencing 30 September 2019. Mr Shergill, a qualified pharmacist (BPharm), brings a wealth of 20 yearsâ experience in the UK healthcare and software businesses.

Besides, the UK has as large as 700,000 people living with dementia, and the figure is expected to touch 850,000 by 2021, which would subsequently increase the demand for better dementia care within the aged care sector.

FY19 Results- For the year ended 30 June 2019, PainChek reported an outstanding increase of 550% in its revenue from ordinary activities to AUD 135,000, while net loss also increased to AUD 3.26 million, up 147%. During the year, the company executed a share placement of 21,724,138 shares to raise AUD 3.15 million and also received proceeds of AUD 1,059,500 via exercise of 47,300,000 options.

In August 2019, PainChek had announced the receipt of regulatory approval from Singaporeâs Health Sciences Authority (HSA) and a two-year licence agreement with leading Singapore aged care provider, Allium Healthcare Holdings Pte Ltd.

AVITA Medical

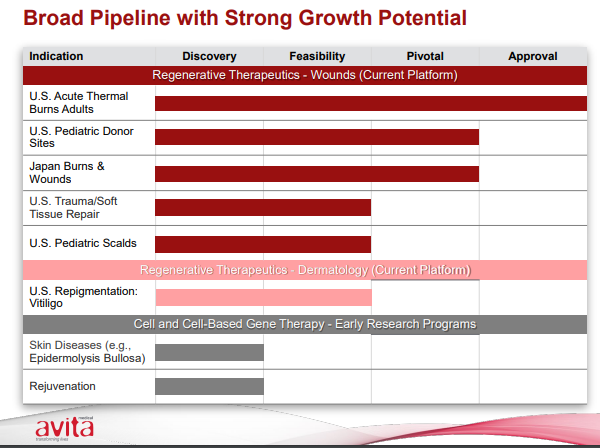

Business Overview- AVITA Medical (ASX: AVH) is a regenerative medicine company, commercialising its technology platform well positioned to address the unmet medical needs in burns, chronic wounds, and aesthetic indications. The companyâs first US product, the RECELL® System, was approved by the US Food and Drug Administration (FDA) in September 2018. Currently, it is registered under TGA in Australia, cleared by CFDA in China. Additionally, in Europe, it has a CE-mark approval.

Source: Corporate Presentation

Company Secretary Appointment â On 11 September 2019, AVITA Medical announced to have appointed Ms Tamara Barr, of Mertons Corporate Services Pty Ltd (Mertons) as the Joint Company Secretary of AVITA Medical Limited following the resignation of Ms Katherine Goland, of Mertons, from this position. Mr Mark Licciardo, also of Mertons, would continue to serve as the Joint Company Secretary of AVITA Medical Limited.

S&P DJI Sep 2019 Quarterly Rebalance â On 6 September 2019, AVITA Medical informed that the company would be added to the S&P/ASX 300 index. The addition would come into effect upon market open on 23 September 2019. As per the company, this demonstrates its increased market capitalisation and trading liquidity achieved during 2019 year-to-date alongside advancement of development and commercialisation activities concerning the regenerative medicine technology platform.

FY19 Results â For the year ended 30 June 2019, AVITA Medical reported an increase of 543% in its sales revenue to AUD 7.71 million from AUD 1.19 million in FY18, while loss for the period attributable to owners of the parent stood at AUD 34.60 million, up 109% from AUD 16.52 million in FY18. The cash balance at 30 June 2019 was AUD 28.98 million.

Andromeda Metals Limited

Business Overview- Andromeda Metals Limited (ASX:ADN) operates as a mineral mining and exploration company, focused on mineral exploration of gold and copper deposits in Australia. The companyâs project portfolio comprisesâ the flagship Poochera Halloysite-Kaolin Project, Drummond Gold Project, Pilbara Gold Project, Camel Lake Halloysite Project, Eyre Peninsula Gold Project and Moonta ISR Copper Project.

Drummond Gold Project JV Update â On 12 September 2019, Andromeda Metals announced that Evolution Mining Limited (ASX: EVN) had formally declared that having met the initial AUD 2.0 million expenditure commitment within the first year of a 2-year execution period under the Earn?In and Exploration Joint Venture Agreement dated 31 August 2018, it has elected to proceed with Stage 2.

As per the agreement, Andromeda Metals would be receiving AUD 200,000 cash from Evolution Mining in a span of ten business days of it notifying the company of its second stage election.

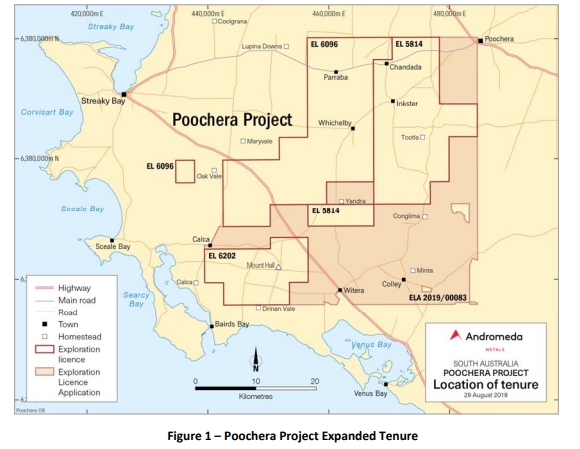

Poochera and Camel Lake Projectsâ Update â On 9 September 2019, the company informed that due to the significant market demand for halloysite?kaolin, a strategic decision was made with the JV partner Minotaur Operations Pty Ltd (agreement signed on 24 April 2018) to add known prospective areas into the existing JV project portfolio. Thus, Exploration Licence Applications (ELAs) have been lodged over the land adjacent to the JV tenements at both Poochera and Camel Lake. The company continues to advance planning for the commencement of exploration activities at Camel Lake with drillhole planning and engagement initiated with key stakeholders.

Additionally, the Poochera Halloysite?Kaolin Project Scoping Study is nearing completion with the results on track to be released before the end of the month.

Source: Companyâs announcement dated 9 Sep 2019

NetLinkz Limited

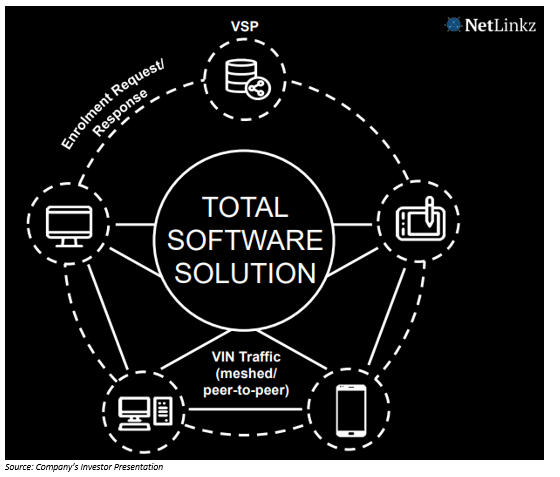

Business Overview- NetLinkz Limited (ASX: NET) offers secure and efficient cloud network solutions. Its technology caters to organisations of all sizes with the Fortune-500 security. The company also has a distribution agreement via reseller contract with China Telecom Wuxi selling its VIN and VSP technology.

FY19 Results - For the year ended 30 June 2019, NetLinkz reported a 340.5% increase in revenue from ordinary activities to AUD 555,000 and loss from ordinary activities after tax attributable to the owners amounted to AUD 18.5 million (up 25.05%).

Recently on 30 August 2019, the company informed the market that the China Software Industry Association had awarded the companyâs IoT Lab operated by iSoftStone in Beijing to be the most Innovative Cloud Service Platform. In addition, its next generation VIN product called VSN for the China market has won the coveted innovation award issued by the China Software Industry Association for Innovative Cloud Service Platform.

China Sales Update â On 12 August 2019, the company informed that JAST Limited - a distributor of NetLinkzâs products in China, had reached a partnership and agency sales agreement with the wholly owned subsidiary of Beijing Digital Telecom in the Henan Province, Henan D. Phone Trade Corporation Limited. Beijing Digital Telecom Co. Limited is one of Chinaâs largest and most successful telecom companies. Henan D. Phone will be offering an ongoing SAAS based subscription model generating monthly payments from its customers for the sale of Netlinkzâs VIN and VSP products.

PPK Group Limited

Business Overview- PPK Group Limited (ASX:PPK) designs, manufactures, distributes, supports and services CoalTram and other underground diesel vehicles, in addition to alternators, electrical equipment, and drilling and bolting equipment. The company is also engaged in the management of debt and equity investments. Recently on 11 September 2019, the company informed that its Annual General Meeting will be held at 2.30 pm on Tuesday, 26 November 2019.

Dividend Update- On 5 September 2019, the company announced an ordinary fully paid dividend of AUD 0.010 with a record date of 15 October 2019 and payment date of 20 November 2019 with respect to six monthsâ period ended 30 June 2019.

FY19 Results â For the year to 30 June 2019 (FY19), PPK Group reported a 17% increase in its revenue from ordinary activities to AUD 40.932 million and profit from ordinary activities after tax amounted to AUD 1.80 million, increasing by a stellar 215% over the prior year FY18. The net tangible asset backing per ordinary share was 34.74 cents.

Besides, PPK maintained a strong working capital position with current assets of AUD 21.747 million, of which AUD 11.496 million is highly liquid, and a net working capital position of AUD 13.235 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.