The Australian equity markets have experienced one of their worst phases in history with the ongoing turmoil created by the COVID-19 pandemic. While things have started getting better with improvement in investor sentiment and the ASX indices ending in the green zone, the impact has been severe. It will require a considerable amount of time for the economy to get back on track. The Australian market witnessed massive sell-off in March as investors were surrounded with fear of losing their hard-earned money.

However, despite the unfavourable environment and panic among market participants, some investors are always looking for opportunities to create wealth. They look for stocks that seem undervalued, i.e. stocks that have strong fundamentals and have dealt comfortably with the market fluctuations but are trading at levels deemed low-cost.

In this article, we will look at three ASX-listed companies that seem to be trading at relatively low prices despite robust fundamentals and positive outlook.

Do Read: Here are Must-Have Ingredients to Secret Sauce of Value Investors

Telstra Corporation Limited (ASX:TLS)

Telstra Corporation Limited is engaged in offering information and telecommunication services, which include internet, pay television and mobiles.

Operational and Financial Strength

The Company recently notified the market with its operational and financial performance for 1H FY20 and outlined the following:

- Total income and NPAT for the period stood at $13.4 billion and $1.2 billion on a reported basis, reflecting a decline of 2.8% and 6.4%, respectively. These results indicate that the T22 strategy of TLS has helped in creating value and putting the Company in a favourable financial position during the period.

- The multi-brand strategy of the Company has continued to provide a rise in customer numbers, mainly in the mobile business. The Company managed to add 135,000 retail prepaid mobile services, 173,000 pre and postpaid and IoT Wholesale services and 137,000 retail postpaid mobile services, which include 91,000 from Belong during the period.

Response to COVID-19: TLS has undertaken numerous measures as part of its contribution to the national economic stimulus response to COVID-19. These measures mainly include (1) Hold on further job reduction, (2) Recruitment of an additional 1,000 temporary contractors.

To further strengthen the balance sheet, the Company has priced a €500 million bond issue, and it would use proceeds from the issuance of bond for general corporate purposes.

On 20 March 2020, TLS highlighted that in the current scenario, the outlook of the Company stays in the FY20 guidance range. However, the outlook is the lower end of the range.

Also Read: Is Telstra building a War Chest?.

The S&P had reiterated its A- (stable) rating on 01 April 2020, and Moody’s reconfirmed the Company’s A2 (stable) rating on 02 April 2020. The continual access to low-cost capital as well as A-band credit rating of TLS reflects business strength in the current uncertain time.

TLS stock was trading at $3.060 on 24 April 2020 (at 03:43 PM AEST), an increase of 1.325% compared to the previous close. The market cap of the Company is $35.92 billion, and TLS has ~11.89 billion outstanding shares. Telstra’s one-month and three-month returns are -2.27% and -21.91%, respectively.

BHP Group Limited (ASX:BHP)

BHP Group Limited is a well-known mining giant which is engaged in the production, exploration, and processing of minerals.

Financial Performance for Nine Months to 31 March 2020

- The Company is in a strong financial position supported by its low-cost operations. BHP anticipates that its business will continue to generate steady cash flow.

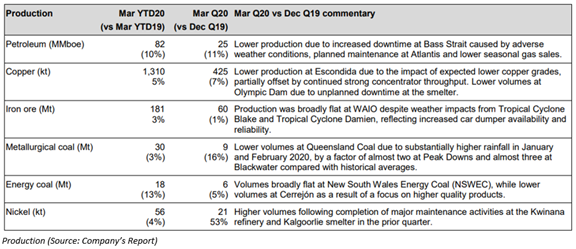

- Solid underlying operational performance throughout the portfolio counterbalanced the effects of natural field decline, scheduled maintenance, as well as Australia’s wet weather.

- BHP reported petroleum production of 25 mmboe for Q3 FY20, reflecting a reduction of 11% because of expanded downtime at the Bass Strait as a result of planned maintenance at Atlantis, lower seasonal gas sales and unfavourable weather conditions.

The Company had six significant projects with a budget of US$11.4 billion under development in petroleum, copper, iron ore and potash. BHP’s projects in petroleum and iron ore are working as per its plan and are subject to impacts from COVID-19 pandemic.

Steps in Response to COVID-19

BHP has had limited COVID-19 cases in its workforce across the globe. The Company has taken the following measures in response to the pandemic:

- The Company has undertaken measures including a decreasing number of people at mine sites and other operational facilities.

- BHP has changed rosters to limit workforce movements.

On the outlook front, the Company anticipates steel production ex-China might go down by a substantial percentage during CY20. For 2020, it expects total petroleum production in the range of 110 MMboe and 116 MMboe.

On 21 April 2020, BHP confirmed that its FY 2020 production guidance stays the same except for nickel (lowered from ~87kt to the range 80-83 kt).

BHP stock was trading at $30.390 on 24 April 2020 (at 03:43 PM AEST), an increase of 2.151% compared to the previous close. The market cap of the Company is $87.64 billion, and BHP has ~2.95 billion outstanding shares. BHP’s one-month and three-month returns are 10.06% and -27.58%, respectively.

Woolworths Group Limited (ASX:WOW)

Woolworths Group Limited is involved in food, general merchandise, and specialty retailing through chain store operations.

Impact of COVID-19: As of now, the Company is not capable of assessing the effects of COVID-19 on its FY20 results considering the changes to customer shopping patterns, closure of the Hotels business for an extended period and uncertainty associated with current sales performance.

The Board of the Company has decided to postpone the split of Endeavour Group from WOW till CY21. The Company has taken this decision by considering the directive from the Government to close Hotels for a prolonged period and the prevailing market conditions.

Strong Balance Sheet Supports Future Growth

During 1H FY20, WOW reported sales and normalised NPAT from continuing operations stood at $32,410 million and $979 million, reflecting a rise of 6% and 15.7%, respectively.

- The Company paid an interim dividend amounting to 46 cents per share with an increase of 2.2% on 9 April 2020.

- WOW closed the half-year with a net debt position of $1,543 million, which was consistent with the financial year-end. This was due to positive impacts of working capital balanced by the payment timings before H20 end affecting trade payables.

- Woolworths possesses a robust balance sheet, with access to funding as well as liquidity. WOW is also backed by its lenders, with substantial headroom in lending covenants and available facilities.

Do Read: Woolworths’ Plan for Food and Grocery Deliveries

WOW stock was trading at $36.020 on 24 April 2020 (at 03:43 PM AEST), a decline of 0.304% compared to the previous close. The market cap of the Company is $45.64 billion, and Woolworths has ~1.26 billion outstanding shares. WOW’s one-month and three-month returns are -0.88% and -11.75%, respectively.