The benchmark Australian Index S&P/ASX 200 is at 6,652.30, up by 33.40 points or 0.50% (as on 01 July 2019, 1: 20 PM AEST). In this article, we would discuss three stocks from the Industrial sector â Cardno Limited (ASX: CDD), Transurban Group (ASX:TCL) and Downer EDI Limited (ASX: DOW), two of these stocks TCL & DOW constitutes to the S&P/ASX 200. Looking at the performance of Industrial Sector from S&P/ASX 200 in Australia, the index is up by 14.81% over the past one year, and its year-to-date performance is +19.04% - as of 28 June 2019.

One Year Performance of S&P/ASX 200 Industrials (Source: S&P Website)

Cardno Limited (ASX: CDD)

Cardno Limited (ASX:CDD) plies for trade in professional infrastructure & environmental services. It delivers specialist expert services to develop and improve physical & social infrastructure for communities around the world.

On 28 June 2019, Cardno Limited reported an update related to the FY19 guidance. In conjunction with the announcement, it was announced that the guidance is consistent with previous guidance where expected underlying EBITDA (FY19) was estimated to be ~A$60 million. Furthermore, the company has been recording encouraging financial results predominantly from the Americas, Construction Sciences and International Development divisions along with newly acquired Raba Kistner and TGM during 1H FY19. Importantly, the escalated results helped to offset the underperforming financial results in the Asia Pacific division compared with prior years.

In addition, Cardno Limited expects to include an impairment charge of ~ A$ 48 million for the year ended 30 June 2019; this impairment charge relates to the carrying value of the domestic Asia Pacific divisionâs intangible assets, predominantly goodwill.

In February 2019, the company reported half-year results for the 31 December 2018. According to the release, the underlying EBITDA of $27.9 million down by 7.6% in H1 2019 compared to $30.2 million in H1 2018; this was due to the challenges in Asia Pacific and investments in international development. Also, American Engineering division performed well with 11.7% growth in revenue against the previous corresponding period; additionally, the divisionâs EBITDA also grew from 3.6% to 4.5%. In addition, the Asia Pacific revenues were down by 1.5% compared with the previous corresponding period, and EBITDA margin contracted from 9.1% to 5.9%; this had been impacted by the roll off of a number of major projects in 1Q18 along investments to ramp up business development. Furthermore, the Net Profit After Tax was at $7.7 million in H1 2019 up by 135.2% compared with a loss of $21.9 million in H1 2018; H1 2019âS net profit after tax also included acquisition cost of $2.8 million, write off on existing borrowing cost on debt finances of $0.5 million and $0.6 million of tax effect of underlying adjustments.

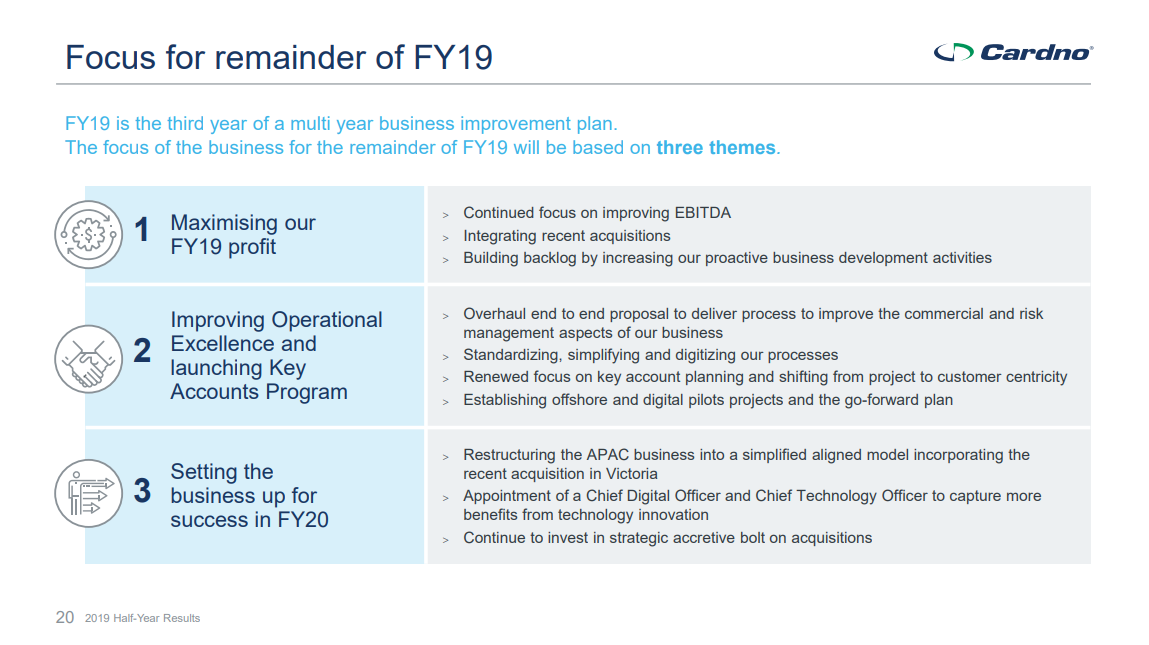

FY19âs Focus (2019 Half Year Presentation, February 2019)

FY19âs Focus (2019 Half Year Presentation, February 2019)

In December 2018, the company reported the completion of the acquisition of Texas-based Raba Kistner Inc, which employees ~470 people and provides specialised engineering services in Construction Materials Testing, Geotechnical Engineering Consulting, Project Management etc. Further, the consideration included an upfront purchase price of US$42.5 million along with performance-linked payment over the next three years for $12.5 million.

On 01 July 2019, CDDâs stock was trading at A$0.930, down by 1.587% (at AEST 12: 49 PM). The performance of the stock in the past one year is -27.86% and its year-to-date return is -5.50%. In the past three months and one month, the return of the stock is -12.50% and 2.16%, respectively.

Transurban Group (ASX: TCL)

Transurban Group (ASX:TCL) is a toll operator in Australia, and the company also develops innovative tolling & transport technology to support transportation.

On 27 June 2019, Transurban announced that Transurban Finance Company Pty Limited â finance vehicle of Transurban Group had priced the $350 million private placement of the senior secured 15-year notes through the companyâs Euro Medium Term Note Programme.

In accordance with the release, the pricing of the notes was concluded on 26 June 2018, and the expected settlement would be by 03 July 2019, subject to customary closing conditions. Also, the proceeds from the transaction would be swapped with fixed rate AUDs and would be utilised for the general business to fund the development pipeline. Furthermore, the notes would be ranked equally with the existing senior secured debt with maturity in July 2034.

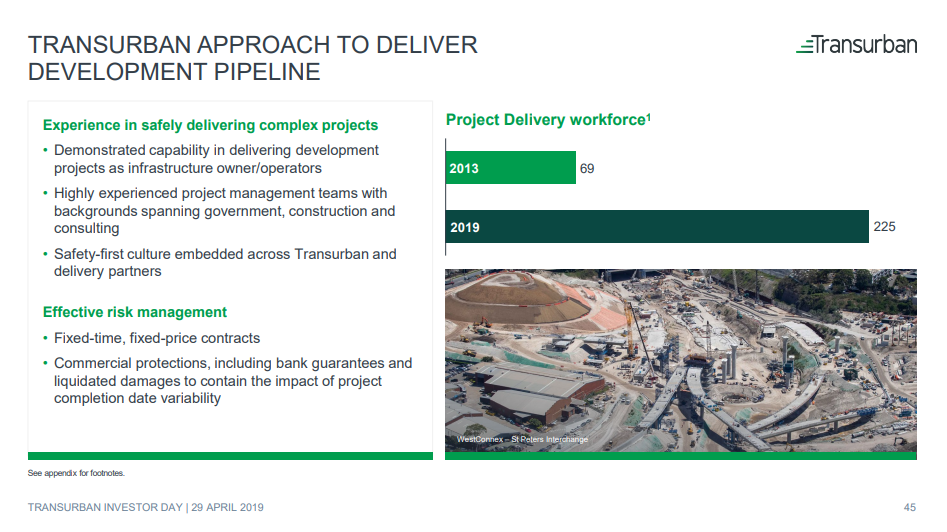

Approach for Development Pipeline (Source: Investor Day Presentation, April 2019)

Approach for Development Pipeline (Source: Investor Day Presentation, April 2019)

On 21 May 2019, the company announced a dividend of 30 cents per stapled security for the six months ending 30 June 2019; this dividend equates to the 28 cents contribution from the Transurban Holding Trust and controlled entities and 2 cents fully-franked dividend from Transurban Holdings Limited and controlled entities. Concurrently, the recent dividend distribution takes the FY19 total distribution to 59 cents, which includes 3 cents fully franked component.

It was also reported that the tax-deferred component would be confirmed in Tax Statements to be issued with the final distribution in August 2019. Also, the Distribution Reinvestment Plan (DRP) is being offered for the distribution for six months ending 30 June 2019, and no discount would be applied. Further, the Board also determined the DRP pricing period, which is 10 days starting from 4 July 2019. According to the release, Ex-Date was 27 June 2019, Record Date is 28 June 2019 and Payment, and DRP allotment is scheduled on 9 August 2019.

On 10 May 2019, the company had priced â¬600 million of senior secured 10-year notes under its Euro Medium Term Note Programme through the companyâs financing vehicle Transurban Finance Company Pty Limited. In accordance with the release, this tranche of the notes had been priced on 9 May 2019, and the proceeds from the bonds would be utilised in refinancing the existing bank facility, funding for the development pipeline and general corporate purpose. In addition, the notes were ranked consistently with the other senior secured debt facilities, and these notes would mature in May 2029.

On 01 July 2019, TCLâs stock was trading at A$14.750, up by 0.068% (at AEST 1:00 PM). The performance of the stock in the past one year is +25.20%, and its year-to-date return is +27.62%. In the past three months and one month, the return of the stock is +11.58% and +5.66%, respectively.

Downer EDI Limited (ASX: DOW)

Downer EDI Limited (ASX: DOW) is a constituent of the Australian benchmark index S&P/ASX 200. The company also owns 88% interest in the ASX-listed Spotless Group Holdings Limited (ASX: SPO).

On 17 June 2019, Downer EDI Limited & Works Finance (NZ) Limited provided updates on the terms of ROADS preference shares. Accordingly, it was reported that the dividend rate on ROADS (Redeemable Optionally Adjustable Distributing Securities) preference shares for the period 15 June 2019 to 15 June 2020 (next reset date) is 5.49% per annum payable quarterly in arrears. Furthermore, the dividend rate equates to a one-year swap rate of 1.44% per annum along with Step-up margin of 4.05% per annum on 17 June 2019. Downer EDI expects that the dividends would continue to be fully imputed.

On 11 June 2019, the company released a Presentation- Downer Group site tour, which briefly touched on the Road services and Rolling Stock service of Downer EDI. Below is a description of those services from the presentation:

Road Services: Downer EDIâs road business offers a strong vertically integrated supply chain to customers; the business caters to state & local governments, waste businesses, miners, airports, toll and other road owners. It intends to provide value proposition through an efficient and predictable journey, environmental sustainability, putting the road user first and enabling for economic prosperity.

Some of its highlights and services from the business includes Detritus Processing Facility in Sydney and Green Vision recycling in Auckland, which is owned, managed and operated by Downer EDI, and it also manages 58,000 kilometres of the road network in Australia & New Zealand. In addition, the road business also produces 3.1 million tonnes of asphalt per annum and provides specialist asphalt surfacing to most of the Australian racetracks of international standard.

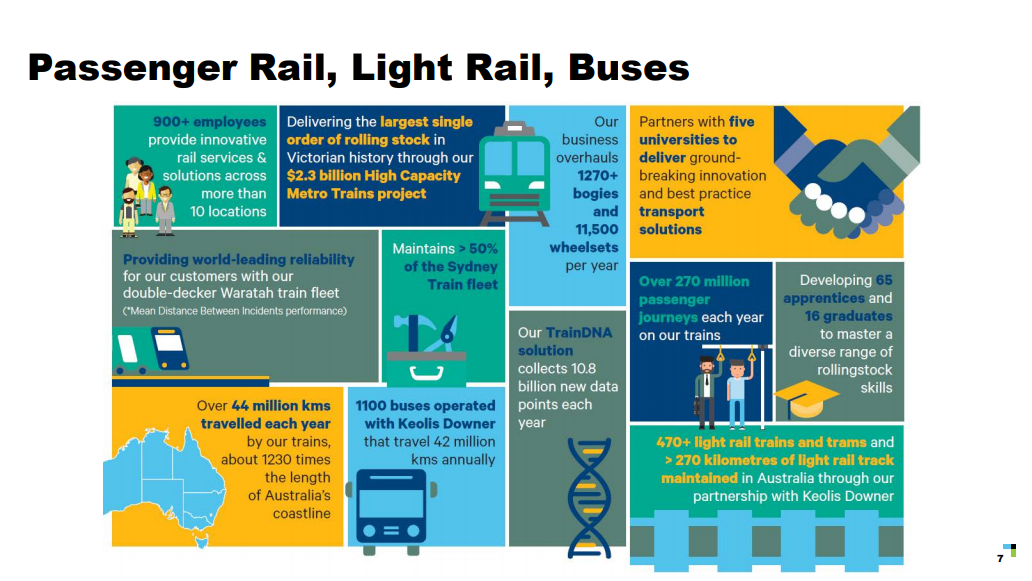

Rolling Stock Services: The companyâs passenger rolling stock services provide a significant and growing base of long term, high-margin asset management contracts; this is also underpinned by the relationship with the worldâs largest rolling stock manufacturer in CRRC. According to the presentation, the business caters to the need of NSW Government, Victorian Government and WA Government through 624 Waratah Rail Cars (NSW), 455 HCMT Rail Cars (VIC), 179 A/B Class Rail Cars (WA) and more.

Also, in project management services, Downer EDI provides project management services for the design, construction and commissioning of passenger rolling stock. Further, it also designs and constructs rolling stock related depots and facilities used for rail and light rail operations. Under its Asset Management services, Downer is Australiaâs largest rolling stock asset manager providing maintenance and overhaul services (Through Life Support) to network operators with over 1,945 rail cars under long term management.

Overview of Service & Highlights (Source: Companyâs Presentation, June 2019)

Overview of Service & Highlights (Source: Companyâs Presentation, June 2019)

On 01 July 2019, DOWâs stock was trading at A$7.040, down by 1.734 from the previous close. In the past one year, the return of the stock is +1.62%, and its year-to-date return is +3.59%. The performance of the stock in the past three months and one month is -11.17% and -12.18%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.