Companies that make profits either reinvest that amount in business expansion or pay part of the profit to the shareholders as a reward. This payment to the company shareholders is known as dividend. Dividend stocks are generally popular among investors, as they provide regular cash streams to them. Moreover, investors consider them as less risky investments, as they are relatively less volatile.

There are three key dates that the holders of dividend need to know - ex-dividend date, record date and payment date.

Record date: When a company announces a dividend, it sets a record date, requiring the dividend holder to be on the companyâs books as a shareholder on that date to be entitled to the dividend.

Ex dividend date: The ex-dividend date for stocks generally precedes the record date. If an investor purchases a stock on its ex-dividend date or after that date, he/she is not entitled to get the next dividend payment. However, if an investor buys a stock before the ex-dividend date, he/she receives the dividend.

Also, price of the stock declines by that amount (dividend amount) on the ex dividend date.

Payment date: It is the date on which the dividend holder receives the dividend.

Recently on 3 September 2019, three ASX-listed companies â Woolworths Group Limited, Altium Limited and Downer EDI Limited went ex-dividend. Let us have a look at the related dividend announcement, in addition to other recent updates by these three diversified sector players.

Woolworths Group Limited

ANZ-focused, Woolworths Group Limited (ASX:WOW), engaged in the management of the most trusted and well-known brands, announced a fully franked dividend of AUD 0.570 on 29 August 2019. The dividend on ordinary fully paid shares of the company is being paid for the six-month period to 30 June 2019. It has ex-dividend date of 3 September 2019, record date of 4 September 2019 and payment date of 30 September 2019.

With a market cap of AUD 46.21 billion and approx. 1.26 billion outstanding shares, the stock of WOW was trading at a price of AUD 36.450 on 4 September 2019 (AEST 01:32 PM), down 0.708% from its previous close. The stock has delivered positive returns of 3.15%, 17.74% and 25.42% in the last one month, three months and six months, respectively.

On 3 September 2019, the company announced that Woolworths Group CEO Brad Banducci sold 130,000 shares to support funding of anticipated tax payments arising from share rights vesting as part of his compensation. Mr Banducci now holds 195,808 shares, which still surpasses the minimum shareholding requirements set by the company for owning its shares.

FY19 Highlights

For FY19 ended 30 June 2019, the company reported sales from continuing operations of AUD 59.98 million, representing an increase of 5.3% from AUD 56.94 million recorded during the same period a year ago. Moreover, WOW registered a 5.0% and 7.2% increase in EBIT and net profit after tax to AUD 2.72 million and AUD 1.75 million in FY19, respectively. The companyâs basic earnings per share grew by 8.8% year-on-year to 134.2 cents, while full year dividend went up by 9.7% to 102 cents per share over the prior corresponding period.

FY19 Key Financial Metrics (Source: Companyâs Report)

During the reported year, Woolworths Group registered good progress on its transformation across all of its businesses. Particularly in the second half of FY19, WOW reported a stronger trading performance.

Over the last 12 months to June 2019, the company completed or started several landmark transactions. WOW is expecting to witness some pressures from the uncertain consumer environment and input costs on retailers and suppliers, in addition to impacts from new enterprise agreements, during FY20. However, WOW is well-placed to address all these challenges and deliver value for both customers and shareholders during the financial year 2020.

Altium Limited

Established in 1985, Altium Limited (ASX:ALU), a California-headquartered electronic design software company, had updated the market regarding a dividend distribution for the period of six months to 30 June 2019, on 19 August 2019. The unfranked dividend of AUD 0.180 is scheduled for payment on 25 September 2019 (Ex Date: 3 September 2019 and Record Date: 4 September 2019).

On 4 September 2019 (AEST 01:52 PM), the stock of ALU was trading at a price of AUD 36.500, down 0.896% or AUD 0.330 from its previous closing price. Altium Limited has a market cap of AUD 4.82 billion, ~ 130.97 million outstanding shares and an annual dividend yield of 0.92%. The stock has delivered positive returns of 10.10%, 20.67% and 10.53% in the last one month, three months and six months, respectively.

FY19 Highlights

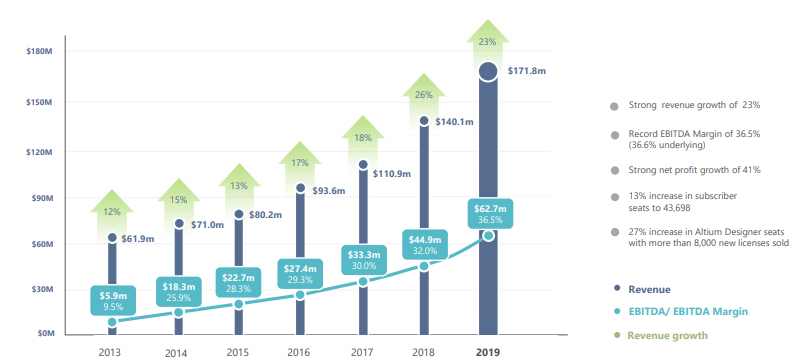

For all the business segments and regions in which the company operates, it reported outstanding results during the full year ended 30 June 2019 (FY19). ALU posted an increase of 23% in revenue to USD 171.8 million and a 40% rise in EBITDA to USD 62.72 million, while earnings per share grew by 41% to 40.57 cents and EBITDA margin went up from 32.0% to 36.5% during FY19. Additionally, the companyâs subscription base registered record growth of 13%, growing to more than 43,600 subscribers. Also, new Altium Designer seats increased by 27%. Moreover, ALUâs operating cash flow went up by 42% to USD 69.1 million.

FY19 Financial Highlights (Source: Companyâs Report)

In China, the companyâs business reported a 37% revenue growth, while in the US and EMEA, revenue grew by 14% and 20%, respectively.

With such results, ALU is expecting to exceed its revenue target of USD 200 million in 2020, as well as register a higher EBITDA margin floor of 37% and achieve the halfway mark of 50,000 subscribers as early as 2020. Additionally, the company aims to have an Altium Designer subscriber base of 100,000 subscribers before 2025 to dominate the market and achieve it revenue goal of USD 500 million in 2025.

Downer EDI Limited

ANZ-focused integrated services provider, Downer EDI Limited (ASX:DOW), on 22 August 2019, had announced a dividend of AUD 0.140 (Ex Date: 3 September 2019, Record Date: 4 September 2019 and Payment Date: 2 October 2019). The dividend on the companyâs ordinary fully paid securities is related to a period of six months to 30 June 2019.

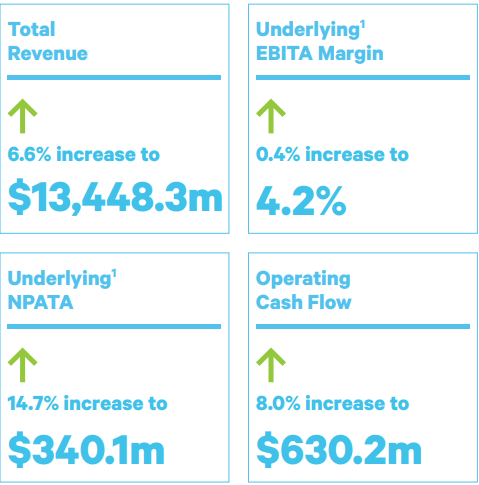

The dividend was announced as the company released its full-year results for FY19, reporting a 6.5% year-on-year increase in total revenue to AUD 12.81 billion. DOW registered an increase of 266.7% in profit after tax to AUD 261.8 million, compared with AUD 71.4 million in the same period a year ago.

FY19 Highlights (Source: Companyâs Report)

The stock of DOW was trading at a price of AUD 7.390 on 4 September 2019 (AEST 02:31 PM), down 1.335% from its previous close. It has a market cap of AUD 4.45 billion and around 594.7 million outstanding shares. The stock has delivered positive returns of 2.12%, 12.10% and 2.40% in the last one month, three months and six months, respectively.

CS Energy Contract

On 23 August 2019, Downer EDI announced to have been picked by CS Energy as the preferred contractor for its Callide B and C and Kogan Creek power stations. Under the five-year deal, Downer will be responsible of providing overhaul and capital works services at the facilities.

The company would be engaged in the planning and execution of major overhauls, in addition to related engineering and asset management activities. Moreover, it would handle major projects and engineering work to aid the asset strategy of CS Energy. The scope of work also includes partnering on CS Energyâs maintenance and sustaining capital strategy, with an aim to enhance asset performance efficiency and reliability. This collaboration would also result in the management and prediction of costs across the asset lifespan.

Downer EDI is expecting to sign the new contract in early September 2019, when it would also become effective, though this would be subject to the finalisation and execution of the asset management agreement.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.