Trading Halt:

Trading halt is the temporary suspension of trading of a particular stock on the exchange where it is listed. Generally, companies announce trading halt for their stocks due to the below mentioned reasons:

- Shares of the company are under trading halt, pending an announcement from the company. This announcement may have the potential to impact share prices significantly. Trading halt for this reason occurs for a shorter duration.

- In case of regulatory issues like initiation of investigation of the company by a government department.

- Imbalance in the quantity of buy or sell for a particular stock in the market.

- The shares also go under trading halt because of non-compliance of the listing requirements of the exchange. It comprises of filing of financial results for each and every reporting period, payment of listing fee, etc.

Fact About Trading Halt:

Companies which are supposed to release a sensitive announcement generally wait for the market to close. It is because these companies want to give their investors the time to find out whether the released announcement will significantly affect their investment rationale or not. In such a case, the exchange could delay the opening of trade in these stocks or set a trading halt at market open.

In this article, we would be discussing two stocks which were under trading halt on 23 September 2019 and find out the reasons for the same.

HotCopper Holdings Limited

HotCopper Holdings Limited (ASX: HOT), is the largest stock trading and investment internet discussion forum in Australia, and it has more than 250,000 registered members. The company releases a range of topics regarding listed companies, IPOs, etc and provides a platform where investors can provide their insights on these topics free of cost.

Recent Update:

Trading Halt

On 23 September 2019, the shares of HotCopper Holdings Limited were placed under the trading halt, pending an announcement from the company related to a proposed acquisition. The shares of HOT would remain under the trading halt until it releases the announcement or before the start of the normal trading day on 25 September 2019, whichever is earlier.

Stock Information:

In the last one month, the shares of HOT have given a return of 6.25%. The shares have traded last on 6 September 2019 at a price of A$0.170. HOT has a market capitalization of A$18.19 million, approximately 106.99 million outstanding shares and a PE ratio of 68.00X.

Superloop Limited

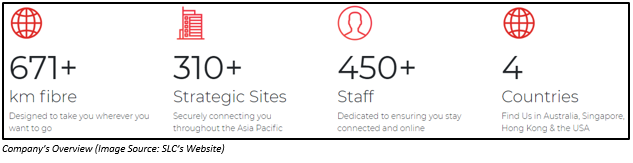

Superloop Limited (ASX:SLC) is the provider of connectivity services for designing, constructing as well as operating networks across the APAC zone.

Recent Update:

Trading halt:

On 23 September 2019, the shares of SLC were placed under the trading halt, awaiting an announcement related to the result of the institutional component of the accelerated entitlement offer.

Equity Raising:

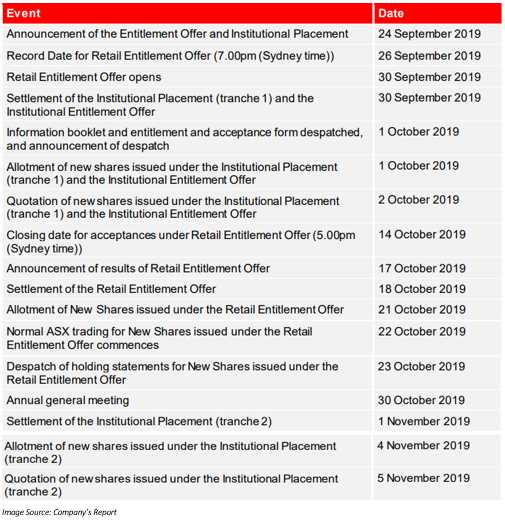

On 24 September 2019, the company released an announcement related to placement and the entitlement offer.

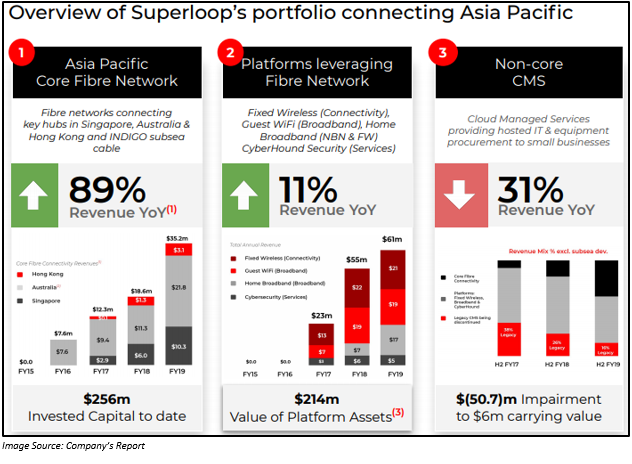

The company intends to raise $90 million at a price of $0.82 per share and would also restructure its existing senior debt facility. The revised and extended senior bank facility with ANZ and Westpac is for a duration of 4 years and has a limit of $61.7 million. The financial covenants were adjusted to indicate infrastructure nature of the proposed usage, including Pro-forma EBITDA from deals entered into by the company.

The capital raising would take place through a fully underwritten two-tranche Institutional Placement worth $55 million. The company would also be raising $35 million via fully underwritten 1 for 6 accelerated non-renounceable Entitlement Offer.

The fully underwritten Institutional Placement as well as the Entitlement Offer would be effected at an offer price of $0.82 per share. This represents a discount of 18.8% to the closing price of the shares on 20 September 2019.

The funds generated through the Equity Raising would be used for repaying the senior secured debt. The proceeds would help in reducing the pro-forma 30 June 2019 net debt along with the net payables from $93.5 million to $7.5 million. It would also support in providing approximately $60 million funding runway for future success-based growth capital.

Commenting on the capital raising, the chairman of Superloop stated that the company has invested more than $256 million in fibre network assets. It is also progressing towards monetizing the value of these assets. He also stated that the support provided by the senior lenders were invaluable and it is important for the company to restructure those facilities which would help the company to access funding on suitable terms and conditions. This will help the company to support its monetization strategy.

Canaccord Genuity (Australia) Limited and Morgans Corporate Limited are joint lead managers as well as the underwriters to the equity raising.

Institutional Entitlement Offer:

Under the Institutional Entitlement Offer, the qualified Institutional shareholders would be invited to participate in the offer. These shareholders have the option to opt for all, part or none of their entitlements. In case, the qualified shareholders do not take up the offer by the end of the Institutional Entitlement Offer period, it would be made available to the unqualified institutional shareholders and would be sold through an institutional shortfall bookbuild on 25 September 2019.

Retail Entitlement Offer:

Under the Retail Entitlement Offer, the eligible retail shareholders in Australia and New Zealand would be encouraged to take part in the offer at the same price and offer ratio as that of Institutional Entitlement Offer.

Stock Information:

The shares of SLC have given a negative return of 28.37% in the last six months. By AEST 2:39 PM on 24 September 2019, the shares continue to remain on a trading halt. The shares traded last on 20 September 2019 at a price of A$1.010. SLC has a market cap of 255.83 million and approximately 253.3 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.