At the time of writing on 7th November 2019 (AEST 12:56 PM), the benchmark index S&P/ASX 200 was trading at 6,698.1 points, up 0.57% or 37.9 points over its previous close. Two ASX listed companies, Cedar Woods Properties and Costa Group Holdings recently made significant announcements. In the article below, we will be digging deeper into both the companies:

Cedar Woods Properties Limited (ASX: CWP)

Cedar Woods Properties Limited (ASX: CWP) is into investment and development of properties. The market capitalisation of the company stood at $565.55 million as on 6th November 2019.

Chairmanâs Address to Shareholders

The company conducted its Annual General Meeting for financial year 2019 on 6th November, wherein, William Hames, the Chairman of the company addressed the shareholders of Cedar. The Chairman outlined on the following:

- The Chairman commenced his address by providing a review of performance of FY19 and added that revenue in FY19 experienced a surge of 56%, which indicates a rise in sales as well as, an increasing contribution from built form projects including office developments.

- The company recorded a rise of 14% over last year in net profit after tax, which amounted to $48.6 million.

- Moreover, the companyâs key metrics such as earnings per share stood at 60.9 cents with a rise of 13% over the prior year and return on equity clocked 12.9%.

- The companyâs strategy revolves around growing its national portfolio, which is diversified by geography, product types as well as price points so that it continues to hold broad customer appeal.

- The Chairman also commented that in accordance with the strategy of the company, it possesses presence in Western Australia (WA), Queensland (QLD), Victoria (VIC) as well as South Australia (SA), with an increasing number of well-located projects in each state.

Rise of 9% in Pre-Sales

- Cedar through a release dated 4th November 2019 intimated the market about a robust performance in the first quarter of financial year 2020, which was primarily fuelled by sales throughout the portfolio and significant progress across numerous key projects.

- For Q1 FY20, the company reported pre-sales amounting to $409 million, reflecting a rise of 9% on the pre-sales of $376 million, which was reported in Q1 FY19.

- It was mentioned in the release that around two thirds (2/3) of presales are anticipated to settle in FY20 with the balance one third to materialize in FY21.

- The construction of the project is continuing in all four states where the company has its operations along with significant milestones anticipated to be delivered as well as settled across the year.

- The company possesses a strong balance sheet, low debt, as well as availability of substantial undrawn finance facilities in order to finance its operations and acquisitions.

- The company further added that due to challenging market conditions, it expects lower earnings in financial year 2020.

The stock of CWP was trading at a price of $7.190 per share on 7th November 2019 (AEST 12:59 PM), with a rise of 1.125% against its previous closing price. The total outstanding shares of Cedar Woods Properties Limited stood at 80.45 million. The stock of the company has generated a return of 11.97% and 25.18% in the time period of three months and six months, respectively. However, on a YTD basis, the stock witnessed a surge of 45.10%.

Costa Group Holdings Limited (ASX: CGC)

CGC is primarily involved in the production of various fruits and vegetables in Australia. The companyâs focus is on mushrooms, berries, glasshouse grown tomatoes, citrus, avocados, etc.

A Brief on Renounceable Entitlement Offer

- With respect to its announcement on 28th October 2019 regarding a fully underwritten pro rata entitlement offer of new ordinary shares in the company to raise an amount of around $176 million at the offer price of $2.20/ new share.

- The company also added that the entitlement offer comprises âInstitutional Entitlement Offerâ and Retail Entitlement Offer.

- When it comes to use of proceeds from entitlement offer, the company will be utilizing the proceeds towards strengthening the balance sheet of the company as well as to ensure that CGC has an appropriate capital structure in place to continue its growth strategy considering recent trading and market conditions.

- In another update, the company announced that it has successfully wrapped up its institutional entitlement offer, part of Renounceable Entitlement Offer by raising an amount of around $87 million.

- CGC added that eligible institutional shareholders have strongly provided their support and taken up around 88% of their Entitlements.

- However, the Institutional Shortfall Bookbuild clearing price of $2.30 per new share demonstrates a premium of $0.10 to the offer price of $2.20 per new share.

- Turning to another part of entitlement offer, i.e. retail entitlement offer, which has opened on 6th November 2019 and is anticipated to raise around $90 million, would be closing on 18th November 2019.

- Retail entitlement offer provides opportunity to subscribe for one new share for every four currently held shares in consideration of the offer price of $2.20 per new share.

CY20 Outlook

- The company stated that the financial performance of its produce categories as well as international segment are anticipated to improve in CY20, underpinned by recent and continuing investment in the business, operational initiatives and more normalized market conditions;

- The management of the company is focused towards neutralizing unusual circumstances. Subject to receiving adequate rainfall in its operating regions, for a return to more balanced portfolio performance from CY20, the company is focused to ensure that it is well placed;

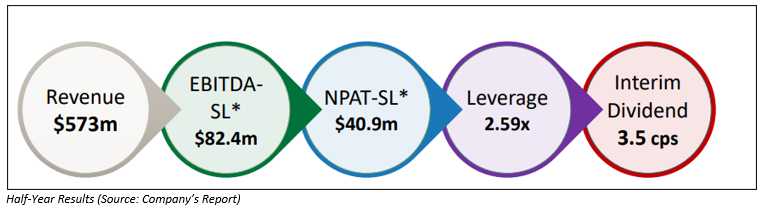

- The following picture provides an idea of results for the half-year ended 30th June 2019:

The stock of CGC was trading at a price of $2.790 per share on 7th November 2019 (AEST 12:59 PM), up 1.455% from its previous closing price. The market capitalisation of CGC stood at $881.73 million. The total outstanding shares stood at 320.63 million, while the stock has generated a return of -20.91% and -44.56% in the time period of three months and six months, respectively. Moreover, on a YTD basis, the stock witnessed a decline of 58.69%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.