As per a study by KPMG Australia, there has been an increase in the Australian fintechâs by ~ 8% and around 629 fintech companies are active in Australia. Fintech or Financial technology is a new technology. This technology aims to automate and improve the application of financial services. Financial technology helps the companies, business owners, as well as the customers in managing financial operations and processes.

During April 2019, as per one of the releases by ASIC, a market survey supported via ASICâs Innovation Hub shows that fintech businesses would be seeing growth in the demand as an alternative source of funding. The innovation hub of ASIC gives practical support to the start-up companies as well as scale-ups as they pass through the financial regulatory system of Australia. ASIC is committed to provide informal support to financial technology companies related to their regulatory obligations.

Australian fintech companies have started making their mark on a global scale. As per the recent media release of KPMG, it was highlighted that there were seven Australian fintech companies that were represented in Fintech 100. Fintech Innovators, which is a collaboration between fintech investment firm H2 Ventures as well as KPMG Fintech, made this announcement and highlighted seven Australian fintech companies which rank amongst the leading players across the world. Three such companies are:

Airwallex is ranked 32nd, Judo Bank ranked at 33rd position and Afterpay Touch is at 47th position.

The government in Australia also sees the potential in the fintech sector and has plans to give a thrust to this sector to improve export.

In this article, we would try to know about four ASX listed financial technology companies and cover their recent developments.

Zip Co Limited (ASX: Z1P)

On 7 November 2019, Zip Co Limited (ASX: Z1P), a leading player in the digital retail finance and payments industry announced that it had signed a strategic agreement with Amazon Commercial Services Pty Limited (Amazon) under which ZIP Co would be available as the payment option to the customers who purchase through Amazon.com.au. The deal sees Z1P as Amazonâs 1st Australian instalment payment choice.

The companyâs relationship with Amazon would help Z1P to deliver on its strategic vision to provide its customers with ease and an option to pay for daily need goods. At the same time, the relationship would support in growing the network of acceptance for 1.5 million digital customers of the company.

On the other hand, as per the strategic agreement, Z1P would be issuing warrants to an affiliate of Amazon to acquire to a maximum of 14,615,000 ordinary shares (Warrants). Each Warrant can be exercised at a price equivalent to the volume weighted average closing price of the shares of the company on Australian Stock Exchange for the 20 trading days earlier to 31 October 2019, which was $4.70.

EML Payments Limited (ASX: EML)

On 26 November 2019, EML Payments Limited (ASX: EML), an ASX listed financial services company that specialises in prepaid stored value product announced the appointment of Sonya Tissera â Isaacs, (AGIA, ACIS) as Company Secretary.

Sonya Tissera has immense experience in corporate governance and company administration for listed as well as unlisted companies. Mrs Tissera, along with Mr Paul Wenk, Company Secretary and Group General Counsel, will together perform as Joint Secretaries.

Recently, on 11 November 2019, EML announced the acquisition of Prepaid Financial Services (Ireland) Limited for an upfront enterprise value of £226 million (A$423 million) along with an earn-out component to a maximum of £55 million (A$103 million) and capital raising.

On 13 November 2019, EML payments released the AGM presentation. To know details, click here.

Afterpay Touch Group Limited (ASX: APT)

On 25 November 2019, Afterpay Touch Group Limited (ASX:APT), a tech-driven payment company announced that the final copy of Audit report is being received and provided to AUSTRAC as per the notice.

Recently, on 13 November 2019, Afterpay released its company information for the period ended October 31, 2019. APTâs underlying sales for 4 months period ended 31 October 2019 increased by 110% to $2.7 billion. Active customers and merchants increased by 137% to 6.1 million and 96% to 39,450 respectively as compared to the previous corresponding period.

FlexiGroup Limited (ASX: FXL)

On 25 November 2019, FlexiGroup Limited (ASX: FXL), the provider of various range of finance solutions to customers and business via a network of retail and business partners. The company supported by a group of unsecured, consumer receivables (initiated in Australia) announced the pricing of $265 million asset-backed securities under its rebranded Buy Now Pay Later offering â humm.

The company is a regular issuer of asset-backed securities, and since 2011 it has been engaged in executing securitisations of its Buy Now Pay Later (âBNPLâ) receivables under the Flexi ABS programme.

After the relaunch of its buy now pay later services in April 2019, the company had seen a great momentum across hummâs target verticals and the total retail partners climbing to more than 18,000 and solid volume growth across these important verticals.

In FY2020, the company has added more than 132,000 new customers to the humm platform. It experienced a 35% growth in the number of the transaction as compared to the previous corresponding period.

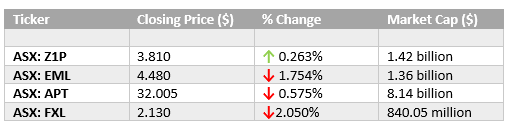

Stock prices of the above-mentioned companies on ASX on 27 November 2019 (AEST 03:42pm)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.