Boom refers to a period during which an increase is reported in commercial activities either within a business, industry, market or economy.

Boom is a phase in the business cycle which is followed by a bust. Boom and bust in the economic cycle involve rapid growth usually followed by inflation, thus leading to economic contraction.

In general, economic cycle is measured with the help of an increase and decline in real GDP or GDP that is adjusted for inflation. It is the fluctuation in the economy, as a result of output from various sectors within that economy.

Probable Causes of boom and bust cycles

- Loose Monetary Policy

- Loose Fiscal Policy

- Boom and Bust in Asset Prices

- Bank Lending

- Multiplier/accelerator effect

A Glance at Australian Economic Growth:

Australia has seen 28 years of uninterrupted economic growth. The Australian economy is expected to continue to surpass every other major advanced economy in the future as well. According to latest assessment by the International Monetary Fund, real GDP of the country would grow by an annual average rate of 2.7 percent until 2023. This represents an increase when compared with an annual average rate of 2.6 percent during 2014-2018 (real GDP grew by 2.9 percent in 2017-18).

From 1991-92 to 2017-18 (27 years of economic growth), out of 19 major sectors, 12 sectors expanded by at least 3 percent per annum. The average yearly growth rate of Services sector was 3.4 percent and the sector outperformed progress in non-services industries of 2.1 percent. The tech driven industries in Australia like information, media & telecommunications; and professional, scientific & technical services soared by a yearly average rate of ~ 5 percent over this time frame. Other industries like financial/insurance services and health care & social service also grew strongly during the period at ~ 4.5 percent each.

S&P/ASX 200 Information Technology (Sector):

S&P/ASX 200 Information Technology from 2 January 2019 till 14 November 2019 grew by ~ 34.58 percent, while the benchmark index S&P/ASX 200 grew by ~21.18 percent. This shows that the technology sector outperformed its benchmark index during the reported period. On 14 November 2019, S&P/ASX 200 Information Technology closed at 1,423.6, up 1.62 percent from its last close, while S&P/ASX 200 inched up by 0.54 percent to settle at 6,735.1.

In this article, we are discussing recent developments of six tech stocks trading on the ASX.

EML Payments Limited (ASX: EML)

EML Payments Limited (ASX: EML), the issuer of pre-paid financial cards, on 13 November 2019, released its AGM 2019 presentation and notified about the completion of the placement and entitlement offer, valued at approx. $156 million.

AGM:

In the AGM presentation, the company discussed the Director's Remuneration Report, the re-election of Director, Mr Peter Martin, increase in Non-Executive Director Fee Pool, Grant STI Options to CEO and MD, Grant of LTI Options to CEO and MD, and Amendment to the Company's Constitution.

Other than these, the company also provided its FY2019 review. The company delivered 82 percent growth in its EBITDA CAGR in 5 years. In FY2019, the companyâs revenue was $97.2 million, EBITDA was $29.1 million, GDV (Gross Debit Volume) was $9.03 billion. The company has a presence in 23 countries in regions including North America, Europe and Australia.

The presentation also covered EMLâs FY2019 business update.

- In its Gift & Incentive segment, GDV was $1.06 billion (up from $0.74 billion in FY2018), revenue was $66.4 million (up from $46.6 million in FY2018).

- In General Purpose Reloadable (GPR) segment, GDV was $2.74 billion (up from $3.35 billion in FY2018), revenue was $23.9 million (up from $21.6 million in FY2018).

- In the Virtual Account Numbers (VANS) segment, GDV was $5.23 billion (up from $2.67 billion in FY2018), revenue was $6.4 million (up from $2.4 million in FY2018).

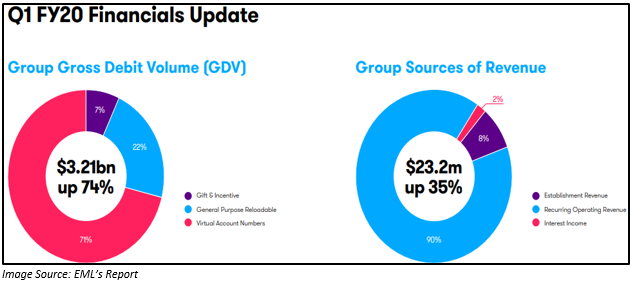

The company also highlighted its Q1 FY2020 results.

Gift & Incentive segmentâs revenue grew from $9.3 million in Q1 FY2019 to $13.6 million in Q1 FY2020 and GDV increased from $139 million in Q1 FY2019 to $223 million in Q1 FY2020. GPR segmentâs GDV grew from $709 million in Q1 FY2019 to $715 million in Q1 FY2020. VANSâ segment GDV went up from $963 million in Q1 FY2019 to $2,276 million in Q1 FY2020 and revenue from $1 million in Q1 FY2019 to $3.1 million in FY2020.

The presentation also covered Acquisition of Prepaid Financial Services (Ireland) Limited and equity raising.

Computershare Limited (ASX: CPU)

On 13 November 2019, Computershare Limited (ASX: CPU) released its AGM 2019 presentation, under which the company highlighted its FY2019 management results. Revenue grew by 4.8 percent to $2,411.4 million, while EBITDA went up by 10.2 percent to $685.9 million and EPS increased by 12.8 percent to 71.46 cents during FY19.

The presentation also highlighted that the company in 10 years had recurring revenue CAGR of 8.4 percent, EBITDA margin of 27.5 percent and ROE of 26.9 percent.

During the period, the management took some key steps to execute its long-term growth plans. The purchase of Equatex was completed during this period and work was initiated targeted towards bringing the advantages of this investment into the larger Group. The process of transition of major business lines from a regional to a global mode was also started, allowing each of them to identify and take advantage of the best market opportunities.

WiseTech Global Limited (ASX: WTC)

Recently, WiseTech Global Limited (ASX: WTC) was under limelight when J Capital Research Limited (J Cap), a registered investment advisor with the US SEC alleged WTC of inflating its profit by 178 percent and also related to the acquisitions made by WTC.

Other Allegations:

- Customer attrition and Fall in revenue

- Organic Growth

- Dissatisfied customers

On 23 October 2019, WTC responded to the allegations and rejected the claims of J Cap related to financial impropriety and irregularity in the report. The details can be read by CLICKING HERE.

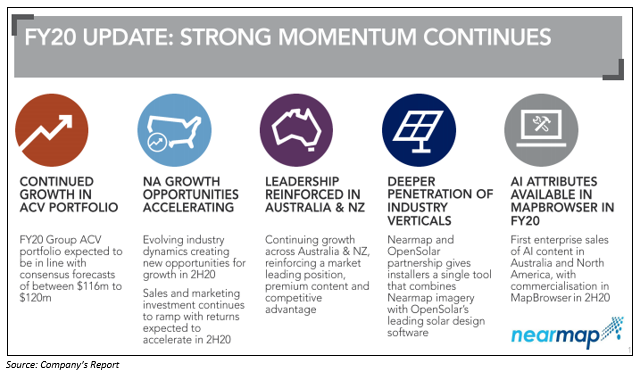

Nearmap Ltd (ASX: NEA)

Nearmap Ltd (ASX:NEA), a provider of geospatial map technology for business, enterprises and government customers, on 13 November 2019, released an announcement related to notice of initial substantial holding.

The notice confirms that Mitsubishi UFJ Financial Group, Inc now has interest in 22,966,608 securities and has a 5.09 percent voting rights.

The company also recently updated the market with 2019 AGM Presentation, under which strategic objectives executed during FY19 were discussed and FY20 update was shared.

Catapult Group International Ltd (ASX: CAT)

Recently, Catapult Group International Ltd (ASX:CAT), a global leader in elite sports performance technology, announced the appointment of Michelle Guthrie as an Independent Non-Executive Director (INED), effective from 1 December 2019. Meanwhile, the company also announced that Calvin Ng, Non-Executive Director, would retire from the Board after the 2019 AGM.

In another market release, the company announced the renewal of its union-wide performance partnership with Rugby Australia. The expanded partnership now includes the new Vector technology of CAT. The Vector platform of the company helps in improving player performance, lessening injury risk and supporting return to play processes. This technology would be implemented across the entire Australian representative teams, academies and Super Rugby franchises along with match officials.

Data#3 Limited (ASX: DTL)

Leading Australian IT services and solutions provider, Data#3 Limited (ASX:DTL), on 13 November 2019, released its 2019 AGM update.

In the AGM, the company took its shareholders through the FY2019 results, highlighting

- Revenue growth of 19.8 percent to $1,415.6 million

- EBITDA went up by 26.1 percent to $28.3 million

- EBIT grew by 32.1 percent to $25.8 million

- NPAT excluding minority interests increased by 28.7 percent to $18.1 million.

- DTL declared a dividend of 10.70 cents per share, representing a growth of 30.5 percent as compared to the previous corresponding period.

The company reported a strong start to FY2020. Laurence Baynham, Chief Executive Officer and Managing Director, stated that in the first half of FY2020, DTL is projecting a pre-tax profit in the range of $11.0 million to $12.5 million.

Stock Performance:

Below table illustrates the performance of the above discussed tech stocks on ASX on 14 November 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.