Consumer Staples

Consumer Staples increasingly appear more desirable in the status quo. Predominantly, the sector includes industries skewed towards the essentials of humans and human life.

Consumer Staples consist of Food & Staples Retailing, Food, Beverage & Tobacco, and Household & Personal Products, as these industries are less prone to cyclical risks posed by the companies.

Alternatively known as the consumer defensive sector, which has come into prominence among investors, amid a wider slowdown in the economy.

In this article, we would discuss about two infant formula stocks, which is classified under consumer staples sector on ASX.

The a2 Milk Company Limited (ASX: A2M)

A2M is a mid-cap company engaged in the sale of milk branded products that are produced from cows having naturally A2 protein type milk. Based in New Zealand, the stock of the company is listed on ASX, NZX and Chi-X.

Status quo for the infant formula stock under discussion appears to have been heavily impacted by the market, as the company missed to deliver on the market consensus during the full-year results that were released in August. Despite posting decent results, the stock witnessed a sharp decline in its price after the results were released. Subsequently, this opened a wide value gap, resulting in price target upgradation by brokerages, lately.

In its full year results ended 30 June 2019, the company posted revenue growth of 41.4% to clock NZD 1.3 billion compared to NZD 922.35 million a year ago. Consequently, its net profit after tax was noted at NZD 287.7 million for the period, up by 47% from NZD 195.7 million in the previous year.

Reportedly, the company has successfully increased its market share in China & Australia. The company achieved decent growth in liquid milk businesses, particularly in Australia & the USA. The total fresh milk growth of 22.9% with revenue of NZD 174.9 million was achieved across the group.

The gross margin of the company improved to 54.7%, primarily driven by an increase in price, which was somewhat offset by currency movements, particularly a weaker AUD. Further, the company has redefined its approach to inventory management, allowing it to adjust actively amid demand fluctuations.

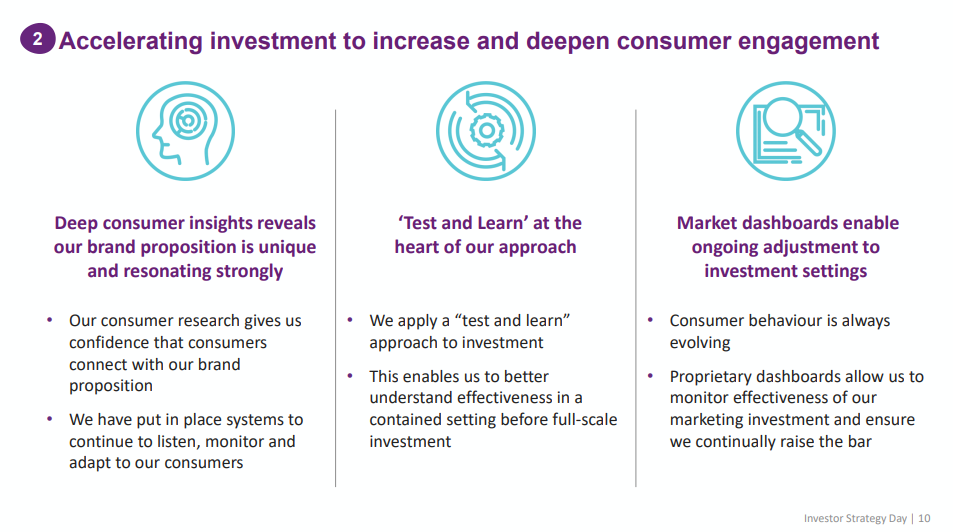

Consumer Engagement (Source: A2M’s Investor Strategy Day Presentation)

The core markets of the company include Australia, New Zealand, Greater China and the US. In addition, the company is actively seeking new markets, and consumer research was undertaken by the company in Vietnam, Korea and Hong Kong.

The company increased its marketing expenses by 83.7% to NZD 135.3 million spent on advertising in the US & China, depicting the focus of the company in building its brand value and accelerating its brand awareness.

The research & development remains a priority for the company, including independent clinical studies. The company expects its revenue growth to be underpinned by increasing brand & marketing investment in China and the US.

Besides, it expects an increase in the marketing investment to approximately 12 per cent of sales, investment in organisational capability and gross margin percentage is expected to be broadly consistent with FY 2019.

On 8 October 2019, A2M was trading at $12.11 (at AEST 2:12 PM), down by 1.143%.

Bellamy’s Australia Limited (ASX: BAL)

Recently, the company had notified about its Scheme Implementation Deed (SID). Under the SID, the company is being acquired by China Mengniu Dairy Company Limited (SEHK: 2319). Accordingly, Mengniu would be acquiring all the shares of Bellamy’s via a scheme of arrangement.

Under the scheme, the shareholders of the company would receive $12.65 per share in cash paid by Mengniu. Besides, the company would pay a fully franked dividend of $0.60 per share to the shareholders prior to the implementation of the scheme.

In its full year report for the period ended 30 June 2019, the demand from China for the company’s products was impacted by regulatory change, a lower birth rate amid increasing competition. It’s rebranding depicts the most important investment in Bellamy’s history, delivering a premium brand & product with the world leading level of DHA for an organic formula.

Since March relaunch, the momentum has been positive, and the company has doubled the investment in marketing, as well as China capability to better activate the brand, and consumer engagement. The company had also redefined its trade and channel economics to incentivise trade partners, including daigou, social networks and e-commerce platforms.

Consequently, these items impacted the results for FY 2019 period, including a one-off write-down of legacy-label inventory, and a significant level of Q3 destocking and trade change-over against the expectation.

Brand (Source: BAL’s FY19 Results Presentation)

It was reported that the business is expected to return to sustained growth in FY 20, and this confidence is strengthened by the accelerated growth in Bellamy’s food business along with the planned launch of new products.

Further, the new products included an organic ultra-premium formula series, an organic goat formula series, and a China offline organic food range. The company had acknowledged the process for Camperdown’s SAMR registration, and the management was confident that the registration would be achieved.

In FY 2019, the company witnessed a 19% decline in revenue for the period to $266.24 million compared to $328.7 million in the previous year. Its net profit after tax was down by 48.9% to $22.11 million compared to $43.25 million in the previous year.

FY 20 Outlook

Reportedly, the company anticipates 10-15% growth in the net revenue at an EBITDA margin in line with the previous year. It is expecting better growth in the second half, attributing to the new product launches. The company remains confident in its growth strategy and medium-term target of $500 million in revenue. However, this target was deferred beyond FY 21 due to the ongoing SAMR registration.

On 8 October 2019, BAL was trading at $13.00 (at AEST 2:26 PM), up by 0.077%.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.