Summary

- APT in such difficult times – on the one hand, has been crossing the milestones of active shoppers in the United States and on the other side, making changes in the management to stay strong.

- CSL had a strong 1H2020 with growth seen in revenues, dividend distribution and cash flow from operations.

- Travel restrictions have put SYD operations in problem; therefore, to meet its debt commitments and maintain liquidity, the company has signed agreements for additional debt financing.

- BLD is seeing some positive news coming its way –the Supreme Court of Queensland gives its final orders for pending litigations and the company is receiving funding both by issuing Senior notes and through bank facilities.

In the past few months, the Australian equity market has experienced double whammy due to bushfire and the currently evolving COVID-19 leading to its significant decline. However, things are getting back on track as the economy is reopening and the markets have started showing signs of recovery. The investors are keeping an eye on every update across the globe and accordingly are choosing on their participation.

With this backdrop, we have screened some trending and popular stocks:

Afterpay Limited

Afterpay Limited (ASX: APT) is a BNPL entity, which provides payments solutions for businesses and consumers. The company recently notified the market with the changes in the Board, which is as follows:

- APT stated that Elana Rubin accepted her transition from interim Chair to Chair of the company’s Board, effective immediately.

- Effective June 1, 2020, Sharon Rothstein will act an independent Non-Executive Director to the Company.

Do Read: Why Afterpay is on record Levels amid Coronavirus?

BNPL leader, Afterpay Limited in an update to market announced that following its two years of operations in the US, it currently has over five million active shoppers. APT’s platform is being offered by more than 15,000 retailers and brands to its customers helping it reach to nearly 9 million U.S. customers, ~1 million of which are new customers who joined the platform during COVID-19.

In the month of April 2020, the company had experienced over 15 million app and site visits, and its U.S. Shop Directory contributed around 10 million lead referrals to its retail partners.

At the close of trading session on 9th June 2020, the stock of APT settled at $50.700 per share with a rise of 0.178% as compared to its previous closing price. The stocks of APT has delivered a return of 32.56% during the period of one month to shareholders.

CSL Limited

CSL Limited (ASX: CSL), a biotechnology company, engaged in various approaches to treat Human health development.

Partnership for the development of Vaccine for COVID-19

- Recently, the company has entered into a significant partnership agreement with the Coalition for Epidemic Preparedness Innovations (CEPI) and The University of Queensland in order to ramp up the development, manufacturing and distribution of a COVID- 19 vaccine candidate pioneered by researchers at The University of Queensland.

- Under the terms of the agreement, Coalition for Epidemic Preparedness Innovations and the company would finance the manufacturing and development of molecular clamp enabled vaccine of The University of Queensland for COVID- 19 pandemic.

- The funding would be utilised - for the remaining phase 1 safety study, which is being led by The University of Queensland and will be followed by subsequent late stage clinical trials and industrial scale manufacturing leading to the creation of potentially millions of doses in 1 year.

- In the event of successful clinical trials, a vaccine is expected to be available in 2021.

Do Read: How CSL is combating with the COVID-19 Pandemic?

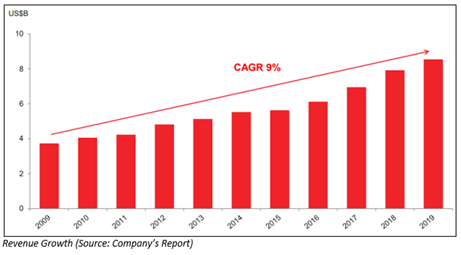

Over the span of 10 years (2009-2019), the company reported a CAGR of 9% in revenue. During 1H FY20, the company recorded a growth of 11% in revenue and NPAT also went up by 11%. This reflected strong growth in immunoglobulin portfolio, continued evolution of the haemophilia portfolio as well as strong performance from Seqirus.

At the close of the trading session on 9th June 2020, the stock of CSL settled the trading session at $272.50 per share, reflecting a drop of 2.394% as compared to its previous closing price. The stock of CSL delivered a return of 41.72% in last one year.

Sydney Airport

Sydney Airport (ASX: SYD) is engaged in the operation of airports. In the recent traffic performance for the month of April 2020, the company experienced a robust decline. Total passenger traffic for the month went down by 97.5% to 92,000 passengers. Forty-three thousand international passengers, who passed through the Sydney Airport, showcasing a decline of 96.9% while domestic passengers traffic stood at 49,000 with a drop of 97.9% over pcp. The company stated that this downturn is likely to persist until the government provides some ease in travel restriction.

On 20th April 2020, the company secured an additional bank debt facility amounting to $850 million. This shall ease the pressure of SYD to meet the debt commitments and expected capital expenditure for the next 12 months. Although, the current balance sheet figures show that it’s in a comfortable position and doesn’t require further equity funding yet, the company shall not be proceeding with dividend payment for the HY ending June 2020.

At the close of trading session on 9th June 2020, the stock of SYD settled the session at $7.050 per share, reflecting an increase of 8.796% against its previous closing price.

Boral Limited

Boral Limited (ASX: BLD) is involved in the manufacturing and supply of material to be used for building, construction etc. Recently, the company has been in talks regarding the litigation with Wagners Holding Company Limited. The Supreme Court of Queensland though reserving the final orders have announced that the pricing notices filed by Boral on March 1, 2019 and April 1, 2019 are not effective and valid under the Cement Supply Agreement between the parties. In contrast, the Pricing Notice issued on October 2, 2019 is valid.

The findings of the court gave some clarity for the parties moving forward around Boral’s ability to issue and rely on a Pricing Notice. This hold importance considering the long-term nature of the Cement Supply Agreement, which remains binding on the parties until December 2031 and the requires BLD to purchase a pre-determined volume of cement from Wagners on an annual basis.

In another update, the company announced that it has successfully raised US$200 million by the issue of US Private Placement (USPP) note. The Company will issue notes in tranches holding coupon of 4.49%. First tranche notes will expire in 5 years whereas second tranche notes will expire in 7 years.

At the close of trading session on 9th June 2020, the stock of BLD settled the session at $3.82 per share, reflecting an increase of 5.817% against its previous closing price.