Innovation in Fifth Generation (5G) wireless technologies shall act as a governing factor for the survival of telecommunication companies in Australia. The competition in telecom industry is ever increasing due to which the telecom companies nowadays are focused on providing unmatchable services to the customers and retain them. Due to the roll out of NBN, the telecommunication companies in Australia are facing many challenges and are currently figuring out ways to deal with the situation.

In the light of the above scenario, letâs look at four telecommunication companies which are looking good in terms of long-term growth.

Telstra Corporation Limited (ASX:TLS)

Telstra Corporation Limited (ASX: TLS) is a leading telecommunications and technology company in Australia, offering a complete range of communications services and competing in all telecommunications markets by providing provide 18.3 million retail mobile services, 3.7 million retail fixed bundles and standalone data services and 1.4 million retail fixed standalone voice services.

The company operates globally, spanning its operations to over 20 countries with over 3,500 employees.

In its latest announcement dated 3rd October 2019, the company announced regarding the appointment of Mr. Kim Krogh Andersen as Group Executive, Product & Technology. On the appointment of the new Group Executive, Telstra CEO Andrew Penn said Mr. Krogh Andersen would be a strong addition to Telstra's very experienced leadership team, with some of the best technology, product and networks experience globally.

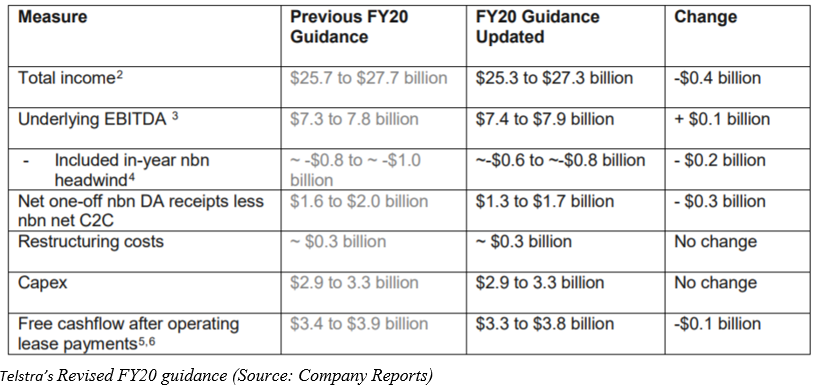

The company recently updated its FY20 guidance following the release of NBN (National broadband network) Co's Corporate Plan 2020. NBN Co's Corporate Plan 2020 informed regarding the reduction in the total number of premises forecast to be connected during FY20 from 2 million to 1.5 million. Following the change from NBN, Telstra updated its FY20 cost reduction target from $660 million to $630 million.

At market close on 4 October 2019, the companyâs stock was trading at a price of $3.420 with a daily volume of ~ 18,636,755 and a market capitalisation of circa $40.44 billion. The stock has a 52 weeks high price of $3.978 and a 52 weeks low price of $2.663 with an average volume of ~29,823,935. In the last six months the stock has increased by 3.55% as on 3 October 2019.

Vocus Group Limited (ASX:VOC)

Vocus Group Limited (ASX: VOC) is a specialist fibre and network solutions provider which owns a portfolio of several popular brands catering to enterprise, government, small business, wholesale and residential customers across Australia as well as New Zealand.

On 24th September 2019, the company announced its annual report to shareholders with an objective of providing shareholders and interested parties with clear, easy to understand information on the company and its performance in FY19.

Key highlights from FY19 (year ending 30th June 2019)

- The companyâs Coral Sea Cable survey, design and manufacture completed and laying commenced;

- The company implemented a digital operating model for improving customer service experience and reducing the cost of service;

- The companyâs modernisation program for legacy technology was approved and is underway;

- The companyâs Tier One Executive and Senior Leadership team was established;

- The company renegotiated MVNO agreement with Optus for improved mobile offers paving a pathway to 5G and fixed wireless broadband;

- The companyâs Commander brand refreshed as Commander Centre channel was reinvigorated and new centres were opened;

- The company also simplified enterprise and retail products, making their services easier to purchase and consumer and better customer service experience.

According to the Chairman and CEO report, the companyâs cash conversion was strong at 100% in FY19 and is expected to be in the range of 90-95% in FY20. The companyâs profit before income tax and expenses for FY19 dipped to $52.698 million in from $89.83 million in FY18.

At market close on 4 October 2019, the companyâs stock was trading at a price of $3.420 with a daily volume of ~ 1,397,168 and a market capitalisation of around $2.15 billion. The stock has a 52 weeks high price of $4.900 and a 52 weeks low price of $2.810 with an average volume of ~ 2,399,750. In the last six months the stock has decreased by 4.17 % as on 2nd October 2019.

TPG Telecom Limited (ASX:TPM)

TPG Telecom Limited (ASX:TPM) is primarily involved in providing telecommunication services to consumers, wholesalers and corporates.

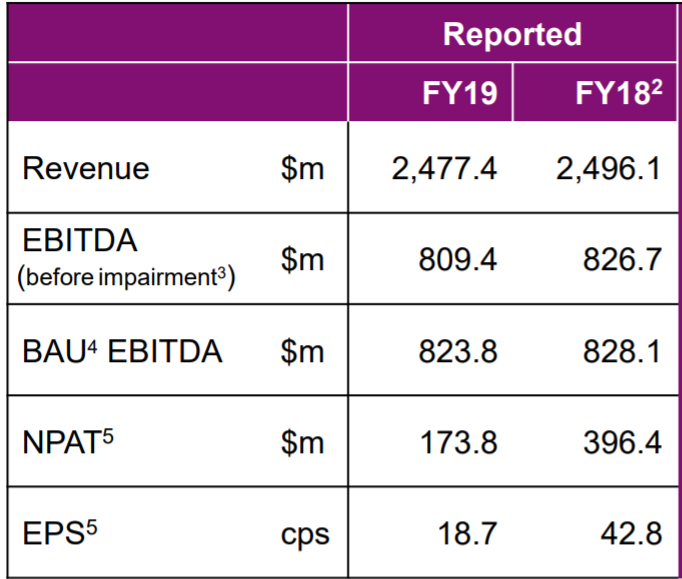

On 5th September 2019, the company announced its FY19 results. Key highlights of the results were as follows:

- The companyâs earnings before interest, tax, depreciation and amortisation before impairment for the period was $809.4m (reported);

- The company achieved a Net Profit After Tax attributable to shareholders (NPAT) of $173.8m (reported) for the period;

- The companyâs earnings per share (EPS) were 18.7 cents per share;

- The company had strong net operating cashflows before tax during the year, exceeding EBITDA at $836.3m.

FY19 Results Summary (Source: Company Reports)

The FY19 results were majorly impacted by the company decision to cease the rollout of its Australian mobile network in January 2019 and one-off transaction costs relating to the Groupâs planned merger with Vodafone Hutchison Australia.

The companyâs total FY19 capital expenditure of $717.3 million includes:

- Installation of $352.4 million for the 2x10MHz of 700MHz spectrum acquired at auction in 2017;

- Investment of $86.1m in the Australian mobile network build which has now ceased;

- And $80.1m in the Singapore mobile network build.

The residual $198.7 million of capital expenditure was lower than FY18 by $59.3 million and was within the guidance range of $180 million -220 million provided at the start of FY19. At the end of FY19, the company had net debt of $1.94 billion which included remaining spectrum liabilities payable in early 2020.

At market close on 4 October 2019, the companyâs stock was trading at a price of $6.930 with a daily volume of ~980,130 and a market capitalisation of approximately $6.36 billion. The stock has a 52 weeks high price of $8.580 and a 52 weeks low price of $5.940 with an average volume of ~ 1,088,979. In the last six months the stock has increased by 0.44% as on 3 October 2019.

5G Networks Limited (ASX: 5GN)

5G Networks Limited (ASX: 5GN) is an Australian telecommunication with a vision of providing endless digital experience to the customers through services like data connectivity, cloud and data centre. The company also primarily provides high-speed broadband services to the corporates.

On 2nd October 2019, the company announced its Dividend Reinvestment Plan Price for the shareholders. According to the announcement, the Issue Price of the shares to be allotted to participants in the Dividend Reinvestment Plan for the 2019 fully franked ordinary dividend is $0.76 per share. The dividend will be paid on 18 October 2019.

Recently, the company successfully completed the transaction to acquire the Australian Pacific Data Centres (APDC) located in Sydney CBD.

Notable highlights of the acquisition are as follows:

- Unlocking of several cost synergies with expected benefits to be circa $500,000 of annualised savings starting H2 FY20;

- The capacity of Pyrmont Data Centre is over 150 racks with current utilisation at 30% with scope for future expansion;

- The Tier 3 designed data centre has been built in order to leverage the chief standards of security and access control;

- With data centres in Data Centres in Adelaide, Melbourne and Sydney, the companyâs combined capacity exceeds 600 racks.

- The acquisition defines the foundation for CBD and inner Sydney fibre network expansion to key clients with data centre access requirements.

At market close on 4 October 2019, the companyâs stock was trading at a price of $0.730 with a daily volume of ~149,606 and a market capitalisation of approximately $48.68 million. The stock has a 52 weeks high price of $1.715 and a 52 weeks low price of $0.375 with an average volume of ~ 500,598. In the last six months the stock has decreased by 20.21% as on 3 October 2019.

5GN Six-month Price Chart (Source: ASX)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.