Below mentioned stocks have witnessed an improvement in their share prices during the intraday trade. However, in the past six months these stocks have provided negative returns. Letâs take a closer look at these stocks -

Lynas Corporation Limited (ASX:LYC)

The Australian mining company, Lynas Corporation Limited (ASX: LYC) has witnessed an uplift of 6.806% in its share price during the intraday trade. This rare earths mining company achieved record production during the first quarter of FY19. During the quarter, the company added separated Nd and Pr to its product suite which strengthened the companyâs position in the Japanese market. The companyâs Invoiced sales revenue was A$101.3 million in the 2019 March quarter which was 26.8% higher than the previous quarter.

On 21 May 2019, the company is going to conduct its Investor day, the theme of which is âLynas 2025: Growing with the Market.â

In the past six months, the share price of the company decreased by 17.32% as on 15 May 2019. LYCâs shares last traded at $2.040 with a market capitalization of circa $1.27 billion as on 16 May 2019.

Aristocrat Leisure Limited (ASX:ALL)

Gaming machine manufacturer, Aristocrat Leisure Limited (ASX: ALL) delivered record profit in FY18 with NPATA increasing by around 34% to $729.6 Million. During 2018, the company achieved around 25% growth in its Class III North American premium gaming operations footprint, while also growing its Class II footprint by over 8%. Today the companyâs shares are up by 4.05% as compared to last day close price.

The company is moving towards a more diversified Digital portfolio. It is expected that the companyâs FY2019 results will be skewed to the second half of the financial year, reflecting the planned cadence of game releases and corresponding UA investment.

In the past six months, the share price of the company decreased by 4.05% as on 15 May 2019. ALLâs shares last traded at $26.870 up 4.961% during the dayâs trade with a market capitalization of circa $16.35 billion as on 16 May 2019.

oOh!media Limited (ASX:OML)

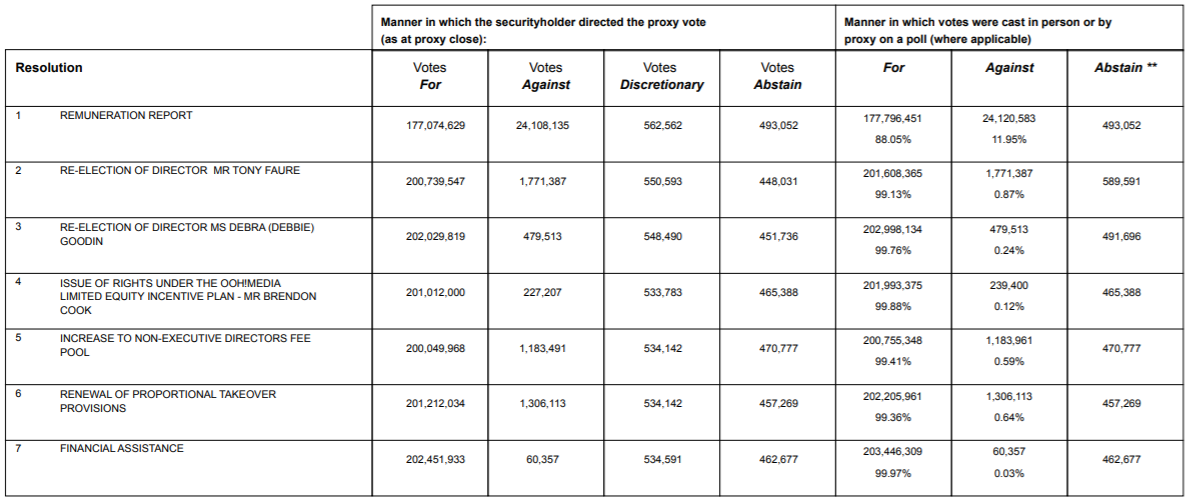

The leading media company, oOh!media Limited (ASX: OML) witnessed an uplift of around 5.337% in its share price during todayâs day trade. Today, the company held its Annual general meeting in which it passed 7 resolutions through shareholderâs vote.

AGM Results (Source: Company Reports)

AGM Results (Source: Company Reports)

In 2018, the companyâs total revenue increased by 27% to $482.6 million and its underlying NPATA increased by 18% to $51.1 million. During the year, the company acquired Adshel (which has since been rebranded as Commute) which positioned oOh! as the largest Out Of Home company across both Australia and New Zealand. In 2018, the companyâs Underlying EBITDA (ex-Commute) increased by 5% to $94.2 million, which was at the low end of the guidance range which was provided at the half-year result.

In the past six months, the share price of the company decreased by 20.36% as on 15 May 2019. OMLâs shares last traded at $3.750 up 5.337% during the dayâs trade with a market capitalization of circa $851.98 Million as on 16 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.