Paying a dividend is one of the strategies a company adopts to retain its shareholders. In general, a mature company offers dividends to its shareholders while a company in its growing phase will likely reinvest the amount for future growth.

From an investor’s point of view, investing in dividend-paying stocks is attractive to those investors for whom passive income is the prime focus, such as old age investors. Also, a company that pays dividend creates a positive market sentiment amongst the investors. A dividend-paying stock increases an investor’s interest in the company, thus leading to growth the demand, thereby, enhancing the value of the stock.

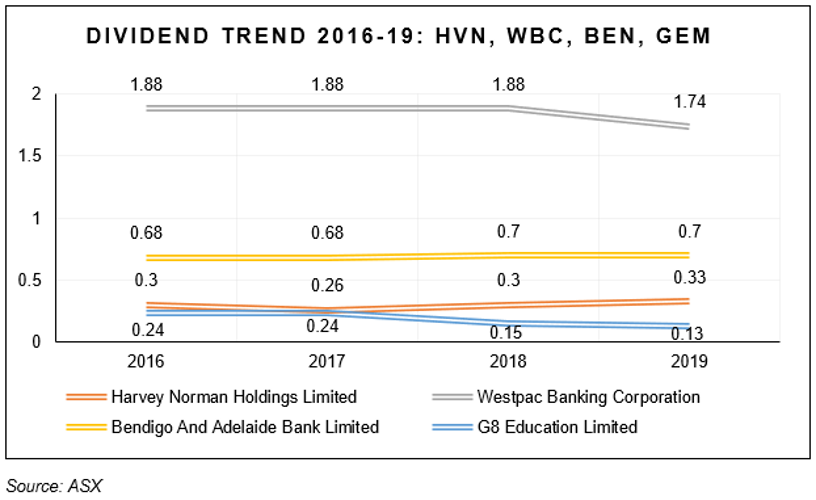

Let us look at some of the high yielding companies with a focus on dividend growth and upcoming business plans. Four companies under the radar are Harvey Norman Holdings Limited, Westpac Banking Corporation, Bendigo And Adelaide Bank Limited and G8 Education Limited.

Harvey Norman Holdings Limited (ASX:HVN)

An Australia-based company, Harvey Norman Holdings Limited is into the business of selling consumer electricals and homewares.

The company has offered an impressive dividend yield of 7.6 percent annually, fully franked, as at 23 January 2020. The dividend amount has increased every year since 2017, with a CAGR of 13 percent and 3 percent in the span of 2017-19 and 2016-19, respectively.

Supporting the notable yield was the company’s FY 2019 performance in terms of sales revenue (company-operated) and bottom line, which were 12.1 percent and 7.2 percent up from the previous year figures.

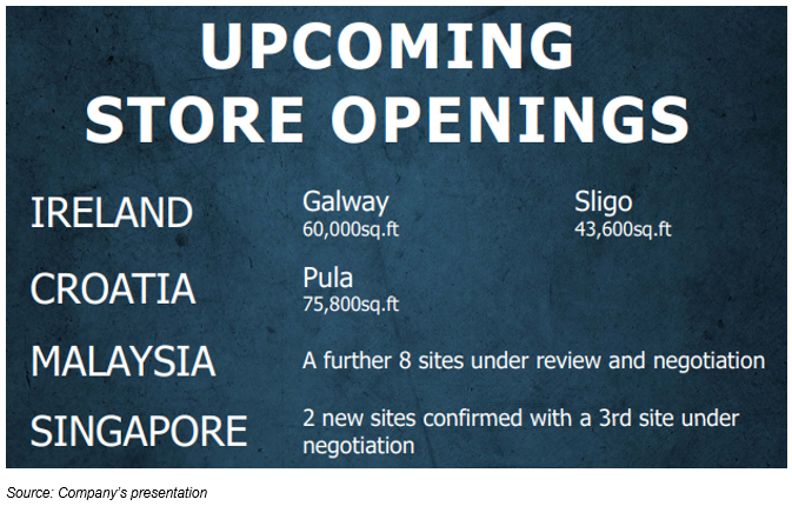

As a forward-looking approach, HVN is giving importance to develop creativity in technology in this tech-savvy environment and so, has plans to invest in its technology and company’s franchisees as a strategic move. Also, by the end of FY 2020, the company has plans to invest overseas with an intention to set off nearly 18 new stores, primarily in Malaysia, as part of the company’s expansion strategy.

The HVN stock was trading $4.350 at the end of 23 January 2020, an increase of 0.23% from the previous day’s closing price. The delivered a positive return of 2.69 percent and 35.67 percent in the last six months and one year, respectively. The 52-week low and high price of the stock was noted at $3.150 and $4.667, respectively. The company had outstanding shares of around ~1.25 billion and market capitalisation of nearly $ 5.41 billion.

Westpac Banking Corporation (ASX:WBC)

Financial service provider company, Westpac Banking Corporation engages in typical banking services encompassing business banking, institutional banking, wealth management and consumer banking services.

In FY 2018, the company paid an annual dividend of 1.88, which dropped to 1.74 in FY 2019. Despite this, WBC was able to deliver an impressive annual dividend yield of 6.92 percent, fully franked, as at 23 January 2020.

Also, the company’s operational performance for FY 2019 fully endorses the annual dividend paid. The key highlights, as mentioned by the company, are as follows:

- Statutory net profit after tax ($6,784 million) dropped by 16 percent in FY 2019 as compared to FY 2018

- Common Equity Tier1 capital ratio fell 4 bps during FY 2019 as compared to the previous year and stood at 10.7 percent (as on September 30, 2019)

- Return on equity for FY 2019 was 10.7 percent, a decline of 240 bps on a y-o-y basis

- Cash earnings stood at $6,849 million, down 15 percent on a y-o-y basis

The decline in profit figures for WBC is subject to the impact of the challenging political and economic conditions prevailing worldwide. Going further, the company expects certain positive outcomes in FY 2020, which are as follows:

- Expected growth in business credit by 3 percent, housing credit by 3.5 percent and other personal credit by around 2 percent.

- In FY 2019 there was a reduction in the cash rate by RBA from 1.5 percent to 0.75 percent. The company further expects the reduction to 0.5 percent in early 2020.

The impact of financial performance was seen on the stock performance in the last six months and one year with returns of -9.70 percent and -2.37 percent, respectively, as on 23 January 2020. The stock last traded at $25.080, moving down by 0.239 percent compared to its previous closing price.

The company has outstanding shares of around ~3.61 billion and a market capitalisation of nearly $90.8 billion. The 52-week low and high price of the stock was noted at $23.860 and $30.050, respectively.

Bendigo And Adelaide Bank Limited (ASX:BEN)

ASX- listed, Bendigo and Adelaide Bank Limited offer banking and financial services primarily catering to small to medium enterprises and retail sector in Australia. BEN was founded in 1858 and provides services such as foreign exchange, wealth management, payment, treasury, consumer finance, residential and commercial.

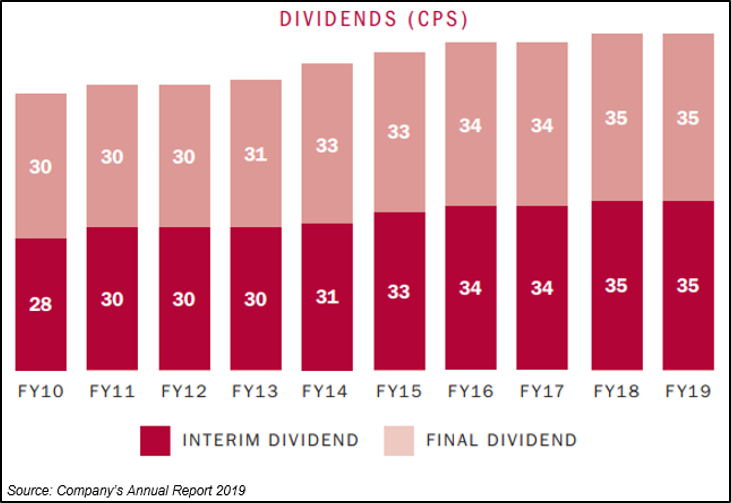

As of 23 January 2020, the annual dividend yield is 6.9 percent, 100 percent franked. Also, the dividend distribution by BEN to its investors has increased at a CAGR of 2 percent from FY 2010 to FY 2019.

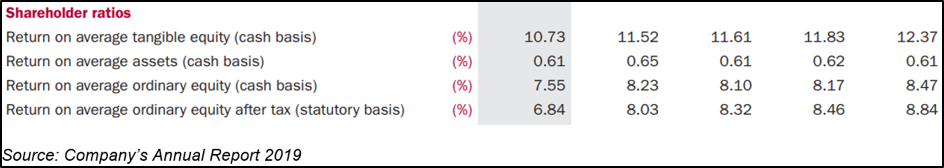

The significant dividend is very well supported by the company’s financials. In FY 2019, Common Equity Tier1 capital ratio had increased by 30 bps on a y-o-y basis to 8.92. Moreover, doubtful and bad debts were $50.3 million, a decline of 28.8 percent as compared to the previous year. Other useful ratio stats for shareholders are as follows:

On 23 January 2020, the stock of BEN last traded at $10.160, an increase of 0.099 percent compared to its previous closing price. The company has outstanding shares of around ~493.84 million and market capitalisation of nearly $5.01 billion. The 52-week low and high price of the stock was noted at $ 9.370 and $ 11.740, respectively. The stock has delivered returns of -11.66 percent and -8.64 percent in the last six months and one year, respectively.

G8 Education Limited (ASX:GEM)

An Australia-based company, G8 Education Limited, is into the business of providing and operating in childcare services, including educational centres and developmental childcare.

The annual dividend yield of GEM stock was 6.51 percent, which is 100 percent franked, and price to earnings ratio was 13.170x as at 23 January 2020. However, viewing the annual dividend since 2016, there is a decline in the amount of distribution. In FY 2016 and FY 2017, annual dividend was 0.24, which dropped to 0.15 in FY 2018 and then, further dropped to 0.13 in FY 2019.

On 23 January 2020, the stock of GEM last traded at $1.925, a decline of 1.786 percent compared to its previous closing price. The company has outstanding shares of around ~460.18 million and a market capitalisation of nearly $901.95 million. The 52-week low and high price of the stock was noted at $1.832 and $3.635, respectively. The stock has delivered returns of -27.41 percent and -33.78 percent in the last six months and one year, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.