Metals and Mining Sector

Australia is a fortunate country as it has abundance of minerals underneath it. The metals and mining sector is the major contributor in the countryâs GDP, making it an export-oriented country. Australia is an important supplier of iron ore, gold, copper, aluminium etc. making it one of the top 4 major mineral producing countries.

Let us look at some of the metals and mining companies which performed well during the last week period.

Aldoro Resources

About the company: Aldoro Resources Limited (ASX: ARN) is a junior exploration entity, formed to explore and develop Ryans Find, Leinster Projects, Kalgarin, Cathedrals and many other mineral opportunities. The project has over 1,100 km2 of secured tenure with the prospects for any of the two, or both, nickel-cobalt mineralisation.

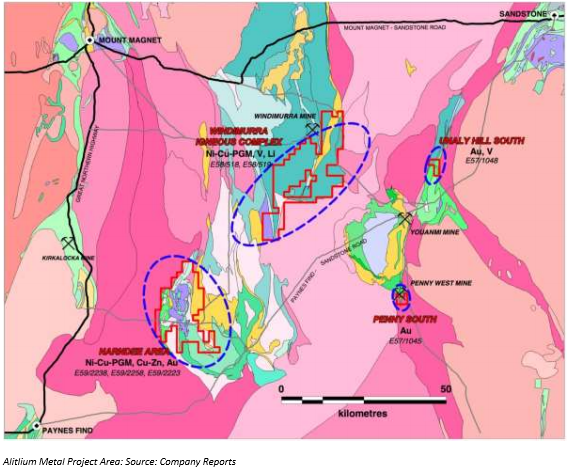

Acquired new exploration projects: Aldoro Resources notified on 6 September 2019 that it had inked a binding option agreement to procure 100 percent of Altilium Metals Limited. Altilium has many advanced exploration projects in the Murchison Region which includes the multi-commodity Narndee Project Area and the Penny South Gold Project in the Youanmi Gold Mining District. As per the agreement, Aldoro has agreed to pay $50,000 option fee to lock the option to procure full ownership of the issued share capital of Altilium.

Also, Altilium currently has 2 Exploration Licence Applications and 5 Exploration Licences in the Murchison Region. The tenements cover several exploration plans surrounding the Windimurra-Narndee Igneous Complex and the Younami Gold Mining District. The main focus of the projects are gold, nickel and copper mineralisation. The tenements have 4 main project areas, covering an entire area of 756 km2.

Altiliumâs Managing Director, Dr Caedmon Marriott and Chairman Rhod Grivas will join the board of ARN and would add substantial mineral exploration and capital market experience to the company.

New Discovery in Cathedrals Belt: The company reported a new discovery of nickel-copper sulphides at Mt Alexander Project, which is close to Aldoroâs Cathedrals Belt Nickel Project. St George proclaimed that nickel-copper sulphides were intersected in its first ever drillhole at the new Radar Prospect. In addition to that, it reported surface geochemical results related to EM anomalies, Fish Hook Propsect.

ARN is expecting on ground exploration to begin during the upcoming months period, which will mainly focus on regions recognised in the analysis of the aeromagnetic data.

Stock Performance: On 10th September 2019, the stock of ARN last traded flat at a price of AUD 0.195, which was near its 52-week high of AUD 0.250, with a market cap of around AUD 6.93 million and approximately 35.53 million outstanding shares. In the previous one-week period, the company has given a total return of 50%.

White Cliff Minerals Limited

About the company: White Cliff Minerals Limited (ASX: WCN) is a mineral exploration company. The Companyâs cobalt-nickel projects are located in Western Australian region. Further, it holds interest in Aucu Gold-Copper Project, Kyrgyz Republic and Merolia Nickel and Copper Project among many others.

RTG to acquire stake in Chanach Gold Project: On 6 September 2019, WCN notified the market through the update of RTG Mining Inc (ASX:RTG) announcing that RTG had entered into a SPA (Sale and Purchase Agreement) with WCN to buy a 90% stake in Chanach gold and copper project in the Kyrgyz Republic from WCN. The total cost of acquiring the project will be close to US$3.65 per ounce of Gold and US$0.0063 per pound of Copper. The deal is valued for the amount of US$2.15 million cash and US$0.5 million in RTG Mining Incâs stock (which is escrowed for twelve months period). The transaction is dependent on WCN shareholder approval with an aim to conclude it by middle to late October this year.

Request for trading halt: On 4th September this year, WCN requested for a trading halt of its securities pending a release of an announcement by the company, related to the disposal of the companyâs 90 percent stake in the Aucu gold-copper project.

Stock Performance: On 10th September 2019, the stock of WCN last traded at a price of AUD 0.006, which was near its 52-week low of AUD 0.003, with a market cap of around AUD 3.29 million and approximately 470.35 million outstanding shares. In the previous one-week period, the company has given a total return of 33.33%.

Australian Vanadium Limited

About the company: Australian Vanadium Limited (ASX: AVL) is involved with the exploration for vanadium/titanium and other economic resources, along with the development of vanadium electrolyte production.

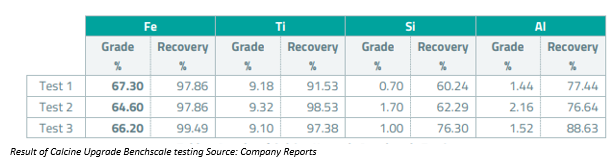

Successfully upgraded the calcine iron content: On 9 September 2019, AVL updated on benchmark scale testwork on iron and titanium rich calcine, considered as a tailings stream under the Australian Vanadium Project roast-leach process, defined in the Pre-Feasibility Study.

AVL further elaborated that it can successfully upgrade the calcine from a lower grade (<55% Fe) iron concentrate to a higher grade (>62%) iron product which can be further sold in the global market. This will help AVL to improve its revenue in the coming years as higher-grade iron ore seeks more value in the global market.

Further, testing is in process, which will separate titanium from the high-grade iron calcine, thus improving its product quality. The by-product sales would have a positive effect on overall costs and hence can could help the AVL to achieve the goal of becoming one of the lowest cost producers of vanadium worldwide.

Vanadium Project awarded by federal Government: On 6 September 2019, AVL notified that it had received an award for its high-grade Vanadium Project by the Federal Government. This award provided official credit to the companyâs role in the economic growth, employment and contribution to Western Australia region. This project will have a major impact in the Western Australian economy and is expected to create 400 direct construction jobs and 200 ongoing jobs.

New order: On 4 September 2019, as per the companyâs release, AVLâs wholly owned subsidiary, VSUN Energy has bagged an order of 20kW/80kWh vanadium redox flow battery. This storage system will be setup at an orchard in Packenham, Victoria. This storage system will be fitted with the collaboration of Profit Share Power Pty Ltd. This storage will supply minimum 4 hours of stored renewable energy and hence, would allow the client to further increase their renewable energy generation and consumption.

Stock Performance: On 10th September 2019, the stock of AVL last traded flat at a price of AUD 0.015, which was near its 52-week low of AUD 0.011, with a market cap of around AUD 29.61 million and approximately 1.97 billion outstanding shares. In the previous one week, the company has given a total return of 27.27%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.