Spotlight on Graphite and 5 Key Stocks

What is Graphite?

Graphite is a naturally-occurring form of crystalline carbon, considered as a good conductor of electricity.

Key Graphite Properties include:

- Electrical and Thermal Conductivity

- Resistance to Corrosion

- Resistance to High Temperatures

- Lubrication

- Inertness

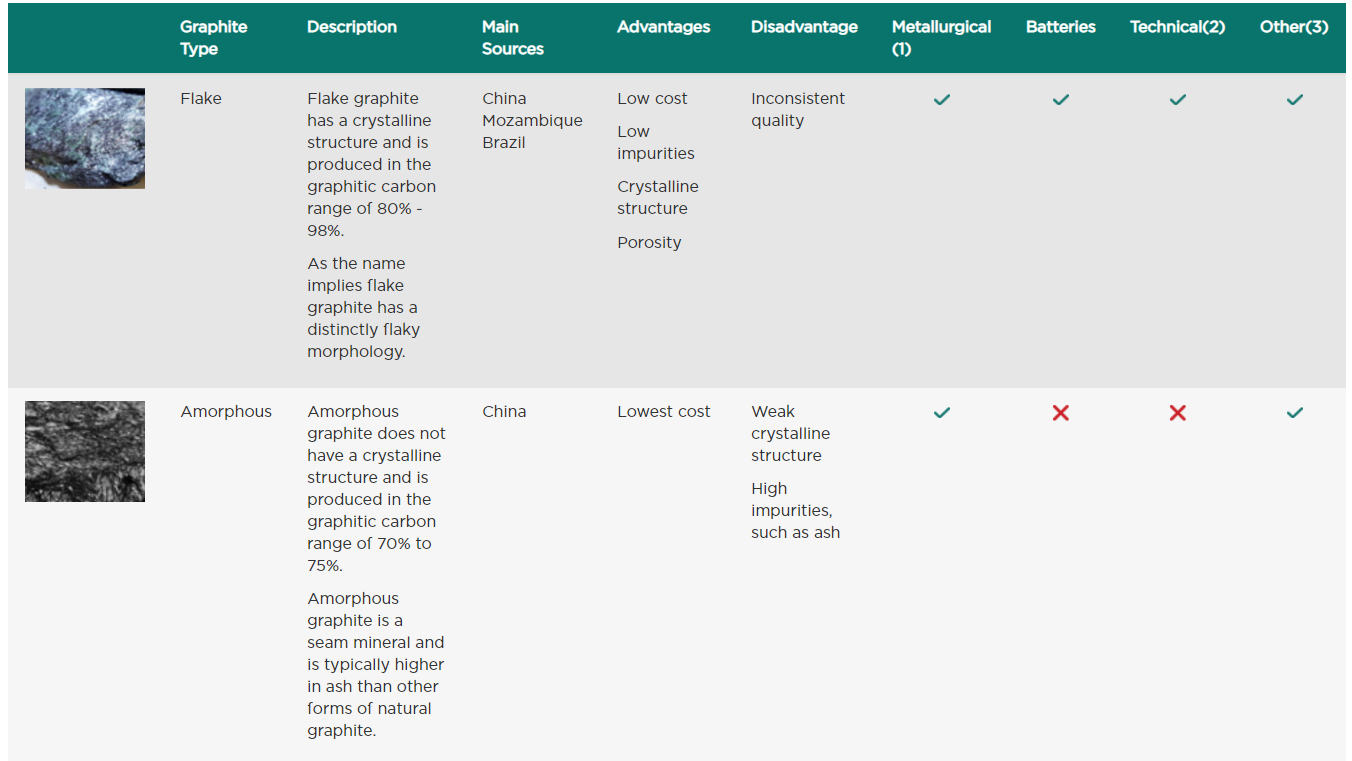

There are several different types of Graphite, which include Flake, Amorphous, Vein and Primary Synthetic.

Flake graphite has a crystalline structure with distinctly flaky morphology. Flake is mainly sourced from countries like China, Mozambique and Brazil. It is produced in the graphitic carbon range of 80 percent to 98 percent and is considered as low-cost graphite with less impurities.

Graphite Properties and Uses (Source: Syrah Resources Limited Reports)

Amorphous Graphite is a seam mineral, which is mainly sourced from China at a very low cost. Amorphous has a weak crystalline structure and is not used in batteries. It is typically higher in ash than other forms of natural graphite and is produced in the graphitic carbon range of 70 percent to 75 percent. On the other side, Vein Graphite is a rarest and most valuable form of graphite, which is produced in the limited tonnages with very high-grade quality. It has small economic sources and is not used in the manufacturing of batteries.

Applications for Graphite

Natural Graphite is a critical material for vehicle electrification, energy storage and emissions reduction. In parallel with cobalt and lithium, graphite is also a key part of lithium-ion battery production. It is believed that without natural graphite, the cost of clean energy storage systems will be higher than what it currently is. Along with Natural Graphite, Synthetic Graphite is also in great demand, which is primarily used as a conductive electrode in refining iron in an electric arc furnace.

Graphite is one of the main components in lithium batteries, which are used in electric vehicles. Graphite is used in the anode of the battery, where oxidation of lithium metal takes place in the battery charging. Due to the worldwide adoption of electric vehicles, the battery industry has witnessed substantial growth in the recent past. Graphite is one of the largest contributors by weight in lithium-ion batteries.

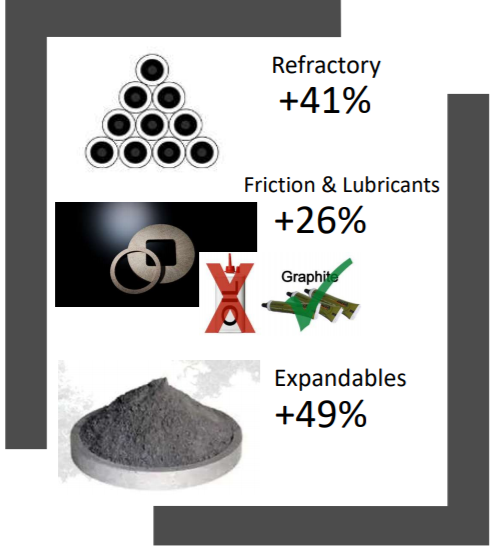

According to Battery Minerals Limited (ASX: BAT), in short-term to 2023, it is expected that significant growth in demand will be experienced in traditional graphite sectors like refractories, fire retardant materials, friction and lubricants.

Graphite sectors Outlook for short-term to 2023 (Source: Battery Minerals Limited Reports)

As per the leading graphite producer, Syrah Resources Limited (ASX: SYR), battery industry growth is leading to around 35 percent forecast increase in natural graphite demand in the next three years. Besides this, Graphite is also used in the manufacturing of âLeadâ for pencils.

5 Graphite Stocks on ASX - SYR, ASN, BAT, FGR, MNS

Syrah Resources Limited (ASX:SYR)

An Australian-based industrial minerals and technology company, Syrah Resources Limited (ASX: SYR) intends to become the worldâs leading supplier of superior quality natural graphite products. The company is primarily involved in the development of the Balama Graphite Project, which is currently running at its full capacity of ~350ktpa. The company recently announced the appointment of a highly experienced Sara Watts for the role of Independent Non-Executive Director. In her over a decade of experience, she held various senior management roles in big companies like IBM Asia Pacific and City West Housing. Her experience in finance, audit and operations will be a valuable addition to the companyâs Board.

The company is sharply focused on continued market penetration of its graphite products at competitive prices, and the qualification of its anode materials from the BAM plant in the United States.

The companyâs grand vision of emerging from a start-up company which first discovered Balama in 2011, to by the end of 2018, being in commercial production as a global leader in natural graphite production is already an extraordinary achievement. Certainly, the excitement of battery supply chain commodities is now maturing, and the investment community is understandably exercising greater selectivity regarding investments in companies across the sector. The company is establishing a global deep market acceptance for its high-quality natural graphite products across all product sectors and is progressively de-risking its position as the pre-eminent supplier outside of China.

In the last six months, the stock of Syrah Resources Limited provided a negative return of 30.58% as on 5th June 2019. At market close, the stock of SYR was trading at $1.110, with a market capitalisation of circa $390.98 million, on 6th June 2019. Its 52-week high price is set at $3.170 and its 52 weeks low price is set at $0.975, with an average volume of ~5,472,138.

Anson Resources Limited (ASX:ASN)

Anson Resources Limited (ASX: ASN) operates in new energy and technology markets and is involved in the development of the Paradox Basin Brine Project for recovery of valuable chemicals. From this project, the company recently produced around 1 kg of battery quality lithium carbonate.

In the month of May 2019, the company closed its Share Purchase Plan and received applications worth of $608,700. The company has also secured a $15,000,000 facility with Long State Investment Limited in which Long State will subscribe for shares in ASN at any time over the next 24 months, up to a total placement amount of $15,000,000. The company also informed that it has received a placement commitment of $1.65 million from its strategic investor, Chia Tai Xingye International, of 27,500,000 fully paid ordinary shares at an issue price of 6 cents per share.

In the last six months, the stock of Anson Resources Limited provided a negative return of 18.06% as on 5th June 2019. At market close, the stock of ANS was trading at $0.058, with a market capitalisation of circa $30.37 million, on 6th June 2019. Its 52 week high price is set at $0.185 and its 52 weeks low price is set at $0.037 with an average volume of ~1,549,032.

Battery Minerals Limited (ASX:BAT)

Battery Minerals Limited (ASX: BAT), as the name suggests, is focused on the exploration of battery minerals via its two graphite projects, namely Montepuez and Balama, which are located in Mozambique. With the exposure to growing traditional graphite markets, the company is very well-positioned to rapidly respond to Clean Energy Growth.

The company is expecting its production to grow more than 100k tpa (tonnes per annum) graphite flake concentrate from its Montepuez Graphite Project, which is in an advanced stage of development to produce 50ktpa concentrate at 96 percent TGC. Along with the Montepuez Graphite Project, the Balama Project is providing scope for self-funded growth from around 50,000 tpa (tonnes per annum) production-rate to more than 150,000 tpa (tonnes per annum).

In the month of April 2019, the company announced a two-tranche placement to raise in aggregate a total of around $5.1 million via issue of around 204 million Shares at an issue price of $0.025 per share.

In the last six months, the stock of Battery Minerals Limited provided a negative return of 20% as on 5th June 2019. At market close, the stock of ANS was trading at $0.020, with a market capitalisation of circa $26.36 million, on 6th June 2019. Its 52 week high price is set at $0.056 and its 52 weeks low price is set at $0.019, with an average volume of ~2,348,705.

Magnis Energy Technologies Ltd (ASX:MNS)

Magnis Energy Technologies Ltd (ASX: MNS) is having part ownership of over 90GWh of planned lithium-ion battery production in Australia, the USA and Germany and is involved in the proposed development and ultimately mining of natural flake graphite for use in various industries. Magnis Energy recently announced the expiration of 1,000,000 unlisted stock options at $0.70, with an original expiry date of 17th November 2019.

The company recently announced that its technology partner, Charge CCCV has recently supplied batteries to Martac using its proprietary BMLMP cathode technology for its unmanned water and surface vessels and each battery is 20KW in size, which will be used in commercial marine vessels for demonstration and testing purposes.

The company is currently aiming to become a global producer of next-generation lowest cost Li-Ion Battery (LIB) cells for the rapidly growing EV (electric vehicles) and ESS (Energy Storage Systems) markets by creating a competitive advantage through unique IP and by establishing collaboration networks with leading institutions and developers. Further, the company intends to create a global presence for economies of scale through strategic alliances and Joint Venture partners. The company has realised leading battery technology with its high performing, chemically benign anode technology and through the partnership formed with US Based Charge CCCV.

In the last six months, the stock of Magnis Energy Technologies Ltd provided a negative return of 33.33% as on 5th June 2019. At market close, the stock of MNS was trading at $0.200, with a market capitalisation of circa $122.23 million, on 6th June 2019. Its 52 week high price is set at $0.445 and its 52 weeks low price is set at $0.190, with an average volume of ~425,197.

First Graphene Limited (ASX:FGR)

Advanced materials company, First Graphene Limited (ASX: FGR) supplies lowest cost, highest quality graphene in bulk quantities for the development of applications in modern materials, energy storage devices, coatings and polymers.

Recently, the company announced that it is in a unique position to commence commercial sales of PureGRAPH⢠graphene products as it was advised by the Department of Health (NICNAS) that its assessment is completed and the approval will be granted to produce and sell PureGRAPH⢠products in Australia, which is an encouraging news for the company and its shareholders. Along with Steel Blue, the company recently announced that they are working in collaboration to incorporate graphene into existing and new materials of Steel Blueâs footwear.

In the last six months, the stock of First Graphene Limited provided a return of 38.89% as on 5th June 2019. At market close, the stock of FGR was trading at $0.230, with a market capitalisation of circa $109.43 million, on 6th June 2019. Its 52 week high price is set at $0.300 and its 52 weeks low price is set at $0.115, with an average volume of ~1,194,150.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)