We will be discussing four IT enabled payment companies which have modern business models and operate through electronic payment networks. Letâs look at the operating highlights as well as the stock piece movements of these four stocks which fall under the category of âsmall-capâ stocks.

Dubber Corporation Limited (ASX: DUB)

Dubber Corporation Limited is an information technology company which provides cloud-based software technologies.

Q1FY20 Financial Highlights for the period ended 30 September 2019:

- DUB reported revenue of $2.15 million, depicting an increase of 6% on q-o-q basis of $2.03 million and two-times from Q1FY19 revenue of $717 k.

- The business reported that end user subscribers increased more than 117,000 during the quarter, registered a growth of 165% y-o-y

- A per the company update, agreements with service providers increased from 106 to 113 during the reported period.

- Telecommunications Service providers at the stage of billing stood at 52, up from 43 in last quarter.

- The company reported $10.2 million of Contracted Annualized Recurring Revenue (CARR) during the first quarter of FY20.

- DUB reported addition of key strategic staff to enhance its global business prospects. The company has expanded its marketing, development, compliance and support structures during the first quarter of FY20.

Other Highlights: DUB reported continuous to growth in its business activities through increasing demand for its services. The quarter was marked by enhancement and growth of Dubberâs sales teams with the recruitment of top management personnel in Australia, Europe and North America including:

- Global executive roles

- Executive leadership roles in Europe

- Account managers and leadership roles in North America

Guidance: As per the management guidance, DUB notifies that it expects that Artificial Intelligence (AI) will be delivered on a mass scale directly from the source of the call, via networks available on telephone

Stock Update: The stock of DUB closed at $1.380, up 3.371% as on 15 November 2019. The stock has a market capitalization of $253.11 million. The stock has provided stellar returns of 8.10 % and 60.84% in the last three-months sand six-months respectively

Class Limited (ASX: CL1)

Class Limited operates in information technology and specializes in cloud-based, self-managed superannuation fund administration and related software solutions and services. Recently, CL1 reported a change in directorâs interest where one of its directors, named Andrew Russell acquired 100,000 Fully paid ordinary shares.

As per a market update, CL1 has postponed the 2019 Investor Day to 19 November 2019, until early next year.

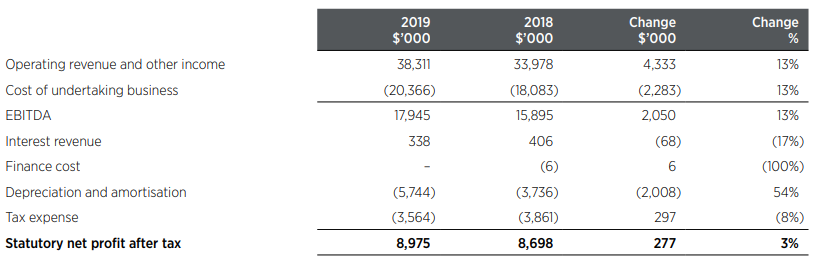

FY19 Financial Highlights for the period ended 30 June 2019: CL1 announced it FY19 financial results wherein the company reported operating revenue and other income of $38.311 million as compared to $33.978 million in previous financial year. The company reported EBITDA at $17.94 million as compared to $15.895 million in the prior corresponding period. The company reported statutory net profit after tax at $8.975 million as compared to $8.698 million in FY18.

FY19 Financial Highlights (Source: Company Reports)

As per the July-September 2019 quarterly update, the company reported the following:

- The company reported total accounts of 181,355 with 1,558 customers using the Class.

- CL1 further updated, growth of Class Super led to 172,555 accounts (net of ~700 AMP suspensions) while class Portfolio grew to 8,205 accounts during the first three month of FY20.

- The company reported growth of Class Trust came in at ~600 accounts during Q1FY20.

Outlook: The company will increase its investment in product development and technical capability by 33% to $12 million in FY20 to give a platform for business growth. As per the Management guidance, for FY21 onwards the business expects a material uplift in revenue and EBITDA performance. The company is focusing to enhance its growth through a combination of âBuilding, Acquiring and Partneringâ.

Stock Update: The stock of CL1 closed at $1.95, down 2.5% as on 15 November 2019. CL1 has a market capitalization of $235.32 million. The stock generated strong returns of 53.85 % and 26.98% during the last three-months sand six-months respectively. At current market price the stock is available at a price to earnings multiples ratio of 26.11x and has generated an annualized dividend yield of 2.5%.

Splitit Payments Ltd (ASX: SPT)

Splitit Payments Ltd provides payment-based services which enables customers to pay for purchases with an existing debit or credit card by converting the cost into interest along with free of charge monthly payments, without additional registration fees or other formalities.

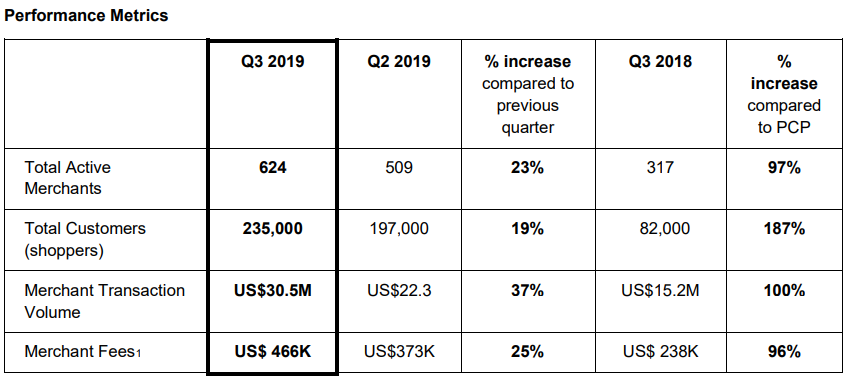

Q3FY19 Financial Highlights for period ending 30 September 2019: SPT declared its third quarter highlight for the financial year 2019 wherein the company reported net operating cash outflow of US$6.9 million, which includes US$0.5 million receipts from customers which includes fees and net repayment of upfront purchase amounts under the Self-funding Arrangement. The cash outflows during the three quarter includes advertising and marketing costs of US$1 million, staff costs of US$0.9 million driven by new hiring, US$0.2 million of research and development costs, corporate and administration costs of US$0.7 million and US$4.5 million used for self-funding arrangement.

Other Operating Highlights:

- The company reported that total merchants of the company came in at 624, up 97% on Q3FY18 count of 317.

- Total Customers during the quarter stood at 235,000, grew 187% on prior corresponding period basis.

- Merchant Transaction Volume of the business came in at US$30.5 million, up 100% as compared to US$15.2 million in previous corresponding period.

- SPT reported its merchant fees at US$466K, an increase 96% from Q3 of FY18.

- The business reported addition of new merchants which includes prestigious brands like Kogan.com, Philips Respironics and Ableton etc.

- SPT made collaboration and integrations with GHL which added ~2,000 merchants. Ally Commerce and Shopify (added ~800,000 merchants) while Divido added ~1,000 merchants during the quarter.

- Other prestigious merchants which were included during the quarter includes Chili Technology, Eight Sleep, Ace Marks, Nili Lotan, Bluefly, Ashford and 1800-Accountant etc.

Q3 performance Highlights (Source: Company Reports)

Outlook: The company is well-funded to explore its growth objectives, with US$16.1million of cash balance as on 30 September 2019, excluding US$4.5 million in future repayments from merchants.

Stock Update: The stock of SPT closed at $0.810, up 2.532% as on 15 November 2019. At current market price, the stock is quoting at a market capitalization of $242.95 million. The stock has generated mix returns of 71.74% and -12.71% in the last three months and six-months, respectively.

Livetiles Limited (ASX: LVT)

Livetiles Limited develops and sells software for digital workplace by means of subscriptions. The company works across varied sectors with the clients ranging from United Kingdom, North America, Europe, Asia-Pacific and the Middle East.

FY19 Operating Highlights for period ending 30 June 2019: LVT announced its full-year results for FY19, wherein the company reported total revenue and other income at $22.486 million as compared to $6.437 million in FY18. The business reported subscription revenue of $16.511 million followed by services revenue of $1.581 million during the financial year 2019. The company reported loss at $42.766 million as compared to a loss of $22.059 million during the previous financial year. The company reported a 167% y-o-y growth in annualized recurring revenue at $40.1 million, depicting a $25.1 million of ARR added during FY19.

Organic ARR growth of 114% was achieved during FY19 driven by the companyâs internal sales and marketing channels, development of the companyâs partner channel, strategic partnerships, ongoing product innovation and strengthening brand awareness.

Other Operating Highlights: The business reported acquisition of new customers which resulted in a total of 919 paying customers as at 30 June 2019 as compared to 536 customers as at 30 June 2018. During FY19, the company reported a strong growth in average ARR/ customer (~56%) aided by organic growth in the LVTâs enterprise customer base along with several new marketing initiatives.

Outlook: As per the management guidance, LVT is focusing to expand its global range of enterprise customers. This will be primarily driven by the companyâs product portfolio, its ongoing sales and marketing investments and co-marketing initiatives with other partners, including Microsoft.

Stock Update: The stock of LVT closed at $0.320, up 4.918% in 15 November 2019. The stock has a market capitalization of $249.43 million. The stock has generated returns of -35.79% and -29.07% during the last three months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.