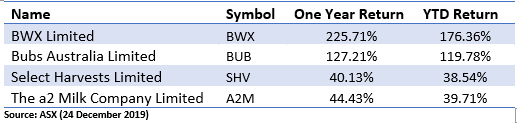

Amid increasing recession fears that lasted for some time in 2019, the Consumer Staples sector witnessed a strong investor’s traction due to the sector’s defensive proposition relatively.

Over the year to 24 December 2019, the S&P/ASX 200 Consumer Staples (Sector) index is up by approximately 23 per cent. However, our list of Shining Consumer Staples features stocks that are out of this index, except for The a2 Milk Company Limited (ASX:A2M).

Let’s talk more about these companies;

BWX Limited (ASX: BWX)

BWX Limited plies trade in the global beauty and personal care market. The company operates through in-house natural brands, and its portfolio includes Sukin, Andalou, Mineral Fusion, USPA and Nourished Life.

In the Asia Pacific, it has a focus on key customer relationships, and it has continued the roll-out of Andalou, Nourished Life platform and other BWX e-commerce sites. Also, the roll-out of Mineral Fusion is underway, and the company believes there is significant opportunity to unlock in the Chinese market.

FY20 Guidance (Source: BWX AGM Presentation)

In North America, its multi-brand selling model is supported by channel expansion. And, the company has added significant capacity along with ERP roll-out, which is favourable to smarter working capital management.

At UBS Australasia Investor Conference, in November, the company noted that the global beauty and personal care market is expected to reach the value of USD 616 billion by 2022, growing at 5.8%.

Also, the skincare segment is expected to dominate with a 26.6% share, and Australasia is the second largest region in terms of per capita spending on beauty and personal care, accounting for a third of the industry value in 2018.

Further, the natural and organic personal care market is outperforming the broader market with 8.6% growth.

Additionally, the company has reaffirmed its FY 2020 in its AGM held in November 2019.

On 27 December 2019, BWX was trading at $4.560 (3:29 PM AEDT).

Bubs Australia Limited (ASX: BUB)

Infant formula manufacturer, Bubs Australia is engaged in manufacturing and marketing of goat milk formula, cow milk formula, cereals, pouches, rusks and snacks. Its stock is recognised in S&P/ASX 300, S&P/ASX Small Ordinaries, and All Ordinaries Index.

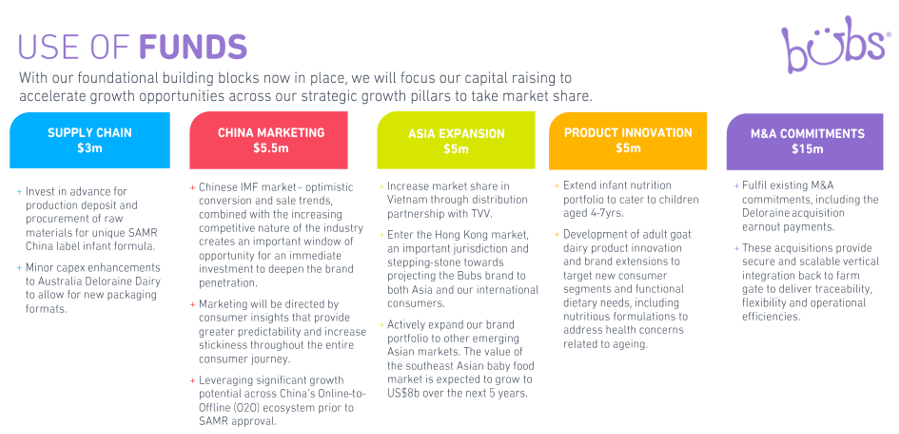

Recently, in its capital raising presentation, the company showcased its capabilities and noted a couple of developments.

It owns exclusive access to Australia’s largest goat milk pool, which provides supply chain scalability, security, traceability and scalability. The company also says that it is the market leader in goat dairy, producing over 65 per cent of domestic goat milk products.

Its herd has grown to approximately 20k milking goats across Australia and New Zealand, which produces fresh goat milk in excess of 20 million litres. It was also said that the company presently produces around 7.5 per cent of the world’s total goat milk powder.

Goat industry is rapidly transforming from a niche production into an emerging commodity that is witnessing a surge in the consumer demand across demographics. And, there is substantial upside for continued expansion of Bubs Australia and New Zealand goat milk supply.

For FY 20, the company is emphasising on three growth engines;

· Sustainable leadership in vertical supply chain and value creation.

· Deepening consumer brand connection to drive scale and improved margin.

· Expansion into new non-infant growth segments and new geographical markets.

Application of Funds (Source: BUB Capital Raising Presentation)

Recently, the company reported undertaking capital raising to raise a total of $35 million through $30 million fully underwritten placement and a share purchase plan of $5 million. It has been reported that the share purchase plan was oversubscribed.

On 27 December 2019, BUB was trading at $0.997 (3:29 pm AEDT).

Select Harvests Limited (ASX: SHV)

Among the largest almond growers globally, Select Harvests has a portfolio of brands that includes Lucky, Sunsol, NuVitality, Soland, Allinga Farms and Renshaw. Its capabilities extend to manufacturing, processing, and marketing of health snacks, nut products and muesli.

According to the ASX CEO Connect Presentation, the company has 7,696 planted hectares of Australian almond orchards, and 35% of its orchards would reach maturity over the next eight years, underpinning future growth.

The company is a bulk & value-added supplier to Europe, Middle East and Asia. It has an exclusive trademark license & distribution agreement with PepsiCo Foods (China) Co. Ltd, and apart from this agreement its brands are being sold in Indonesia, Singapore, Thailand and Malaysia.

In the year ended 30 September 2019, the company posted revenue of $298.5 million and generated an EBITDA of $95.2 million. Its net profit after tax for the period was $53 million at an earnings per share of 55.5 cents. In FY 2019, the company had declared a total fully franked dividends of 32 cents per share to shareholders.

For FY 2020, the company has the following priorities;

· Progressing on 2020 Crop Horticultural Program to ensure optimal tree health and production.

· Implementation of new technology through capital investment in new sorting technology for improved quality.

· To reduce cost per kg across all production stages, and to mitigate water cost for increasing dry conditions.

· Assessing organic and inorganic options to deliver additional growth.

· Deliver process improvement project to improve efficiencies in Consumer Products.

· Execution of export growth strategy in Industrial and Consumer division.

On 27 December 2019, SHV was trading at $8.450 (3:29 pm AEDT).

The a2 Milk Company Limited (ASX: A2M)

Initially, the company was founded by Dr Corrie McLaughlan and Howard Paterson in 2000, who were convinced that all milk is not the same. The company has made significant strides towards the a2 protein contained milk and other parts of the business.

Presently, the company is focusing on its target markets – the US and China. Its target markets provide opportunities in the premium categories. A2M believes that high consumer loyalty and relatively low awareness presents huge growth opportunities.

The company intends to continue expansion into the new market over time, and it has continued market testing in South East Asia while extending the Korean range to involve infant nutrition with Yuhan.

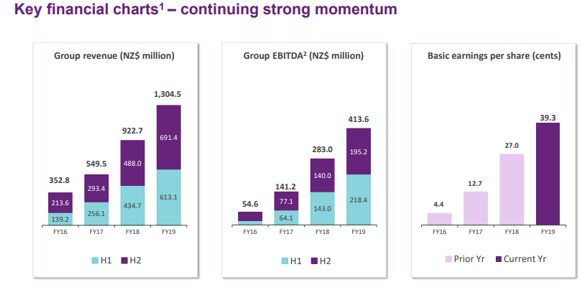

In its AGM 2019, the company provides updates on the FY20 guidance. It was said that strong revenue is anticipated in the key markets underpinned by investments in brand and marketing in target markets.

FY 2019 Results (Source: AGM Presentation)

Due to its strategic focus on gross margin, the company notified that EBITDA margin is expected to be better than the previously communicated. Now, it is anticipating a full-year EBITDA margin between 29% to 30%, which would be supported by better price yield and reduction in the cost of goods sold.

For the first half of FY20, the company has a guidance of NZD 780 million to NZD 800 million, and the EBITDA margin for the period is expected to be better than the full-year EBITDA margin in the range of 31% to 32%.

In December, the company notified that its CEO, Jayne Hrdlicka, would be stepping down due to increasing travel commitments required to service its target markets in the medium term. Concurrently, it was reported that former CEO, Geoffrey Babidge, was appointed to the role of interim CEO starting immediately.

On 27 December 2019, A2M was trading at $14.590 (3:29 pm AEDT).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)