Robo Advice:

Robo-advice is a new kind of wealth management that leverages technology and data science to provide access to professional quality investment advice to the end user. The tasks which were undertaken by human advisers or brokers like understanding the situation of the client and also keeping their portfolio well balanced is made possible through Robo Advice without human intervention. The complete procedure is online so that the users can start investing on their own, and there is no need for paperwork. Through Robo-advice, the user can get ahead with their investment strategy without involving much time.

About Robo Adviser:

Robo Advisers are the digital platform that provides algorithm-driven financial planning facilities with negligible human intervention. It collects pieces of information from the client that are related to their financial condition and the goals which are set for the future through survey via internet. Based on the data that is collected through the online survey, Robo Advisers provides advise to the users and invest the asset of the user automatically.

Robo advisers are also capable of making the right portfolio selection for the clients by analyzing stream of data like the age, income, preferred risk strategy and the life stage of the investor/user. All this is managed for the client at a very low cost as compared to the traditional financial advisers.

In Australia, Stockspot was the first robo-adviser which built a smart, personalized portfolio using its established investment strategies for growing the wealth of the end user. Stockspot customizes the userâs portfolio based on a change in the situation. The user can see their investment at any point in time. There are no exit or withdrawal fees.

Robo Advice Origin:

During the global financial crisis, the investors made huge portfolio losses. The index started gaining momentum in the early parts of 2010. During the phase, most of the active fund managers tended to underperform for a very long period of time. The under performance was largely attributed to the human psychological factors, as uncovered by the behavioral finance studies. To overcome the ill effects of human psychological gaps, few entrepreneurs came up with an idea of integrating low-cost index tracking ETFs with verified portfolio management methods and with a smooth sign-up procedure using automation and thus, the first Robo Adviser originated. Betterment is the first Robo adviser that took birth during the depths of the global financial crisis in 2008-2010.

Letâs look at the few Aussie Robo Advisers:

- Raiz Invest Limited (ASX: RZI): Raiz is one of the ASX listed company. Raiz was launched in January 2016 and has an exclusive model for investors to link up their bank accounts as well as credit cards via their application or the website. The company offers the investors to round up their savings to the nearest dollar and then invest the fund into an ETF portfolio. They also have an option where an investor can invest a larger amount and have regular savings plans.

- Stockspot: Stockspot was launched in 2013 and is the most popular Robo Adviser in Australia. They provide the investors with five ETF portfolios, and it follows the similar structure of Six Park. The investment strategy is framed on Nobel prize winning economic framework. Investors are provided with the statement of advice on signup, which contains recommendations. The company offers all these services at lower costs to the end users.

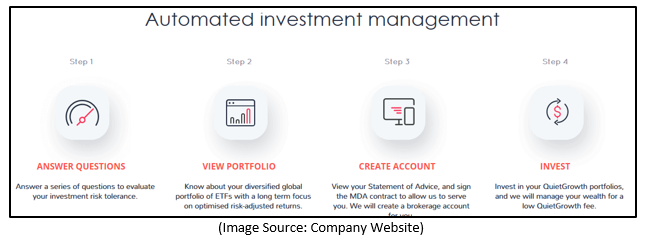

- Quietgrowth: The funds of the investors of Quietgrowth are managed by Saxo Capital Markets. The investment methodology is based on modern portfolio theory. The company aims to provide risk adjusted returns to its clients. The customers access the advisory via the firms robo advisory application.

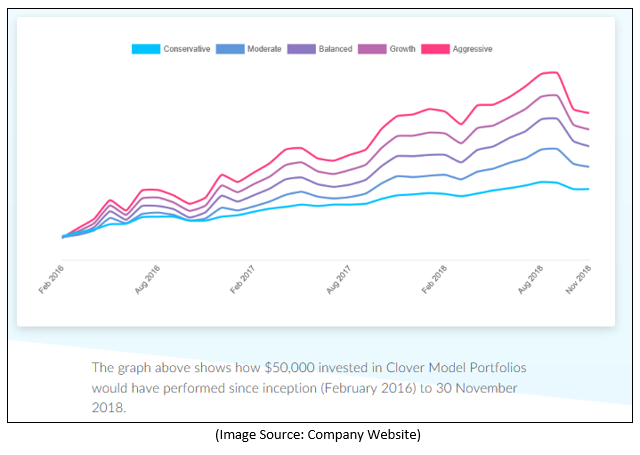

- Clover: Clover was launched in October 2016 and follows the same model as Stockspot, and Quietgrowth. They build customized low-cost portfolio suited to the clients risk profile. All the portfolio is built using ETFâs that are passively corelated with the market.

Pros and Cons of using Robo Advisers:

Robo Advisers also have certain pros and cons.

Pros:

Accessible: The best part of Robo Advisers is that it is easily accessible. In order to access it, users need to have an internet connection and download the application on there mobile phone and start using the features provided.

Low Fees: Fee forms an important component when it comes to portfolio return. Through Robo advisers, the investors are able to reduce their cost. Thus, in the long term, users can save a lot of money and that in turn adds on to better return profile as against high fee traditional investment advisory set ups.

Flexible: Robo advisers are flexible as the users can do financial planning as per their convenience. They are available to the users anytime, every time.

Low Minimum Balances: Robo advisers are beneficial for those small net worth investors. As it is easy to use and has low fee for professional financial management, investors opt for it.

Cons:

- Robo Advisers provides a limited facility.

- They depend on the information which is collected through the online medium. Thus, it may not provide a complete overview based on the questionnaire.

- They may also not ask about other investment.

- It lacks the human interaction ease.

- There could be a chance of model failure.

After the 2008 global financial crisis, robo-advice was first provided by startup companies. Gradually, it is now offered by many global financial institutions. It is generally seen that those companies that are only into robo-advice prefer investment in exchange traded funds. While there are some companies which provide general advice or prefer a hybrid model by using the software in combination with the human planner.

Statistics says that the US is the leading marketplace for robo advice and has an estimated asset under management (AUM) more than US$400 million. AUM is expected to increase by more than 30% on an annual basis. By 2023, this number is expected to reach US$1.5 trillion.

In Australia, robo advise is in the growing stage. In the current scenario, around 20% of the Aussies uses robo advise to take financial advice.

Investing in ETF:

Robo advisory firms typically use the ETF route to invest their clientsâ money, moreover the robo advisers also invest in direct stocks, mutual funds etc.

How are the Robo Advisers Impacting the Traditional Fund managers:

Robo Advisory could be a threat as well as opportunity for the traditional fund managers. Two of the popular fund managers in Australia are Platinum Asset Management Limited and Magellan Financial Group Limited.

Platinum Asset Management Limited (ASX: PTM) is listed on ASX and it specializes in investing global equities. It is Australiaâs most trusted managers of global equities. PTM offers a wide range of product which has different features as per the investorsâ requirement. The company also provide various methods via which the investors can access its popular global and regional equity strategies which includes unlisted Australian-registered managed funds, ASX-listed investment companies and mFund.

Magellan Financial Group Limited (ASX: MFG) is also listed on ASX and was formed in 2006. It invests in global equities and global listed infrastructure keeping in mind to protect the capital of their client.

Threat:

Since the major younger population in Australia is more inclined towards the Robo advisory, it could also be a threat to these fund managers. Considering the low-cost model and ease of access, robo advisory firms could quickly grow in size and compete with the traditional fund managers and brokers.

Opportunity:

The traditional fund managers could incorporate the robo advisory model in their existing business model and capture or build a new client base who are more inclined towards low cost and technology-based investment advisory options.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.