Creating good amount of wealth is a dream of every investor, as every investment an individual make has an objective of gaining a whopping amount of wealth on it. Investment in the retirement focused stocks can lead towards a quality retired life, for which an individual should plan from the beginning.

Retirement planning generally means the procedure of establishing retirement income objectives and the related actions, and the required decisions to attain the objectives.

Importance of Retirement Planning:

- The saved or invested money for retirement might be helpful in facing future circumstances, also it would place an individual in a decent health as well as wealth position.

- If retirement planning is spot on, then an individual would not be dependent on others to meet the financial needs during his/her old age.

- It would also aid in fulfilling the requirement of family, which is not just limited to education, but can go to an extent in meeting monthly expenses as well.

Steps included in Retirement Planning:

- The first requirement is to set a retirement goal, including the amount (approximate) an individual would require during the retirement period.

- Evaluation of current financial position could be taken as next step in retirement planning.

- Identification of the sources of income.

- Assessment of risks associated with the retirement.

For more understanding on the same, we will be having a look at the three ASX-listed retirement focused companies such as Challenger Limited, Class Limited and Lifestyle Communities Limited:

Challenger Limited (ASX: CGF)

Challenger Limited (ASX: CGF) is a multidimensional financial services company, whose core businesses includes of annuities, funds management and administration platforms.

As notified on 22 January 2020, Challenger Limited and its entities has ceased to become a substantial holder in Virtus Health Limited (ASX: VHT) effective 20th January 2020.

Rise in Asset Under Management

The company, in October 2019, updated the market with performance of first quarter of financial year 2020 and outlined the following:

- The company reported Q1 FY20 with total assets under management (AUM) amounting to $84 billion, reflecting a rise of 3%. This rise has been fueled by strong net flows throughout the business and positive investment markets.

- With respect to fund management business, net flows have indicated strong demand for quality active managers with diverse product offerings. It added that strong net flows have provided a contribution to a solid performance by its Funds Management business, with rise of 2%in funds under management.

- During Q1 FY20, the total Life book experienced a growth of 2% even with the disruption in the Australian wealth industry.

- As at 30th September 2019, value of Life’s investment assets stood at $19.7 billion, reflecting a rise of $0.7 billion for the first quarter. This increase reflects quarterly net book growth as well as changes in retained earnings net of dividends paid to the Group.

- On the outlook front, the company is targeting net profit before tax in the range of $500 million and $550 million.

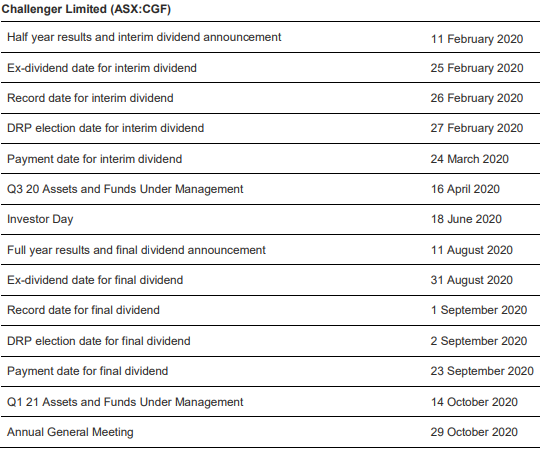

The following picture provides an idea of 2020 financial calendar:

Source: Company’s Report

The stock of CGF last at $8.8 per share, as on 30th January 2020, indicating a rise of 1.033% against its previous closing price. The company has a market capitalisation of $5.33 billion as on 30th January 2020. The total outstanding shares of the company stood at 611.96 million, and its 52-week low and high is $6.220 and $8.840, respectively. The company has generated a total return of 11.81% and 24.07% in the time period of three months and six months, respectively.

Class Limited (ASX: CL1)

Class Limited (ASX: CL1) is engaged in the development and distribution of cloud-based software solutions from more than a decade now.

The company recently via a release to the market has proposed to issue 5,291,000 fully paid ordinary shares on the proposed issue date of 31st January 2020.

A New Strategic Acquisition

- The company recently notified on a strategic acquisition of a leading corporate compliance and documentation technology entity, NowInfinity 3505 Pty Ltd.

- The acquisition of all the shares in NowInfinity 3505 Pty Ltd is for a maximum enterprise value amounting to $25 million that is included in the acquisition transaction.

In another release, on 28 January 2020, the company notified the market with the update for December 2019 quarter where the total accounts have been increased by 2,600 with 1,576 customers currently using Class. It added that the class portfolio has witnessed a rise of 670 accounts. The company continues to load accounts onto Class Trust during the pilot phase and is happy with the results of external research which confirmed a strong appetite for the product.

The stock of CL1 closed the day’s trading at $2.050 per share on 30th January 2020, indicating a fall of 1.442% against its previous closing price. The company has a market capitalisation of $244.74 million as on 30th January 2020. The total outstanding shares of the company stood at 117.66 million, and its 52-week low and high is $1.150 and $2.360, respectively. The company has generated a total return of 8.33% and 41.98% in the time period of three months and six months, respectively.

Lifestyle Communities Limited (ASX: LIC)

Lifestyle Communities Limited (ASX: LIC) is engaged in providing reasonably priced housing facilties for active retirees. The company was officially listed on Australian Stock Exchange in 1998.

The company in November 2020 announced that PricewaterhouseCoopers has been appointed as auditor of the company. In another update, the company announced that it has appointed Mr Mark Blackburn for the role of independent Non-Executive Director, which came into effect from 1st December 2019.

On the FY19 operational front, the company made acquisition of two additional sites, which are situated at Plumpton and Tyabb. The company also acquired additional land in order to expand its development at Wollert.

The company has continued to develop its people, systems as well as processes for supporting future growth, while maintaining its exceptional organisational culture as well as customer centricity.

The stock of LIC closed the day’s trading at $9.120 per share on 30th January 2020, indicating a rise of 0.441% against its previous closing price. The company has a market capitalisation of $949.27 million as on 30th January 2020. The total outstanding shares of the company stood at 104.55 million, and its 52-week low and high is $4.840 and $9.870, respectively. The company has generated a total return of 12.24% and 31.98% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.